Editor's note: Liu Baocheng is a deputy dean at the Academy for Global Innovation and Governance, and director of the Center for International Business Ethics, University of International Business and Economics. The article reflects the author's opinions and not necessarily the views of CGTN.

The Chinese economy is still engaged in an uphill battle against the backdrop of global slowdown. At home, it will take investors and consumers a longer time to restore confidence to pre-COVID-19 levels.

A dynamic yet delicate balance needs to be maintained between growth rate targets and de-carbonization goals. The path to high-quality development is undoubtedly a rugged one since it entails massive structural adjustment, increased human capital input and deepened institutional reform.

On the international front, geopolitical conflicts and protectionist sentiment add further complications to world trade and investment, in which China holds a significant stake.

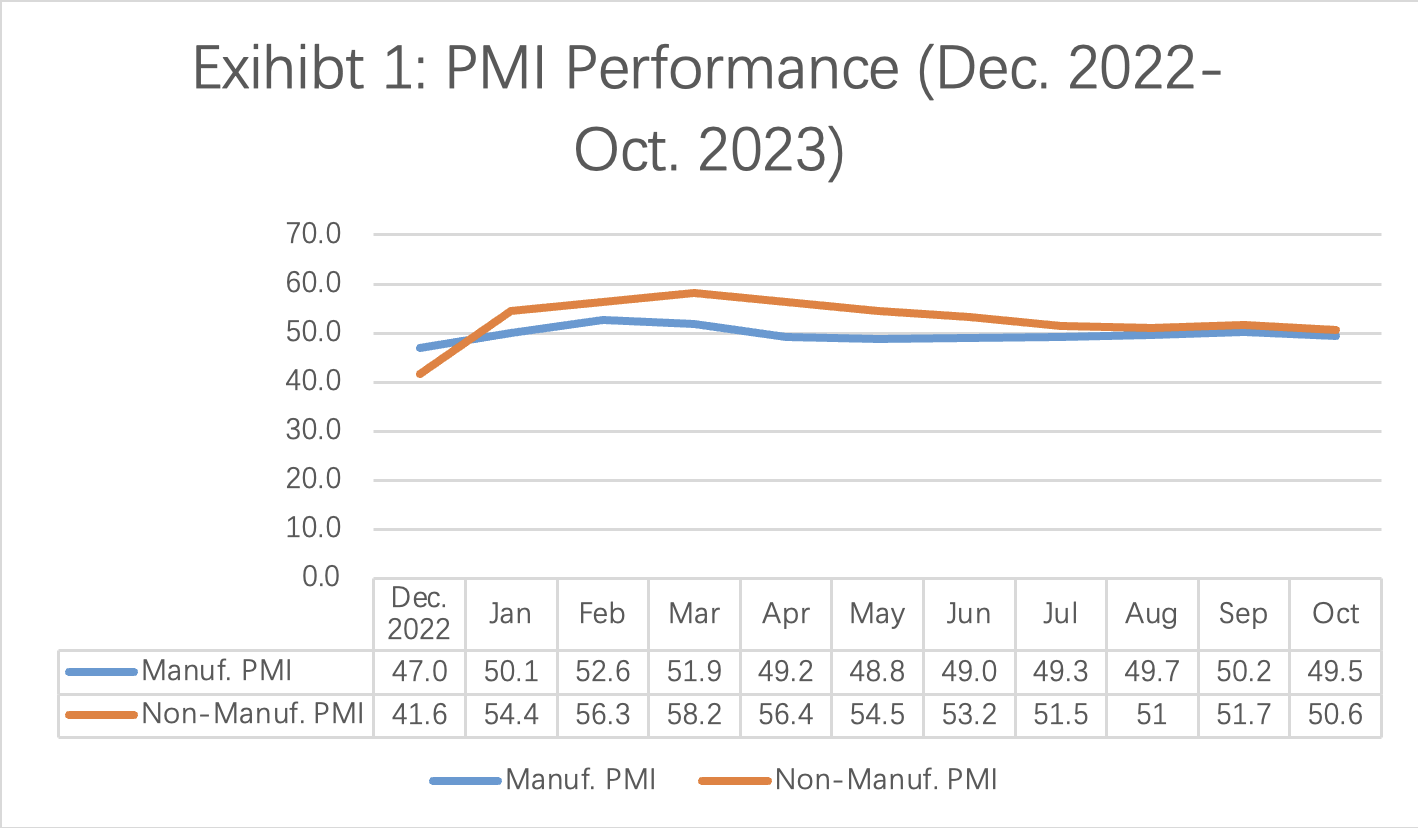

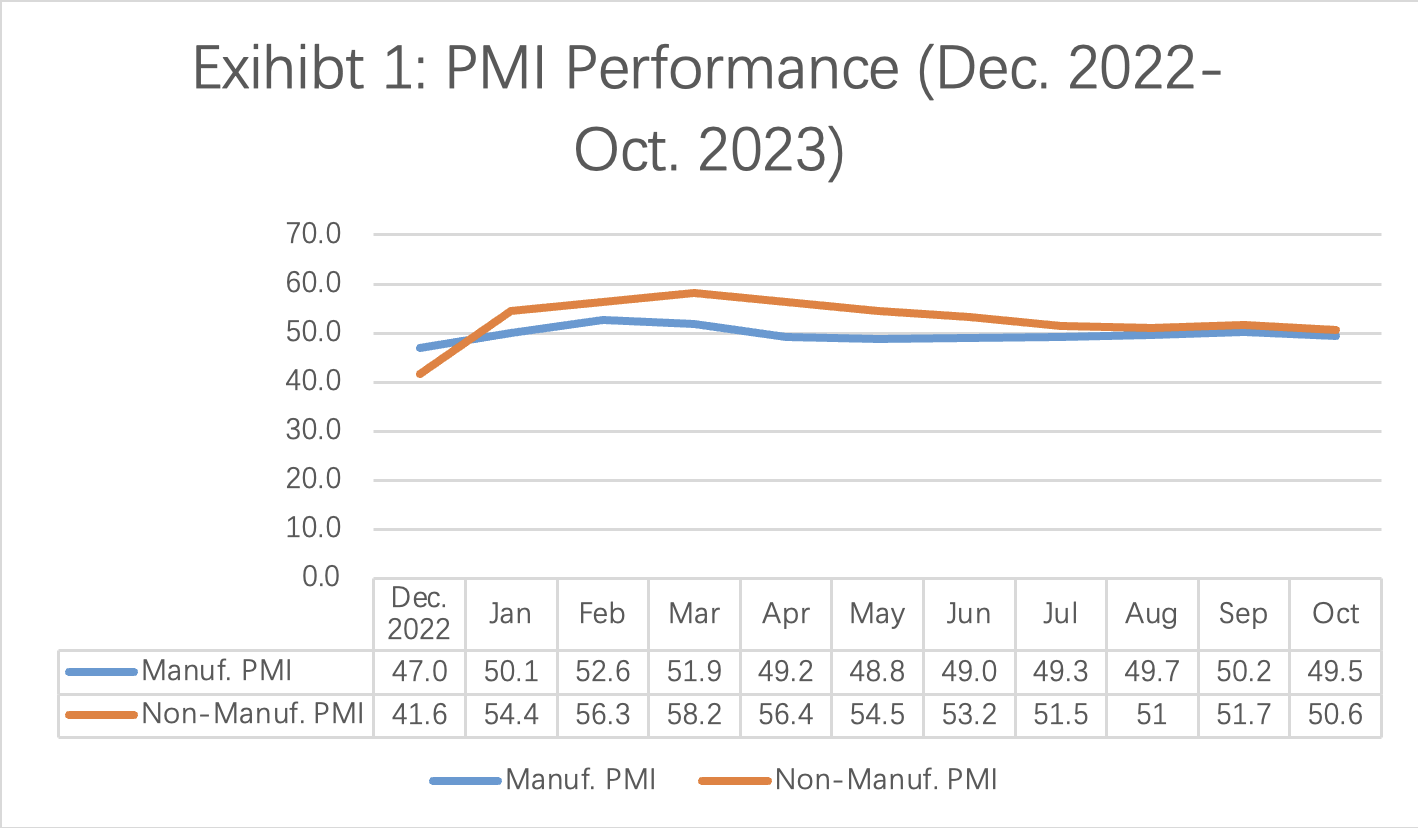

The purchasing managers' index (PMI) is a host of measures indicating current business conditions and anticipating economic trends. Business activities – including new orders, inventory replenishment, and exports – do not only propel growth via investment, but also create employment and increase pay levels, thus directly impact the consumption side.

The Chinese manufacturing industry is facing tough challenges amid the reshuffling of global supply chains and stringent expectations for green transformation, as well as upfront input for digitization. This painful process is expected to be rewarding, in order to adapt to changes in the new competitive landscape.

In the first quarter this year, the PMI in the manufacturing sector noticeably surged from the trough of 47 in December of the previous year, averaging 51.5, heading strongly to the expansion range.

Unfortunately, the reading declined, at a moderate pace, marginally below the critical threshold of 50 since April. After a period of rehabilitation, the PMI managed to climb from May to 50.2 in September, and then retreated to 49.5 in the latest official October release (See: Exhibit 1).

Source: China's National Statistics Survey Center in conjunction with the China Federation of Logistics and Procurement

Source: China's National Statistics Survey Center in conjunction with the China Federation of Logistics and Procurement

Gauging different enterprises, large firms are more resilient performers against chills in the operating environment – afloat above the PMI threshold – whereas small and medium-sized firms (revenue below 400 million yuan and payrolls below 1,000 in the manufacturing industry) are more vulnerable, hitting an average of 48.3 in October.

Among the five PMI sub-indices, production and logistics continue to stay in the expansion range, while new orders, inventory and employment are experiencing contraction.

PMI data in the non-manufacture sector, however, depicts a rosy picture, surging from the trough of 41.6 in December 2022 to a ceiling of 58.2 this March.

The moderate decline in the ensuing months, registering a dip to 50.6 in October has not prevented its performance to stay above the 50 threshold.

The service sector is steadily replacing the manufacturing industry as the primary engine for growth. Logistics and telecommunication are stellar performers achieving 60-plus PMI readings.

With the rocky situation and financial constraints of several giant developers and bankers – and no immediate solutions available to alleviate accumulated debt with selected local government – activities in real estate and financial services have dipped below the threshold.

In addition to infrastructure investment, affordable housing program and home refurbishment are here to sustain the construction sector above the threshold PMI.

The top regulators have devised tough measures to streamline oversight over the financial market.

The biannual central financial work conference on October 31 recognized the current challenges confronting the healthy development of the Chinese financial market.

A host of policy measures are introduced to boost efficiency and enhance risk prevention involving debt restructure and quantitative deliberation on monetary supply.

More liquidation will be channeled to support the real economy.

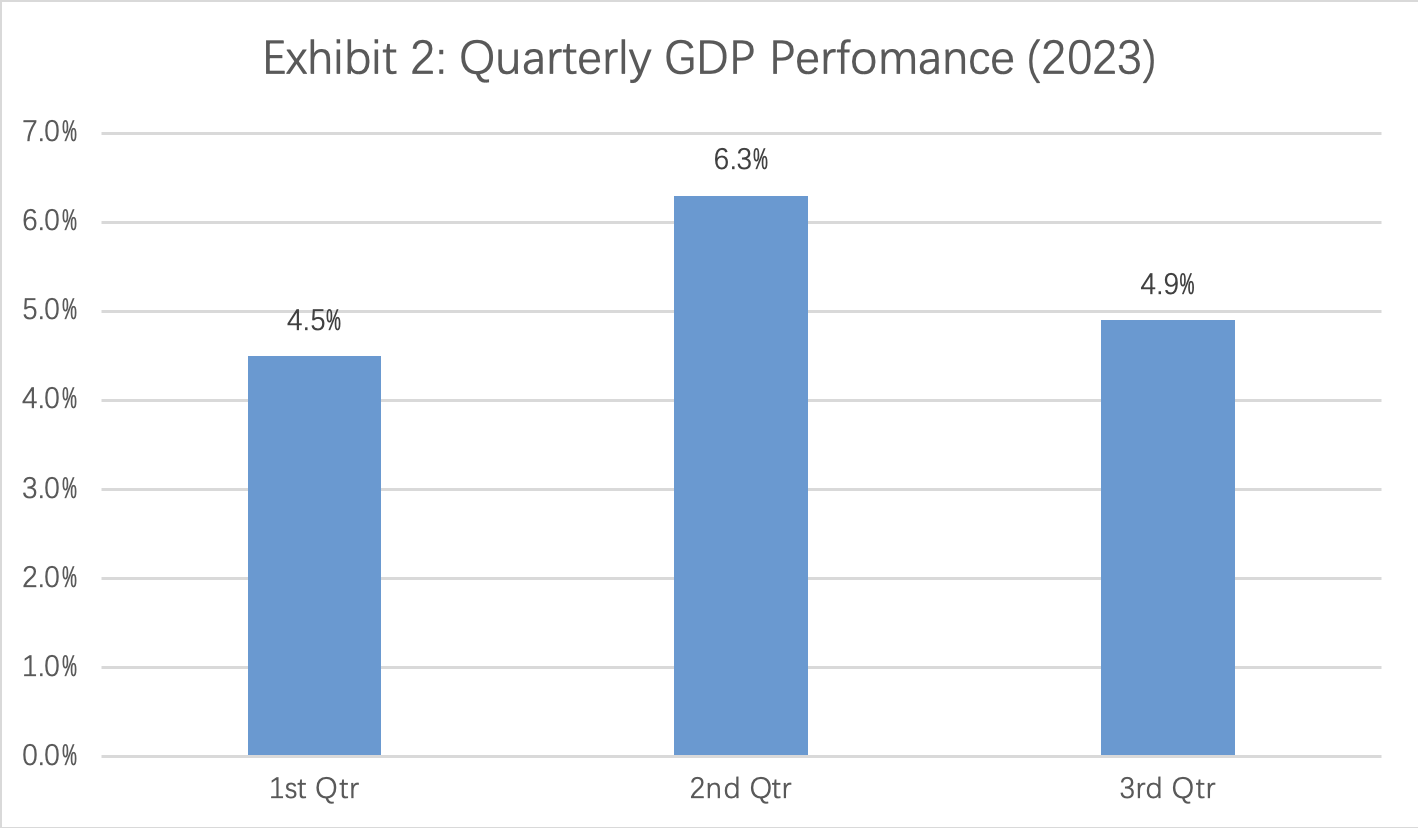

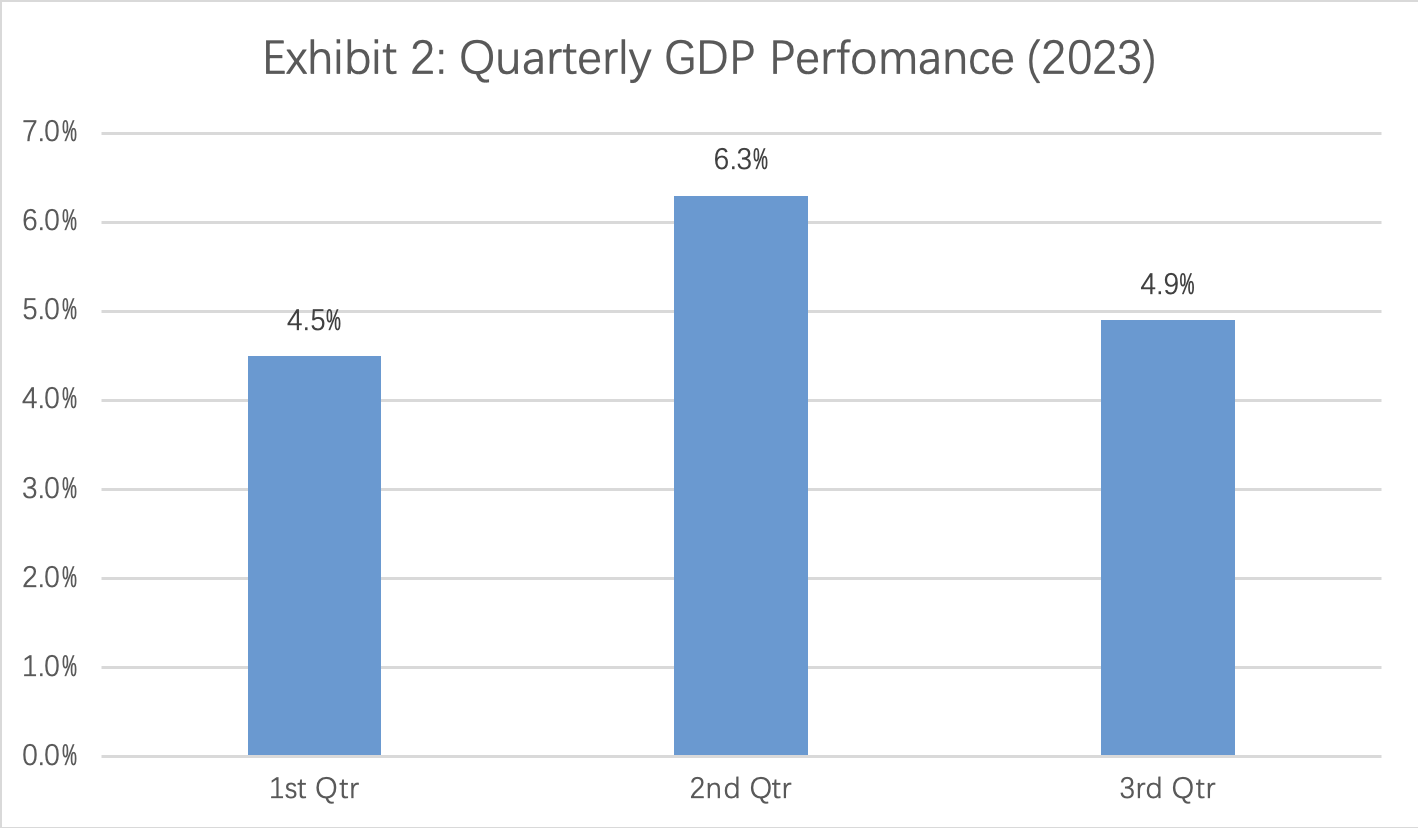

The GDP growth rate over the past three quarters, hitting an average of 5.2 percent year on year, does shed substantial optimism to attaining this year's growth target set forth by the central government at approximately 5 percent. (Exhibit 2)

The misalignment in the performance between PMI and GDP is largely thanks to the anti-cyclical dosages of strategic investment from government and state-owned enterprises (SOEs) in an effort to iron out disruptive swings in the economy.

Aside from mega infrastructures, investment in green energy transition and digital transformation has been placed on top agenda.

Source: China's National Bureau of Statistics

Source: China's National Bureau of Statistics

According to the baseline forecast by International Monetary Fund's World Economic Outlook in October, global growth will be slowed from 3.5 percent in 2022 to 3 percent in 2023 and 2.9 percent in 2024.

Against this backdrop, with reassurance from the central government that China will further open its market for global cooperation, the country continues to act as the locomotive for global growth despite the humongous challenges the country has to meet.