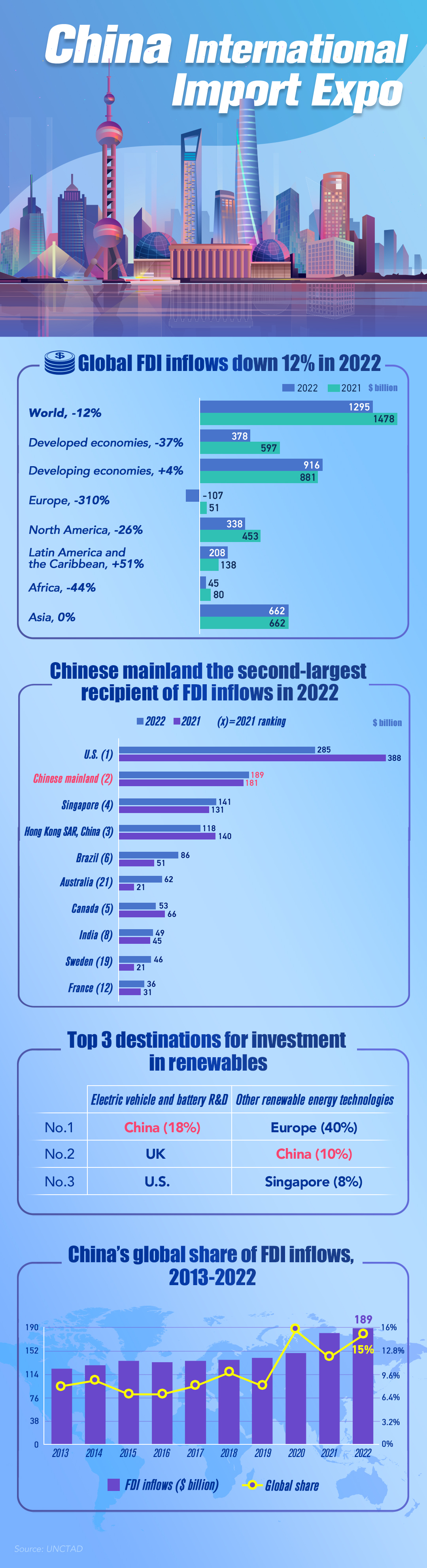

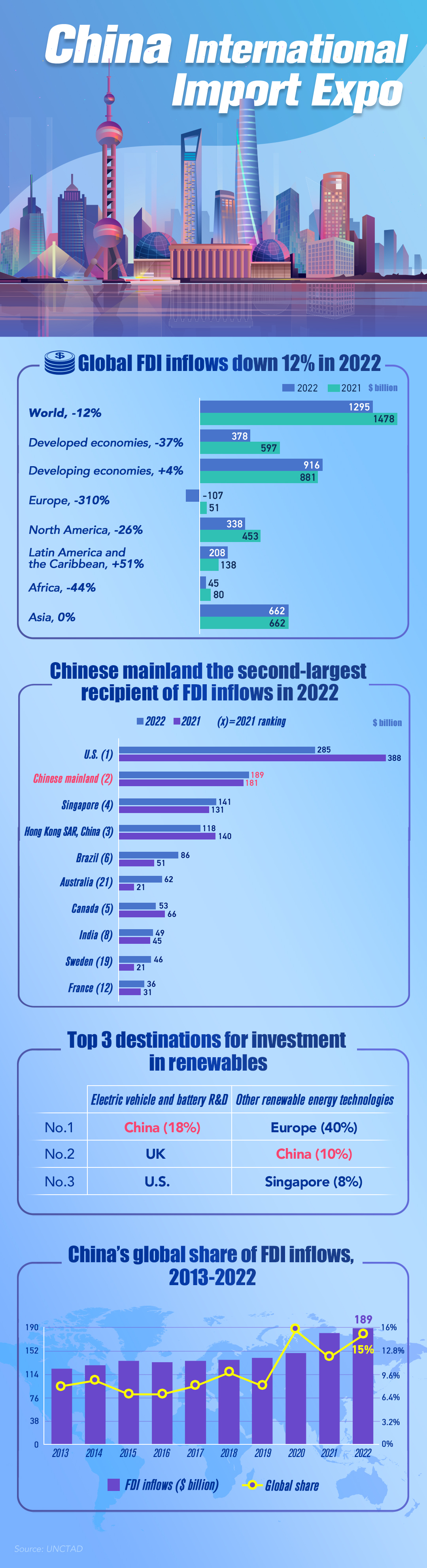

Foreign direct investment (FDI) in China rose 5 percent to a record $189 billion in 2022, while global FDI fell 12 percent to $1.3 trillion after a strong rebound in 2021 mainly due to overlapping global crises, according to UNCTAD's World Investment Report 2023.

China was the second largest FDI host country in the world last year. Its FDI increase was concentrated in manufacturing and high-tech industries, mainly electronics and communication equipment, and came mostly from European multinational enterprises.

The FDI decline was felt mostly in developed economies, where FDI fell by 37 percent to $378 billion. Flows to developing countries grew 4 percent, with a few large emerging countries attracting most of the investment.

International investment in renewable energy generation continued to grow but at a slower 8-percent pace than the 50-percent growth recorded in 2021. Notably, projects announced in battery manufacturing tripled to more than $100 billion in 2022.

For international electric vehicle and battery R&D projects, China is the top host location with a share of 18 percent. The country is also the second largest recipient of investment projects in other renewable energy technologies.

China revised the Negative List for Foreign Investment Access in 2022, removing the 50 percent cap on foreign investment in automobile manufacturing and in ground-receiving facilities for satellite television broadcast.

Cross-border M&A sales in China tripled to $15 billion last year. One of the largest deals was the $4 billion acquisition by BMW (Germany) of a further 25 percent stake in BMW Brilliance Automotive, a Beijing-based manufacturer and wholesaler.