20:50, 13-Apr-2018

China-US Economy Ties: Trump's tariff plan puts jobs at risk

China's foreign-direct investment has helped fuel US economic growth and employment. From 2010 to 2015, China's FDI grew at an average annual pace of 32 percent. Last year it soared 200-percent to 46-billion US dollars, triple the prior year's record.

Mergers and acquisitions accounted for 96-percent of that investment. Some of the biggest deals include conglomerate HNA Group buying networking and software distributor Ingram and Haier Electronic's purchase of the General Electric appliance business. Employment by Chinese-owned firms in the US has jumped ninefold since 2009 to 140,000 jobs.

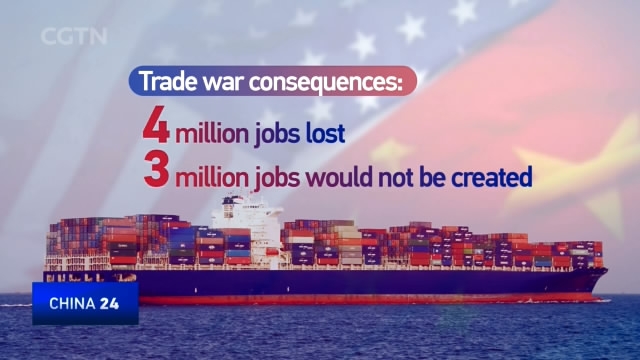

But a possible tariff war could cause job losses in American industries, such as energy and manufacturing. Moody's Analytics puts the figure at up to 4-million jobs. And another three-million jobs may not be created that otherwise would have been.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3