Business

14:44, 08-Jan-2017

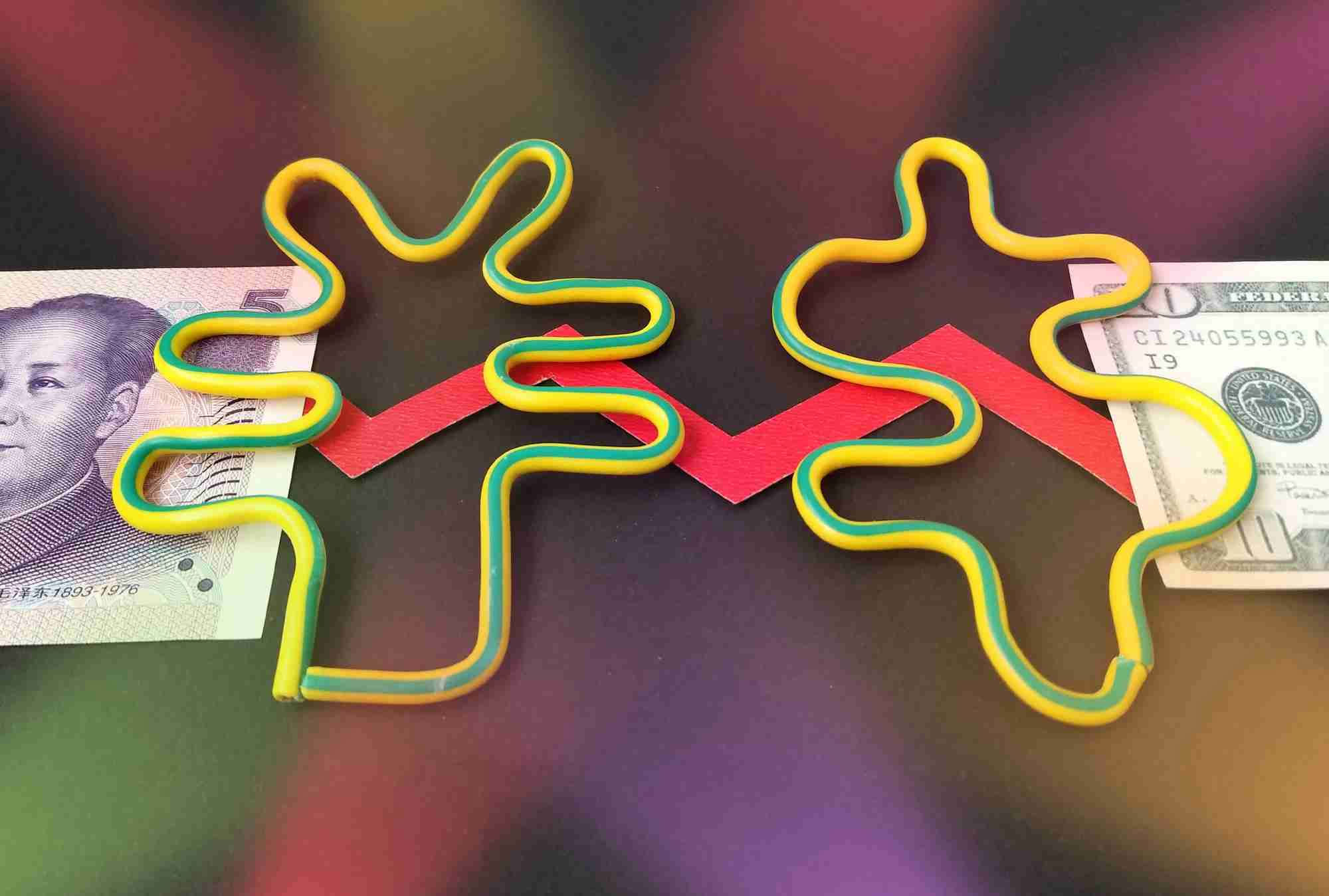

China's forex reserves fall to $3.011 trillion in December

Updated

10:30, 28-Jun-2018

The People’s Bank of China (PBOC) said on Saturday that the world’s largest stockpile of foreign currency last month plunged by 41.08 billion US dollars, to 3.011 trillion US dollars, the lowest level since March 2011.

The decline was smaller than the previous month’s drop of 69.06 billion dollars and less than the expected 51 billion drop, according to a Reuters poll of analysts.

The drop was mainly accounted for by the central bank’s efforts to control the Renminbi’s descent and stabilize the currency, according to a statement by the State Administration of Foreign Exchange (SAFE).

SAFE said other factors for the drop included the strengthening of the dollar against other currencies such as the euro, which dented the value of non-dollar-denominated assets in the reserves in dollar terms.

/CFP Photo

/CFP Photo

The data came days after the biggest-ever two-day surge in the offshore version of the Renminbi, as China worked to curb illegal capital outflows by imposing new capital controls, including strict limits on large business deals abroad and intensified scrutiny on individual forex purchase.

A new US administration led by Donald Trump will be likely to make the stability of the Renminbi harder. Trump has signaled a tougher approach to trade with China, threatening to label China a currency manipulator and impose a blanket tariff on imports.

/CFP Photo

/CFP Photo

Still China has a war chest of 3.0 trillion forex reserves to meet its obligations to foreign creditors. The reserves are twice the amount of China’s foreign debt and can cover more than 20 months of imports.

Based on the ratio of the forex reserves to M2 (the broad money supply), which is adopted by the World Bank to gauge the forex sufficiency, China should maintain the currency reserves between 2.13 trillion dollars and 4.26 trillion dollars to blockade destructive capital outflow, according to economists at the Chinese Academy of Social Sciences.

On Friday, the midpoint for the onshore market was fixed by the PBOC 0.9 percent stronger at 6.8668, a level not seen for a month.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3