China

20:57, 12-Nov-2017

Severed hands and cheap credit: The trends behind Singles’ Day shopping

By Song Yuanyuan

With a record 168.3 billion yuan (25 billion US dollars) spent during China’s annual Singles’ Day retail event, shoppers have been feeling so guilty at their indulgence that they have coined a new greeting, “Did you chop off your hands?”, referring to the desperate measures needed to stop clicking Buy.

On the ninth Singles’ Day, or Double 11, the 168.3 billion yuan raked in by e-commerce giant Alibaba was 39 percent higher than the sum last year. The event is now about three times bigger than America’s “Black Friday” and “Cyber Monday” combined.

So what is driving this shopping bonanza?

Dangerously easy, global shopping

One major reason for the splurge is the addictive ease of buying, with more and more people finding it convenient to shop with their mobile phones. Some 1.48 billion mobile transactions were completed during the 24-hour period, roughly one transaction for every member of the population.

Ninety percent of all Singles’ Day sales were mobile, up from 82 percent in 2016 and 69 percent in 2015.

Alibaba group’s CEO Daniel Zhang /VCG photo

Alibaba group’s CEO Daniel Zhang /VCG photo

“Double 11 has created global synergy among all business forces powered by data technology,” Alibaba group’s CEO Daniel Zhang claimed when launching this year’s promotion.

The facts seem to have borne him out. Singles’ Day purchases or sales were recorded in over 200 countries and regions. Chinese logistics companies are busily expanding overseas to meet growing demand for cross-border online shopping. Meanwhile, more international brands and department stores are also shipping goods to Chinese warehouses.

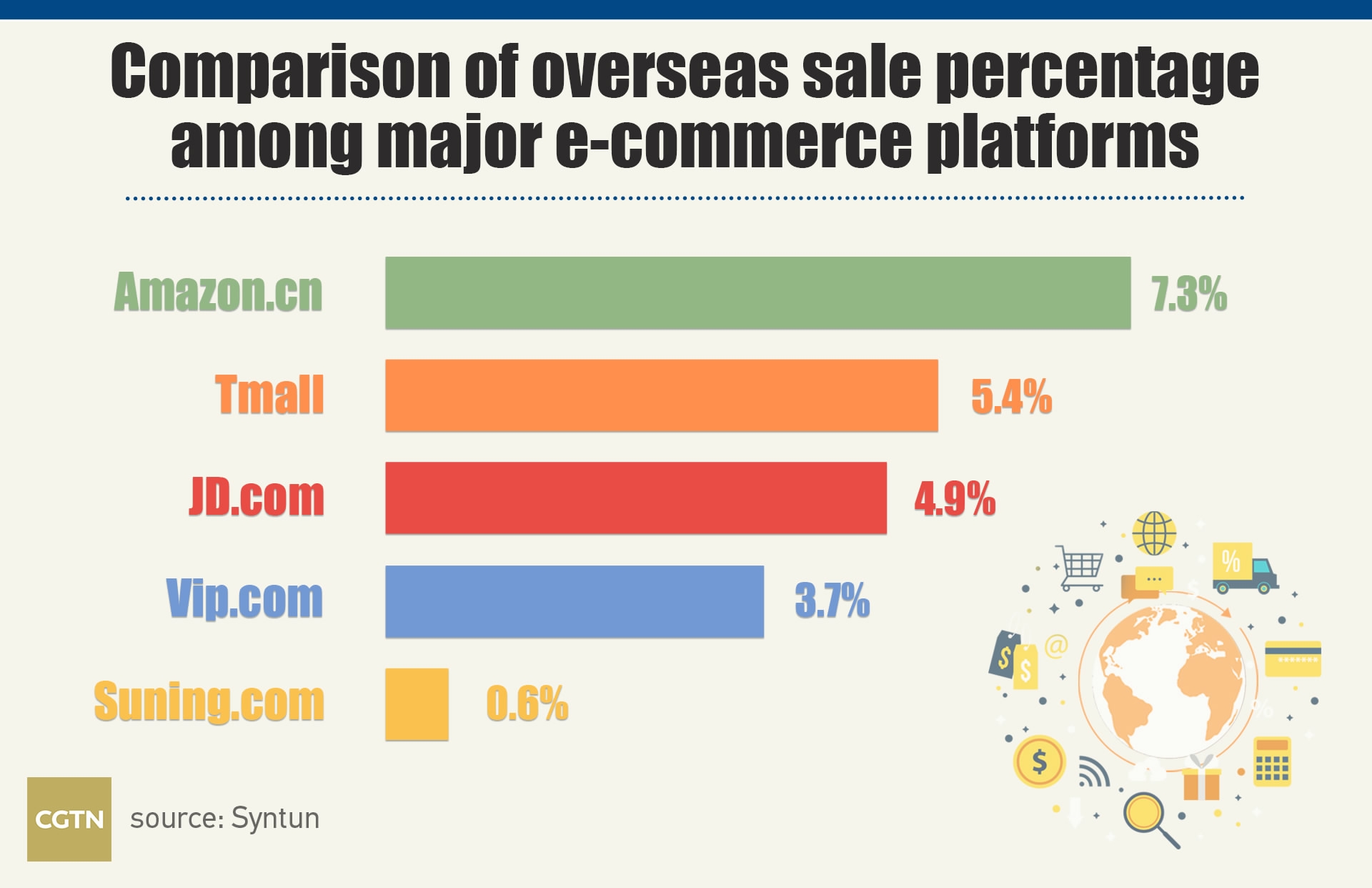

For US e-commerce platform Amazon, its amazon.cn operation has natural advantages in collaborating with big international brands and stores. It had the biggest share of overseas sales on Singles’ Day.

CGTN graphic

CGTN graphic

Lending for the digital age

Consumerism has been given official backing in modern China, with Premier Li Keqiang saying earlier in November that “consumption will be the main driver of economic restructuring, and economic growth should further be spurred by consumption.”

Financial technology, or fintech, is thriving in this environment.

“Digital payment as a leading force in the fintech trend has created new energy for supply-side structural reform. Double 11 shows the great consumption potential in China’s economic upgrading,” said Dr. Li Honghan, a senior fellow with research body the Collaborative Innovation Center of Industrial Upgrading and Regional Finance.

Consumer finance is growing fast as well, based on this new consumer economy. According to a Chinese central bank projection, more than 30 percent of households’ total borrowing will be for “pure commodities consumption” in 2018.

Tmall concept store /VCG photo

Tmall concept store /VCG photo

And as the Internet becomes more and more integral to people’s lives, this lending is increasingly being done online. The iResearch consulting firm’s data shows the Internet finance consumption market in China grew at a speed of over 200 percent from 2013 to 2014, in its initial boom.

Consumer credit apps prompt more spending

“I use both JD credit and Alipay Huabei for mobile payments. These personal credit apps make it so easy to spend money, especially for large payments. For example, JD credit’s installment plans have very low interest and even zero interest, so when I purchase goods over a couple of thousand yuan, I am tempted to use it,” Vivi Mao, a 28-year-old white-collar worker, told CGTN.

Alipay Huabei on the left and JD credit on the right

Alipay Huabei on the left and JD credit on the right

A recent report from Alipay showed that over 45 million youngsters born after 1990 have signed up to Alipay Huabei. This payment option, which was launched in 2015, serves as a virtual credit card for shoppers on Alibaba's Tmall and Taobao sites.

As e-commerce platforms like Alibaba and JD.com have collected massive amounts of data to build detailed user profiles, they’re well placed to develop consumer financial services, as many analysts have pointed out.

Learning from past mistakes

The “traffic jam” of millions of users trying to make payments has commonly caused e-commerce websites to crash on Singles’ Day, but the major players put in a lot of early preparation and testing to make sure that didn’t happen this time, noted Dr. Xue Hongyan, a senior research fellow at Suning Fintech Research Institute.

“Every year’s Double 11 has been a showcase for all the major e-commerce platforms and their financial services as well,” Xue told CGTN.

It looks like there will be plenty more severed hands as they get better and better.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3