Business

23:01, 19-Apr-2018

Could China benefit from US sanctions against Rusal?

CGTN

Russia’s aluminum giant Rusal has held talks with Chinese companies and traders this week, looking for alternative markets to make up for lost exports, according to Bloomberg reports, as US sanctions against the company started to take a toll.

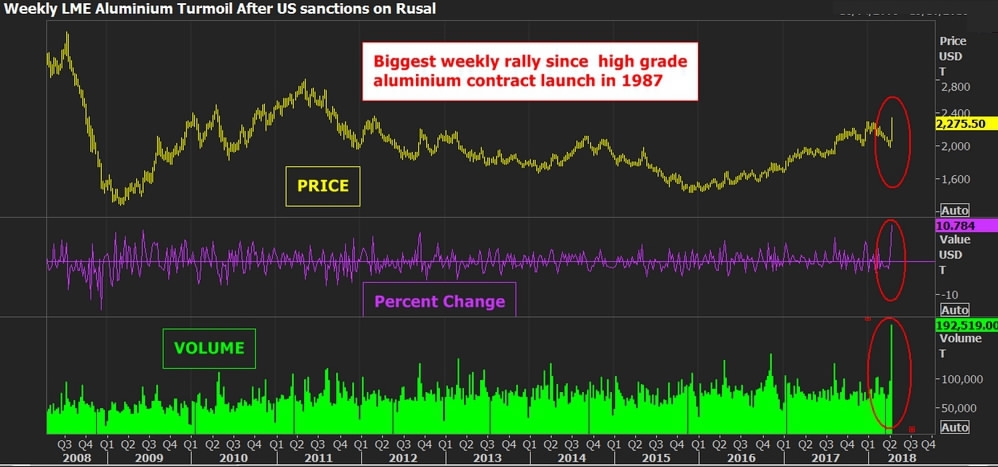

The prices of aluminum had risen by over 20 percent to 2,522 dollars a tonne as of Wednesday on the London Metal Exchange (LME), as fears for supply shortage grow, given that Rusal – the world's second-largest aluminum producer – accounted for more than six percent of global aluminum supplies last year.

As the world’s largest metal market, China is understandably an alternative solution Rusal is seeking.

Whether as a supplier to fill the void in the global market or a potential market for Rusal, will China with irony benefit from the US sanctions, given the political pushback against Chinese aluminum products by Trump?

Reuters Terminal Chart

Reuters Terminal Chart

China could be a savior for Rusal

The Shanghai Futures Exchange (ShFE) has reacted mutedly to the US sanctions against Rusal, widening the aluminum price gap with LME.

China is a huge aluminum exporter, not of primary aluminum but rather of aluminum in the form of semi-manufactured products. Rusal could flow its products to the Chinese market with a discount of around 25 percent, considering China’s lower domestic prices, logistics and duties.

“If Rusal can stomach the discount we would expect units to flow there. China could, in turn, boost semi and even primary aluminum exports to ease the rest of world shortage,” said Oliver Nugent, an analyst at ING Bank in Amsterdam.

Rusal officials and Chinese companies have not reached any deal, and may not do so, as Chinese officials are cautious about the risk of contradicting sanctions, according to Bloomberg reports.

An alternative destination for Rusal material is Turkey, a big aluminum consumer, while some of its metal could ultimately be remelted, then rerouted, analysts said.

More Chinese metal flowing to the US?

China may be the only place with surplus aluminum, and the world now needs Chinese exports, but a more complicated landscape with varied political intentions has choked the needs.

The US has led the political pushback against Chinese aluminum product exports. Trump signed off on a 10-percent import tax on all imports of aluminum from China.

Separately, the US is slapping anti-dumping duties on specific Chinese products. Aluminum foil and aluminum alloy sheet have already been hit with countervailing duties.

Apart from the prices, China domestically has been cutting excess capacity. So the complex has caused a dilemma for the global market to fill the supply gap, and China is unlikely to benefit much from the US sanctions.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3