22:40, 29-Aug-2018

Oil Markets: Shanghai crude futures boost RMB's global usage

Updated

21:41, 01-Sep-2018

02:41

It has been five months since China's crude oil futures market opened in Shanghai, and recent trading has made it the third largest crude oil futures market in the world in terms of trade volume. That in turn has become another factor boosting the use of the Renminbi in major global markets. Chen Tong reports.

Shanghai crude oil futures have been attracting more and more investors over the past five months. The average daily trading volume in August saw an increase of over 700 percent compared with the volume recorded in March. As of the end of last week, the number of Shanghai's crude oil future deals had reached 10.43 million, with a value of 5.06 trillion yuan. That's all providing a broadening bridge for the Renminbi to be more internationally used.

DENG ZHIJIAN, INVESTMENT STRATEGIST DBS CHINA "The trading volume of the Shanghai crude oil futures has reached third place internationally, and that's a significant achievement. In the past, it was difficult for domestic investors and companies to use the yuan to hedge risks because there were many limitations when using it. But as the use of the Renminbi has widened, especially with the launch of yuan-denominated crude futures, more companies can benefit."

Despite the rapid growth of Shanghai's market, the trading volume is still quite small compared with the world's other two large petroleum futures markets -- London and New York. And the pricing of crude oil is still primarily denominated in the British pound and the US dollar. So experts say that while Shanghai's oil futures market is helping internationalize the yuan's usage, that help is still limited for the moment.

LI LIUYANG, CHIEF ANALYST CHINA MERCHANTS BANK "Compared with China's oil demand and other large oil future markets, it's just a small market. So it needs time for this market to make more progress and develop more and let more maybe oil suppliers to join this oil market to make this market bigger to make the Renminbi more internationally used. This is just the first step."

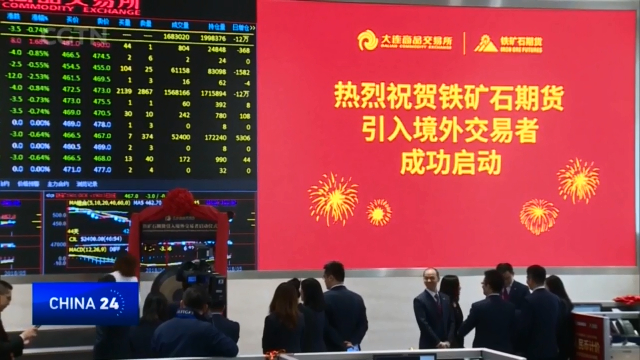

There are other steps being taken in the financial markets to boost the Renminbi's internationalization of course. In May, the Dalian Commodity Exchange opened its iron ore futures to foreign investors. The stock and bond connects with exchanges in Hong Kong are also playing an increasing role in globalizing the use of the Chinese currency.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3