Business

21:59, 25-Jul-2017

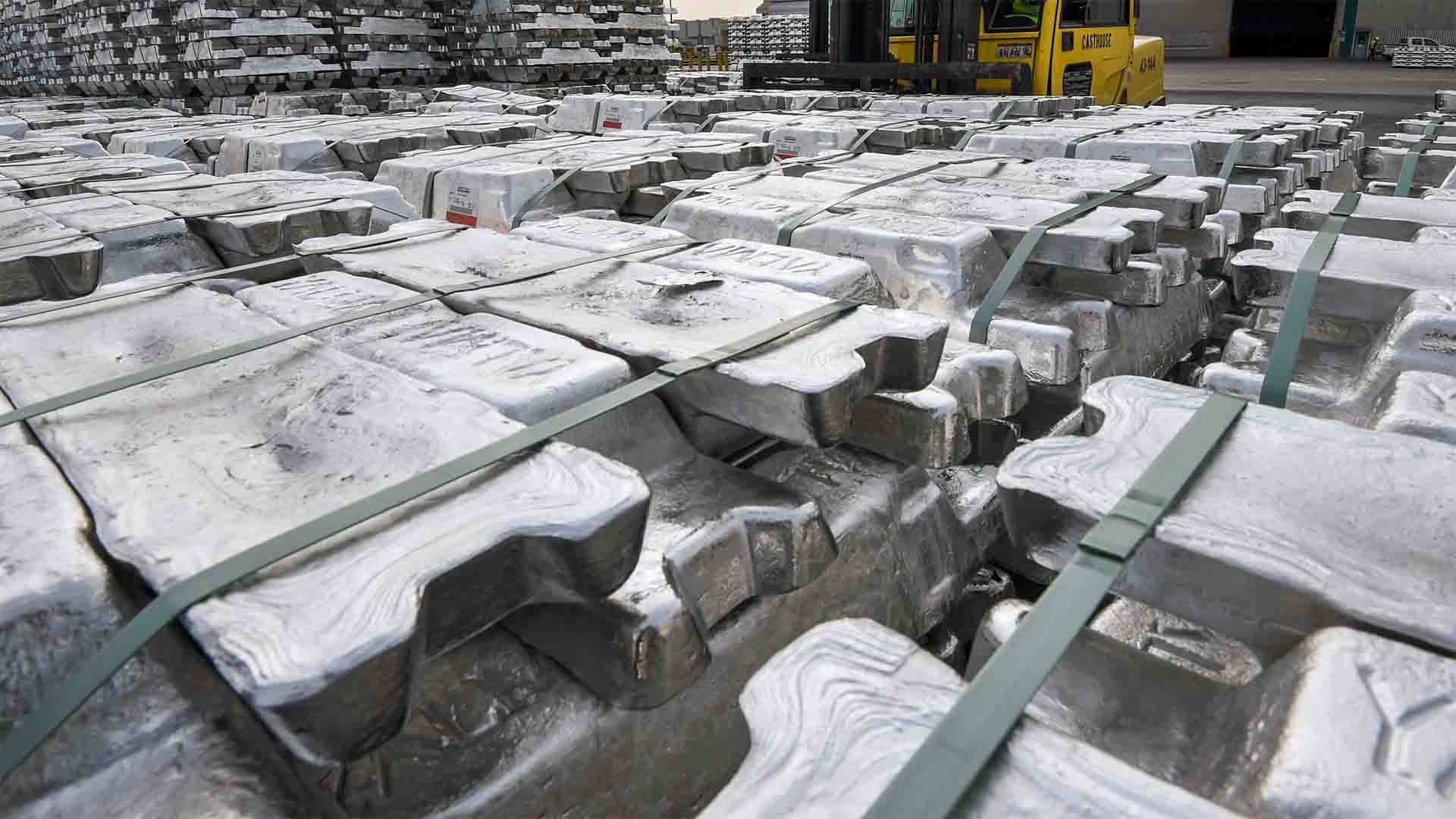

China aluminum industry: will prices continue to rise?

The price of aluminum has been on the rise this year due to market anticipation of production cuts in the second half of the year. And that means that at least for now, aluminum production has become one of the most profitable non-ferrous metals businesses in China, with profit reaching 10 percent per ton.

Whether the production cuts can be effective, however, is still in question; and whether prices will continue to rise, depends on the answer.

Having jumped over 13 percent from a January low of some 12,800 yuan (1,900 US dollars) per ton, the price of aluminum futures is currently above 14,000 yuan (2,070 US dollars) per ton, with the market expecting fluctuations around that level until the third quarter of the year

According to CGTN’s Xu Xinchen, the price rise has been driven by an April decision by the government to cut an estimated five million tons of illicit production, as well as cuts expected due to environmental concerns later in the year. The market demand for aluminum, however, is not decreasing as the metal is becoming a popular substitute for copper and stainless steel.

Rising demand for aluminum has brought the industry back into profit, which has encouraged many aluminum manufacturers both big and small to come back into production.

According to Deutsche Bank, the market demand for aluminum in China increased 8.5 percent in the first half, while production rose 10 percent. Experts say the rapidly increased production has resulted in fairly high inventories at the moment, but it is still not clear whether the supply is sufficient.

Mymetal.net predicts that if all the projected production cuts are implemented, it will take a total of 8.1 to 9.1 million tons of aluminum capacity out of the market. That would leave aluminum production up more than 11 percent from last year.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3