Business

18:58, 04-Sep-2017

Chinese regulators crack down on coin offering markets

By CGTN’s Cyrus Ip

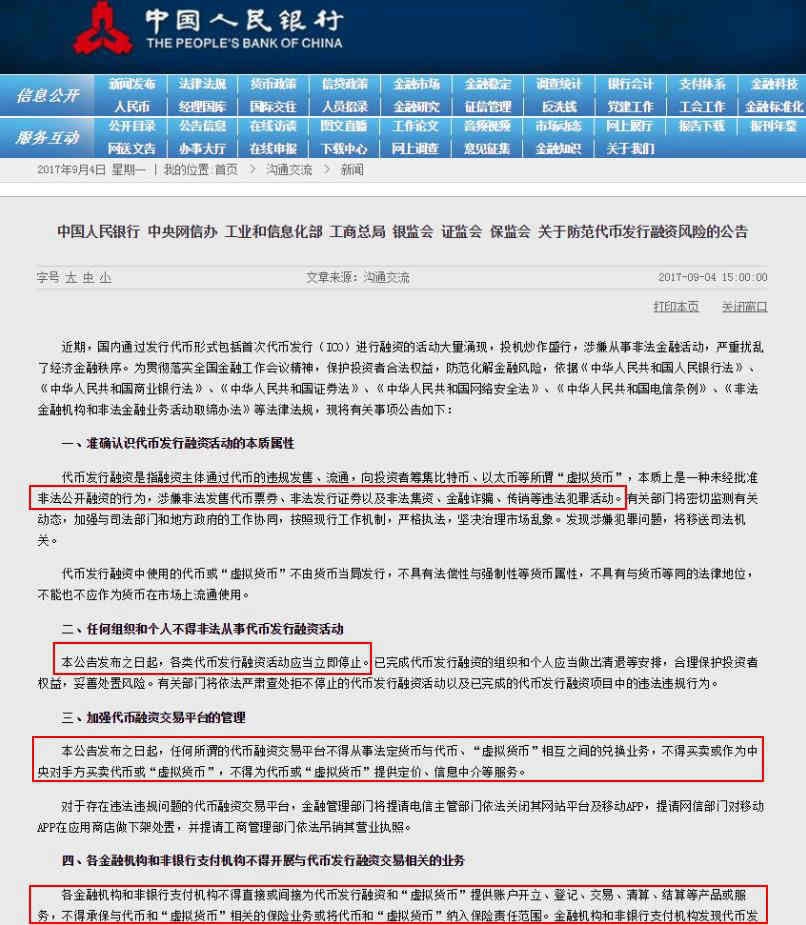

The People’s Bank of China, joined by six national ministries, released an announcement on Monday, defining an initial coin offering (ICO) as “an illegal public financing behavior”, banning the whole financial industry from continuing ICO activity.

Announcement on the website of People's Bank of China / CGTN Photo

Announcement on the website of People's Bank of China / CGTN Photo

The announcement also said regulators will monitor the situation and strictly enforce the laws.

The regulators banned the main businesses of virtual coins (mainly Bitcoin), including any exchanges or transactions. It also ordered all financial institutions to stop serving virtual coin businesses, including exchange, clearing and settlement.

The news came just one day after the ICO service suspension in BTC China – one of the largest Bitcoin platforms in China – who stopped its ICO trading, both ICOCOIN and ICOINFO over the weekend, only one week since it debuted.

The company said the national ICO regulations are still premature, and the business mostly operates in grey areas, suspending the ICO service would be the best for the company. The price of the token used in the ICO, plunged over 30 percent on Saturday, losing over 24 million US dollars of market cap in just 24 hours.

ICO, the acronym for an initial coin offering, is like an initial public offering, but with a cryptocurrency. Startups use this much unregulated method to raise funds, and able to bypass the traditional regulated capital-raising process. Most of the payments are in bitcoin.

China is one of the most active countries in the global ICO market. Data from the Ministry of Industry and IT shows, there were 65 ICOs in the first half of this year, raised more than 2.6 billion yuan in total, and more than 100,000 people have participated.

VCG Photo

VCG Photo

While many ICOs have been a lucky choice for investors, some of them ended with losses, in some cases even involved scam and fraud. This has caused a huge debate about the legitimacy of ICOs among the investment community.

The US Securities and Exchange Commission said last week, that the tokens and coins involved in ICOs would be considered securities, and may need to be registered unless a valid exemption applies. Singapore and Russia are also started to tighten the regulations on ICOs.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3