Business

19:51, 09-Feb-2018

China plans to launch crude oil futures on March 26

CGTN

China plans to launch its long-awaited yuan-denominated crude oil futures contract at the Shanghai International Energy Exchange (INE), a unit of the Shanghai Futures Exchange (SHFE) on March 26, the country’s securities regulator said on Friday.

Preparations for the launch of the contract have almost been completed, said spokesman Chang Depeng with the China Securities Regulatory Commission (CSRC) in a regular press conference in Beijing.

The Shanghai Futures Exchange / VCG Photo

The Shanghai Futures Exchange / VCG Photo

The futures contract will trade medium sour crude oil including Dubai Crude, Upper Zakum Crude, Oman Crude, Qatar Marine, Yemen Masila Crude, Iraqi Basra Crude and crude oil extracted from China’s Shengli oil field, according to a statement released by INE.

“Crude oil futures is the most important commodity contract on China’s futures market,” said Huang Lei, a commodity futures analyst. “It was not easy to design and create a complete system in a new market.”

The introduction of the yuan-denominated oil futures has been in the works for six years. Its launch was delayed several times as the authority evaluated its potential risks. Trading of the oil futures will be open to both domestic and foreign investors.

Most oil trades are currently priced off two crude derivatives, US West Texas Intermediate (WTI) which is used to price crude in the US and elsewhere in the Americas, and London’s Brent which is used to price Middle Eastern, European and Asian crude. They are now executed mainly on the New York Mercantile Exchange (NYMEX) owned by CME Group and the Intercontinental Exchange.

CGTN Photo

CGTN Photo

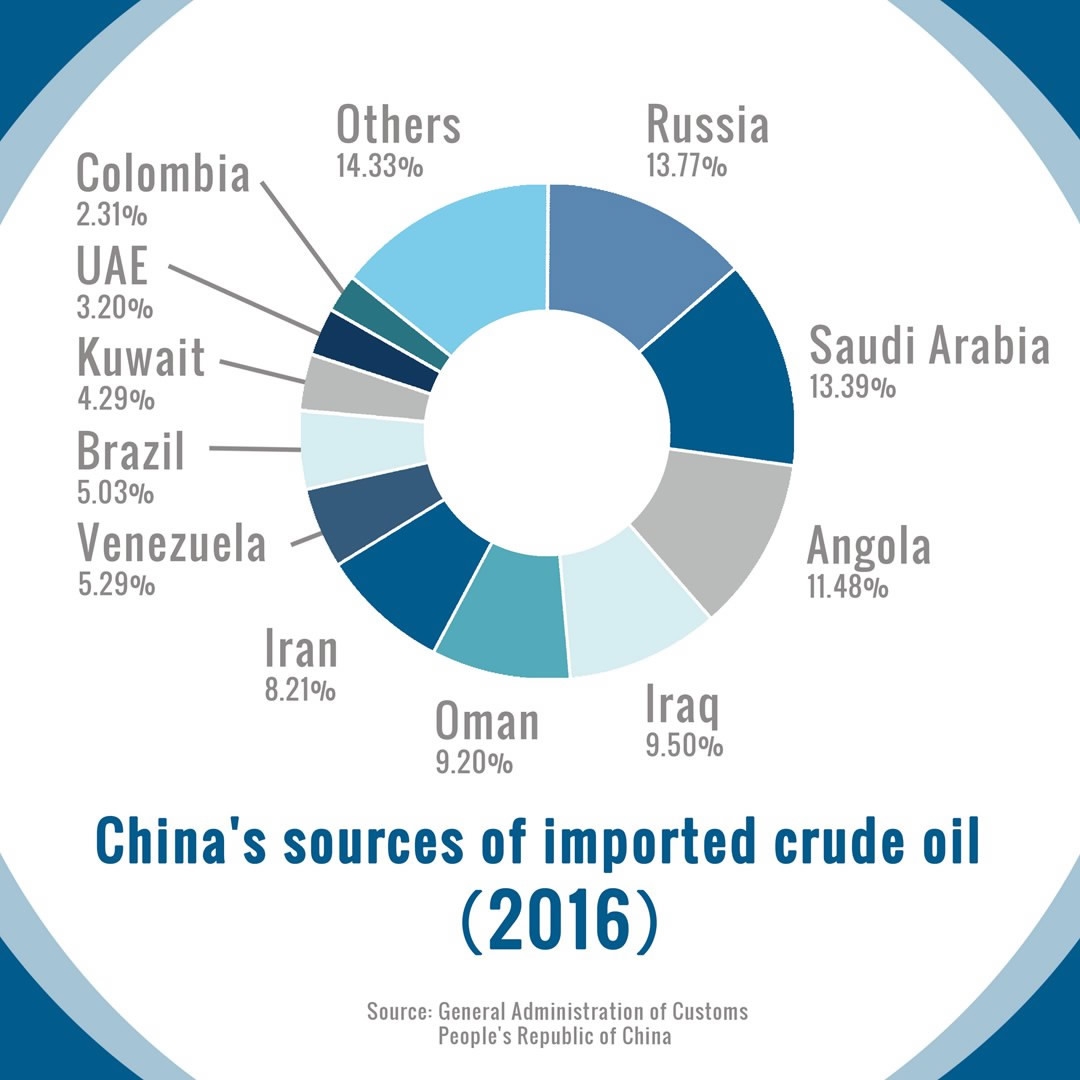

As the world's largest importer of crude oil, China has imported over 67 percent of its demand of crude oil, according to China's National Bureau of Statistics. In 2017, the country imported 420 million tons of the commodity.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3