China

17:32, 15-Nov-2017

More PPP scrutiny to prevent fiscal risks

By Song Yuanyuan

China’s public-private partnership (PPP) projects have developed rapidly since 2014. While intended for promoting the marketization of public service industries and boosting infrastructures, with more participation from the private, many hidden risks have also come up, raising serious awareness among top Chinese government officials.

“Although China has grown into the biggest PPP market globally, in practice, many local governments have misused the PPP model merely as a means of financing, building up even higher debt and leveraging.” Shi Yaobin, China’s Vice Finance Minister said at a recent PPP financing forum earlier in November, raising serious concerns that many PPP projects have been misused by local authorities in order to disguise debt as equity.

Shi Yaobin, Vice Finance Minister speaking at the PPP forum on Nov 1 /photo from public pool

Shi Yaobin, Vice Finance Minister speaking at the PPP forum on Nov 1 /photo from public pool

Rapid development and mass overhaul

According to the data from China Public Private Partnerships Center under the Ministry of Finance (MOF), by the end of September, a total of 14,220 projects with a combined planned investment of 17.8 trillion yuan (2.68 trillion US dollars), nearly a quarter of China’s gross domestic product in 2016, had been registered.

Acknowledging the misconducts problems in PPP’s rapid developments, MOF stepped up scrutiny of PPP projects. Wang Yi, the head of the department of finance and also office dean of the PPP Work Leader Group, said the ministry will carry out a “cleanup” of the national PPP system and all unqualified PPP projects will be removed.

In the first nine months of this year, a total of 973 projects were removed from MOF’s PPP system and among them, 635 projects was removed in the 3rd quarter only.

Disguise debt as equities

The high debt problem has been troubling China’s long-term quality economic growth. China’s total private and public debt has exceeded 250 percent of gross domestic product, up from 150 percent before the global financial crisis, according to the Organization for Economic Cooperation and Development.

Buildings under construction/VCG photo

Buildings under construction/VCG photo

Most PPP in China may eventually transpire as government debts, similar to the local governments’ funding vehicles. “Initially, the PPP model was designed to help relive the accumulating local government’s debts and the low efficiency of public investment, in a push to reform the modern fiscal policy and improve government public services, such as transportation, environment, education and others. But in reality and in practice, local governments have furthermore built up hidden debts”. Ren Pengxing, a researcher of financing market at the China Agricultural Bank told CGTN.

Ren said, many local governments disguised the debt as equities using government bailouts, pointing out that they secretly signed side agreements in which they pledged to buy back the stake in the projects from external investors or to pay them dividends at fixed rates, just for short-term financing purposes.

PPP, the governments’ solo play?

While it uses the English-language abbreviation PPP, China defines the non-government partner as “social capital” instead of “private capital”, which opens the door for state-run firms, as Bloomberg news pointed out.

Photo from Sohu

Photo from Sohu

According to Fitch Ratings, among implemented demonstration projects selected by the government to show how PPPs should work, about 55 percent of the social partners are state-owned enterprises. The SOE share is even higher according to analysis of a larger project database cited by Bank of America, which sees state companies taking up 74 percent of the projects by value.

As Caixin reported, in February, the MOF ordered the government of Hubei Province in central China to investigate a PPP deal in the provincial capital of Wuhan after the project published shareholder information showing that all of the “private investors” were banks. Similar problems were uncovered in contracts to build public transportation in the eastern province of Shandong and the southwestern province of Guizhou.

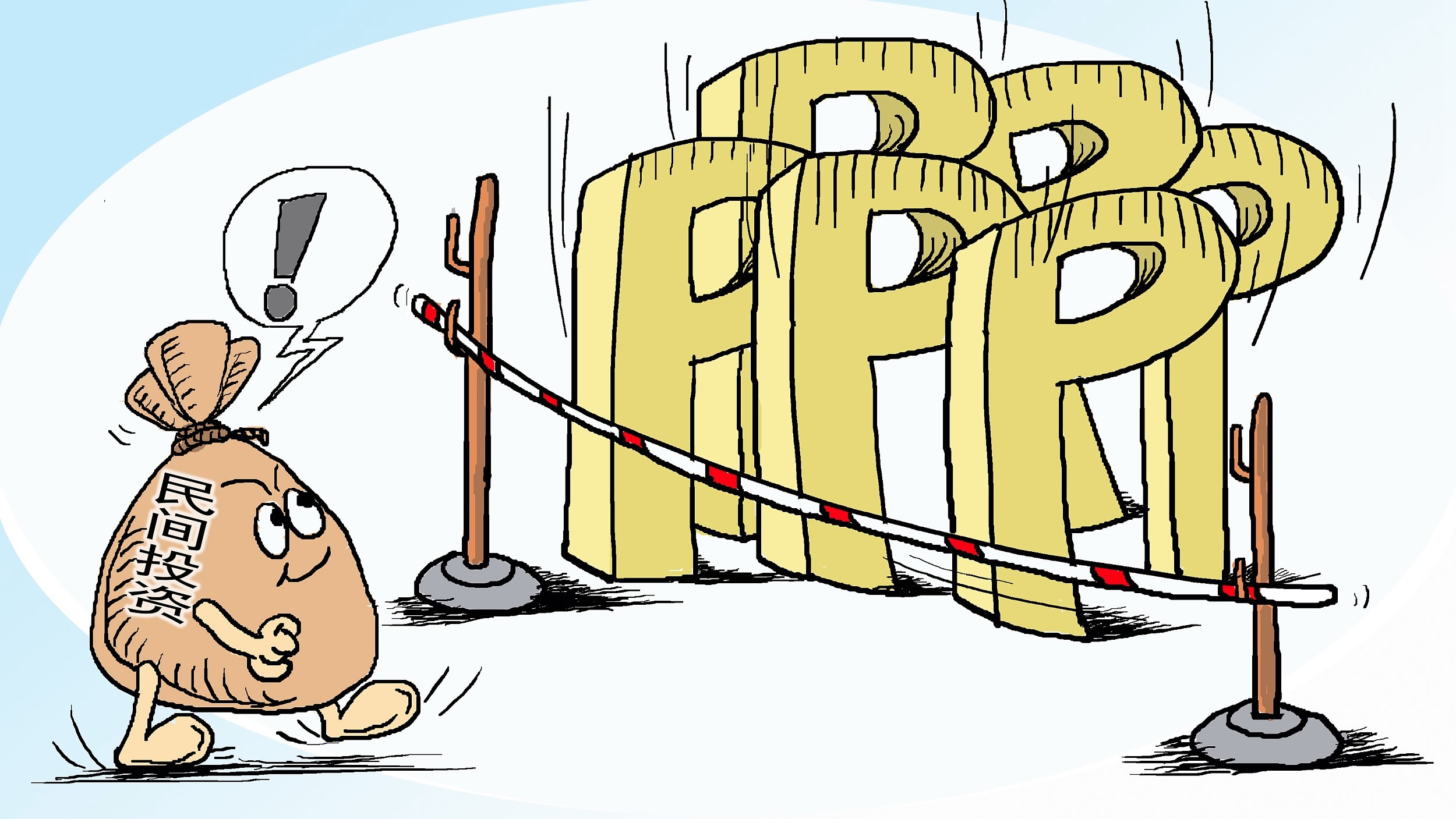

Private investments facing the thresholds of PPP/VCG illustration

Private investments facing the thresholds of PPP/VCG illustration

“Many PPP projects’ capitals are in fact still transferring inside the government institutions. This model is in nature the government’s solo play” Ren told CGTN.

“In many cases, state-owned or state-backed enterprises and financial institutions bound the PPP funds together, and then invest on the construction of PPP, financial institutions just get investment returns on maturity. This model is totally different from the International PPP models which encourages privates firms in participating in PPP construction, and also go against the principle of full competition in project bidding” Ren added.

Lack of enthusiasm among the private

Why there isn’t much enthusiasm among the private sectors in PPP projects? Ren said compared with the government, the private firms are still in a weak position, also considering the changing leadership terms of local governments, this add to many uncertainties. So the private don’t have that much confidence in the governments.

“Protection of private sector’ rights should also be strengthened, also ensuring fair play in the projects bidding,” Ren added.

Some local governments still emphasize GDP growth, neglecting the quality and sustainability, leading to “blind” investments.

As well as concerns about working with local governments, HSBC researchers believe that few private companies are committing to PPPs because the projects don’t look profitable enough. HSBC estimates that average returns on capital of 6 percent to 8 percent for PPPs aren’t attractive when equity investments offer returns of around 10 percent, The Diplomat, an online international news magazine reported.

Can asset-backed securities a new direction of PPP financing?

Guan Qingyou, chief economist of Minsheng Securities and member of PPP expert committee in China’s National Development and Reform Council (NDRC) has many times addressed the problems of PPP model in China, “PPP should not be used as a main channel for local governments’ financing, it must engage both the government and the private sectors at the same time for a business model’s sustainable development.”

This illustration shows the policies facilitating PPP coming out/VCG photo

This illustration shows the policies facilitating PPP coming out/VCG photo

Guan also pointed out, from the policy level, at the very beginning, the promotion of PPP is not unified, showing its “Chinese characteristics”: the State Council made the policies, NDRC take charge of “hardware” projects, like transportation infrastructures, and MOF mainly take charge of software projects, like public service projects, but in reality, hardware projects and public services are closely connected.

Guan believes asset-backed securities (ABS) in PPP projects will diversify its funding and engage the private sector.

At the end of 2016, NDRC and China Securities Regulatory Commission (CSRC) together officially announced to package assets from PPP projects into structured financial products offering income for investors, a move to attract more private participation.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3