18:14, 13-Jun-2018

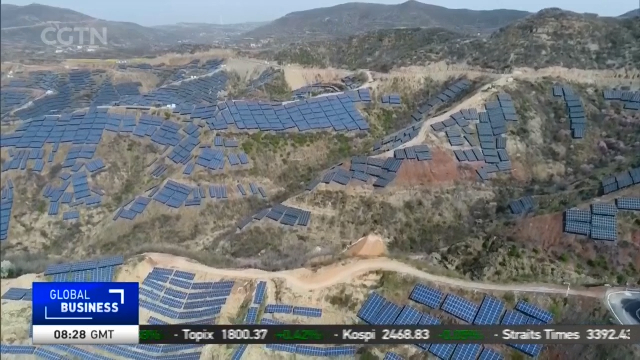

Solar Panel Sector: China cuts subsidies to curb over-heating

03:15

China has released new rules on investments and subsidies for solar panels in order to help cool the overheated sector. Mi Jiayi talked to analysts to find out how the changes will affect the sector.

Companies in the industry could earn bonuses by setting up PV power bases and selling the power to the state grid. But that all came to a stop two weeks ago. The National Development and Reform Commission, the Ministry of Finance and the National Energy Administration announced at the end of May that cuts would be made in national feed-in fees and subsidies for power generated by PV projects beginning this month. PV power generators won't be generating as much profit as they used to. So why did the government decide to cut the subsidies now?

HOLLY HU, SENIOR ANALYST SOLAR, TMT, IHS MARKIT "We have seen very fast growth in PV power capacity over the past two years, and that required a lot of subsidies. China's installed capacity in 2017 alone exceeded 50 gigawatt, and that's more than 50 percent of global demand. Some 80 or 90 gigawatt have not received subsidies. The overall gap in renewable energy subsidies is about 120 billion yuan, and 40% of that is down to PV projects about 45 billion yuan."

A cut in the subsidies will ease financial pressure on the state grid, creating price reductions can be on passed to consumers, but it will also cut the solar companies' revenues. Analysts say that will be a moment of truth for the companies, especially since they have been increasing production capacity in the face of fairly stable demand.

SHAO YU, CHIEF ECONOMIST ORIENT SECURITIES "Subsidies for companies are set up to protect new industries, but when they grow to a certain level, the industries need to compete in the market on their own. Solar companies will now need to lower their costs, and provide higher value-added products to replace those that used to receive subsidies."

Still, it's not all be bad news for solar companies. Holly Hu from IHS says there now could be improving prospects from overseas for Chinese PV companies. For a long time, China's PV product exports have been facing trade barriers in the United States, the European Union and India. But there could be changes in those markets soon.

HOLLY HU, SENIOR ANALYST SOLAR, TMT, IHS MARKIT "The EU is expected to release a resolution of its disputes regarding Chinese solar exports in the fourth quarter of this year. India is the second most important in the world, and Chinese products there have both price and technology advantages. If we can settle our trade disputes with India, that will also help ease things for the Chinese companies."

China now leads in PV development globally, and a large part of that was built on government support. The country's solar companies still have significant potential markets at home of course. China's 13th five year plan says that renewable energy is to supply 1.9 trillion kilowatt-hours of electricity, 27 percent of total power generation by 2020.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3