21:53, 23-Jul-2018

China P2P: Sector facing high defaults amidst liquidity crunch

Updated

21:23, 26-Jul-2018

02:40

China's P2P lending sector has been in trouble in recent months. However, it is now expected to face even stricter scrutiny from regulators because of more than a dozen fraud cases reported since the end of June. Mi Jiayi reports.

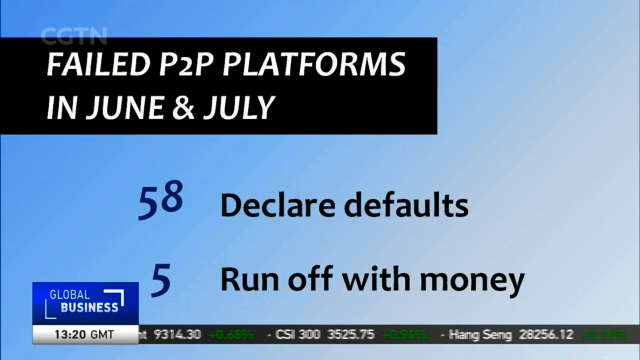

China's peer to peer lending industry has been facing problems since the end of June: founders fleeing with money, platforms accused of fraud or suddenly closed, or cases of outright default. Data from peer to peer research company Yingcan Group show that this month alone, 63 P2P platforms have reported new problems - 58 declared defaults, and five admitting that someone has run off with all the money.

"I have invested in P2P platforms. But I only go with big ones, either listed companies, or ones which have state-owned companies as investors."

To reduce the chances of further upsets, internet finance regulators from Shanghai, and Zhejiang and Anhui provinces met today to talk about how to tighten regulations in the industry. What are the problems they're facing?

JIANG QINGJUN, CEO SUANHUA "There are two types of platforms. Some platforms raise money from investors and loan it to corporations, rather than to individuals. So as the market liquidity gets tighter, these companies taking the loans began having trouble making repayments, and that has led to platforms having trouble cashing out. Another type of platforms raise money but have never loaned it to anyone. On the contrary, they have embezzled the money and then put it into other investments to improve their profits. But in the recent liquidity crunch, their second investments began to lose money, so these platforms have ended up in default."

Analysts warn that investors should look for detailed information about the products they are investing in. One financial expert says recent problems in the P2P industry are now being brought under control.

ZHOU KUNPING, SENIOR ANALYST BANK OF COMMUNICATIONS "Investors should remain calm about the market. Financial institutions with proper licenses, like banks, insurance companies, securities brokers, and mutual funds, the risks are now under control after years of regulation."

The Banking and Insurance Regulatory Commission said Friday it will begin washing out of the market P2P companies that do not meet industry standards. There are over 1,800 P2P platforms operating in China now, with about 50 million registered users and 1.3 trillion yuan of outstanding loans.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3