Business

15:33, 20-Jul-2017

Wanda, Sunac and R&F join hands in historic property deal

By CGTN's Ming Tian

The largest property deal in China's history just added a third member to it.

Wanda Group signed an agreement on Wednesday to sell property to Sunac Holdings and R&F Properties as it continues to transform into a light-asset company.

Wanda will sell 77 hotels to R&F at 19.9 billion yuan (2.94 billion US dollars), and 91 percent equity stake of its 13 cultural tourism projects to Sunac at 43.8 billion yuan (6.48 billion US dollars).

The signing ceremony for the strategic partnership between Wanda Group, Sunac and R&F Properties Group in Beijing on July 19, 2017. /VCG Photo

The signing ceremony for the strategic partnership between Wanda Group, Sunac and R&F Properties Group in Beijing on July 19, 2017. /VCG Photo

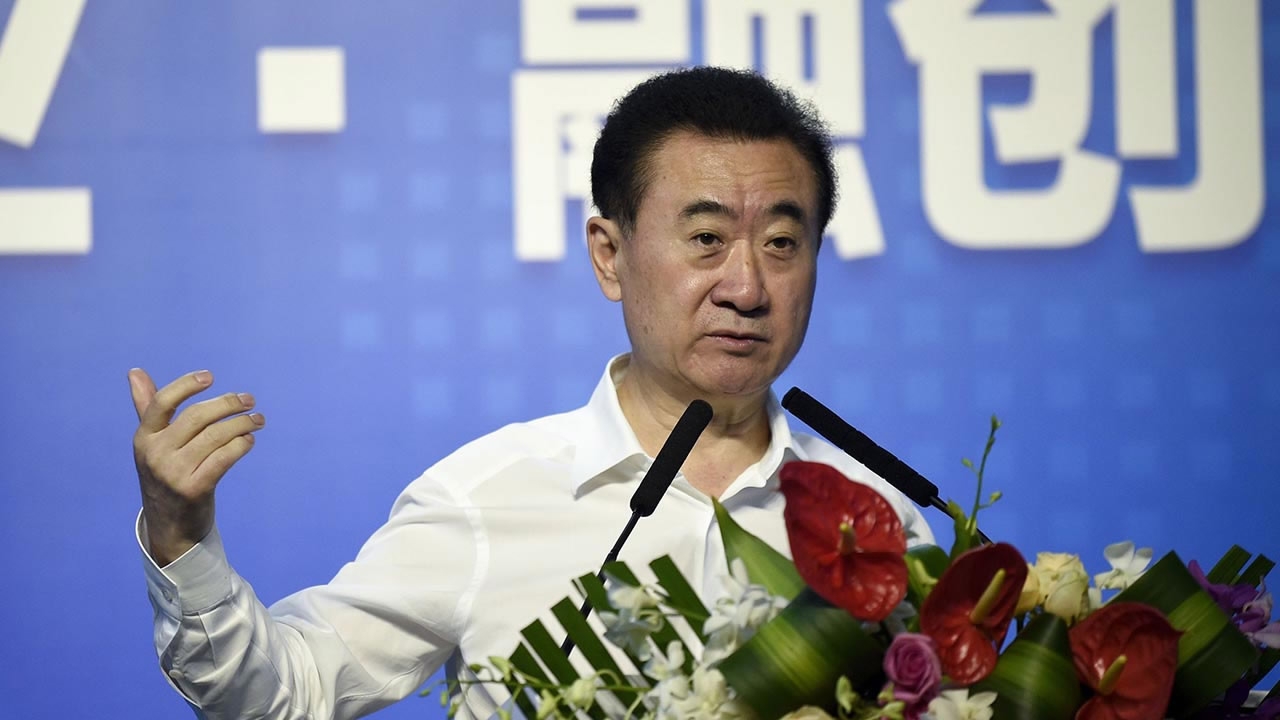

Wanda Chair Wang Jianlin expressed belief that the deal would make his company a winner.

“Through the deal, Wanda has slashed its debts, and collected a large amount of cash. The signing not only means that Wanda has started its light-asset operations, but also that the Wanda tourism sector is also taking on the same development model,” said Wang.

Wednesday's deal inking came as a bit of a shock, as Sunac was reportedly the only buyer in Wanda’s last announcement on July 10. R&F was not known as another potential buyer until the signing ceremony.

Moreover, the signing ceremony was delayed at the last minute for an hour and a half, reflecting the broadness and complexity of the deal.

Wang Jianlin (R), Chair of Wanda Group, and Li Silian (L), Chair of R&F Properties, talk on Wednesday's signing ceremony. /VCG Photo

Wang Jianlin (R), Chair of Wanda Group, and Li Silian (L), Chair of R&F Properties, talk on Wednesday's signing ceremony. /VCG Photo

R&F aims to boost its hotel business through the purchase.

“We will further expand our hotel business, increase our returns on quality properties, and achieve a more diversified operation,” said Li Silian, Chairman of R&F Properties.

Also, the change is in turn a relief for Sunac, which has been known for its aggressive purchases in recent years.

Sunac originally had to pay more than 63 billion yuan (9.31 billion US dollars) for the whole sell-off.

A high-end Wanda resort in a beautiful tourism spot in Yunnan Province. The project is among the 13 cultural tourism projects that Sunac is taking over. /VCG Photo

A high-end Wanda resort in a beautiful tourism spot in Yunnan Province. The project is among the 13 cultural tourism projects that Sunac is taking over. /VCG Photo

“The change for Sunac means better liquidity, as it cuts our debt levels. The new terms are acceptable, and all parties are satisfied,” said Sun Hongbin, Chairman of Sunac China Holdings.

Meanwhile Wanda will be able to pay back most of the company’s bank loans.

The handshake between the three men seemed to suggest everyone is getting what they wanted. But the three companies certainly have taken on diverse paths as real estate developers keep looking for new growth drivers amid changing regulations and market demand -- maybe only time will tell what future means for them.

(Gao Songya contributed to the story)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3