Business

21:33, 22-Nov-2017

Will the military coup put Zimbabwe's economy back on track?

By CGTN’s Liang Rui

The Zimbabwean Stock Exchange experienced a record-breaking bull run fueled by inflation-weary investors. The market peaked at about 15 billion US dollars in early November.

Analysts originally expected a self-correction to cap the spectacular run, before last week's sudden military coup further stirred up the situation.

Though some foreign-owned businesses have taken precautionary measures to safeguard their human and capital assets, most have remained open and are trading as normal, as impending changes on the political landscape could lure investors with a long-term focus.

Hundreds of women in Zimbabwe demonstrated against President Robert Mugabe's government by beating pots, symbolizing a nation facing starvation and economic hardships, on July 16, 2016. /VCG Photo

Hundreds of women in Zimbabwe demonstrated against President Robert Mugabe's government by beating pots, symbolizing a nation facing starvation and economic hardships, on July 16, 2016. /VCG Photo

Over a decade ago, then President Robert Mugabe initiated the “Fast Track” land reform, seizing 1,200 farms from white owners and giving them away to the black people, who did not have qualified management or farming skills.

That has sharply cut agricultural production, worsened already strained racial tensions, driven foreign investors away and also triggered economic sanctions from the western countries. Zimbabwe has since largely been isolated by the international community and has struggled to attract significant foreign investment under President Robert Mugabe.

Therefore, some experts are hoping a government reshuffle could pump up investors’ confidence in Zimbabwean economy.

“The military coup may encourage an inflow of foreign capital, particularly into agriculture and mining, major sectors of its economy. If foreign investors are more sure of the safety of their assets, if they can be ensured of constant reliable supply of electricity and so on, there are reasons to be optimistic,” said Ian Cruickshanks, chief economist of the South African Institute of Race Relations.

But Cruickshanks also reminded the investors to watch closely at the government power transfer and make sure there will be a real change of mind in the leadership of the parties.

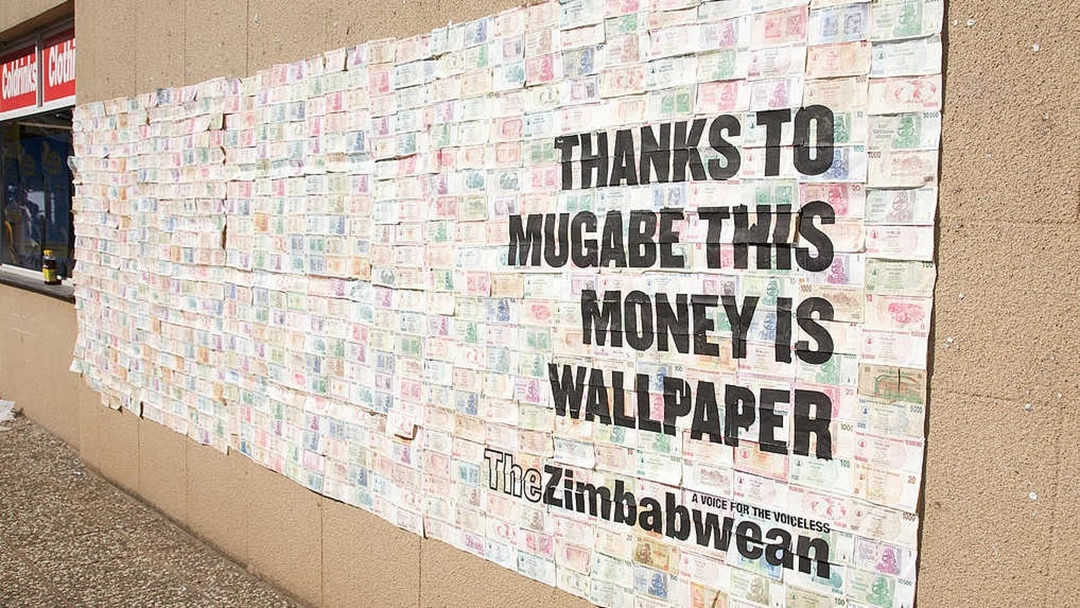

The Zimbabwean Newspaper in 2009 created an ad campaign featuring huge posters, wall murals and flyers made out of trillions of Zimbabwean dollars, to protest the inflation under Mugabe's government. /VCG Photo

The Zimbabwean Newspaper in 2009 created an ad campaign featuring huge posters, wall murals and flyers made out of trillions of Zimbabwean dollars, to protest the inflation under Mugabe's government. /VCG Photo

Farai Vengesai, Investment Analyst with Akribos Capital, said the shake-up might generate a positive effect on domestic policies, which can be good for businesses. But he also believed the Zimbabwean market will keep going down.

“To date I think we have lost 4 billion (US dollars) in terms of market capitalization. There is still a lot of down side, the market is going to bottom down somewhere inside of 10 billion US dollars, and we still have a few days to go before seeing stability in the market,” Vengesai said.

Indeed, the Zimbabwean administration, whether a new one or the existing one, has to face serious challenges recovering the country from decades of economic crisis.

(CGTN’s Gao Songya also contributed to the story.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3