Tech & Sci

08:57, 02-Aug-2017

Apple still struggles in China after record high sales in Q3

Apple delivered surprisingly strong fiscal third-quarter earnings and signaled that its upcoming 10th-anniversary phone lineup is on schedule, driving the stock up 6% to an all-time high in after-hours trading on Tuesday.

The stock climbed above its intraday record high to 159.10 US dollars after the company reported better-than-expected iPhone sales, revenue and earnings per share.

Apple also noted it hit a milestone of 1.2 billion iPhones sold.

Apple Website

Apple Website

The April-June quarter is traditionally a soft one for Apple as the market waits for the September launch of new iPhone models. But Tuesday’s results show that iPhone buyers may be less inclined than they once were to delay purchases until a new model is out.

Apple is widely tipped to adopt higher-resolution OLED displays for the latest iPhone, along with better touchscreen technology and wireless charging – which could come with a 1,000 US dollars plus price tag. The phone is expected to launch in September.

New iPhone

The company said iPhone sales rose 1.6% to 41.03 million in the third quarter ended July 1, above analysts' average estimate of 40.7 million units, according to FactSet StreetAccount. Apple sold 40.4 million iPhones a year earlier.

iPhone 8 is expected to be a hit in the smartphone market. /Reuters Photo

iPhone 8 is expected to be a hit in the smartphone market. /Reuters Photo

But a lower average iPhone selling price of 606 US dollars, well below Wall Street expectations of 621 US dollars, caused iPhone revenue to come in at 24.8 billion US dollars, below expectations of 25.5 billion US dollars.

Apple Chief Financial Officer, Luca Maestri pointed out that the weak price was partly explained by Apple lowering the flow of inventory by 3.3 million units, which he said were “entirely at the high end of the range.”

The company's net income rose to 8.72 billion US dollars, or 1.67 US dollars per share, from 7.80 billion US dollars, or 1.42 US dollars per share, a year earlier.

Chinese Market

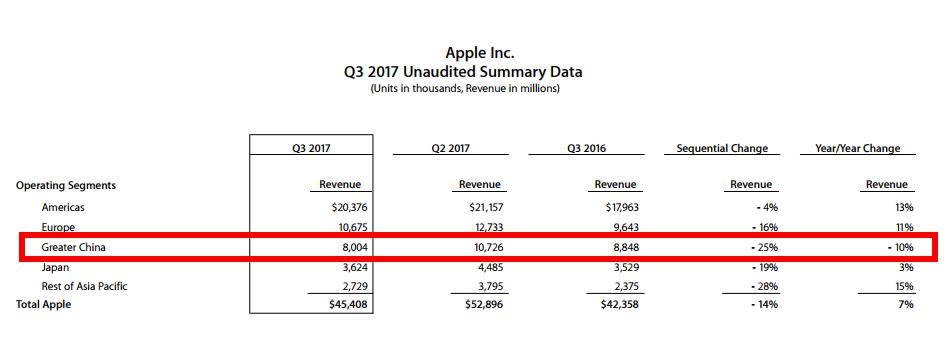

Apple said revenue from emerging markets excluding China grew 18 percent, a bright spot. But sales from the Greater China region fell 9.5 percent to eight billion US dollars in the latest quarter, as consumers switched to newer domestic offerings.

The decline was smaller than recent quarters. Apple's Maestri said the Chinese mainland revenue was flat, as were iPhone sales in the mainland. However, Greater China is the only region that saw negative growth year-over-year.

Apple is doubling down on China as its Chinese rivals pull ahead. /Reuters Photo

Apple is doubling down on China as its Chinese rivals pull ahead. /Reuters Photo

"The decline from a market standpoint was concentrated in Hong Kong, which is a place that has been really affected by a reduction in tourism because the Hong Kong Dollar is pegged to the US dollar,” Maestri said.

Meanwhile, Apple CEO Tim Cook pointed out on the earning call that what they see from the mainland is "more encouraging". When talking about the popularity of WeChat and other instant messaging services in China, Cook described it "a good thing". In his opinions, the rapid development of instant messaging apps in China will make it easier for potential new customers to switch to iOS.

More Coming

Apple CEO Tim Cook declined to directly address U.S. President Donald Trump's claims that Apple will build three new factories in the U.S., instead citing the company's job creation efforts and a one-US dollars billion US manufacturing fund.

Cook also hinted that Apple's experiments with self-driving cars may include ambitions that extend beyond cars. He said the company is making a "big investment" in autonomous systems.

(With input from Reuters)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3