Business

07:30, 01-Aug-2017

US sanctions on Venezuela partly keep oil price at 2-month high

Oil prices rose to two-month highs on Monday, ending the strongest month of the year for crude futures, boosted in part by threats of US sanctions against Venezuela's oil sector.

During the trading day, chatter centered on potential US Treasury sanctions targeting the country's oil sector in response to Venezuela's election Sunday which Washington denounced as a "sham."

That helped boost prices prior to settlement due to concern about possible limits on oil imports from Venezuela or exports of US fuel to that country. After the close, however, the US Treasury Department announced sanctions limited only to Venezuelan President Nicolas Maduro.

A gas station in Caracas, March 23, 2017. /AFP Photo

A gas station in Caracas, March 23, 2017. /AFP Photo

"As far as the oil market is concerned that's a non-event," said James Williams, president of energy consultant WTRG Economics in London, Arkansas. "It's just eye candy as far as I can see."

Benchmark Brent crude LCOc1 rose by 0.3 percent to settle at 52.65 US dollars. Brent earlier hit 52.92 US dollars a barrel, its highest since May 25. US light crude oil CLc1 rose nearly 1 percent to settle 50.17 US dollars a barrel.

Some OPEC and non-OPEC members will meet on August 7-8 in Abu Dhabi to assess how the group can increase compliance with production cuts that began on January 1.

A Reuters' survey on Monday indicated the output from OPEC members rose, with June production revised up by 200,000 barrel-per-day.

In Europe, a production outage at Royal Dutch Shell Plc's (RDSa.L) 404,000 bpd Pernis refinery in the Netherlands following a fire sent benchmark European diesel margins to their highest since November 2015 at 14.60 US dollars a barrel.

The Brent front-month spread LCOc1-LCOc2 rallied to the strongest in 15 months earlier in the session, ahead of the September contract's expiry. The spread ended back in a contango of 7 cents per barrel, meaning prices were cheaper than the next month.

The strength in Brent prices pushed WTI-Brent spread WTCLc1-LCOc1 to the widest since March 28. The spread settled at a discount of 2.48 US dollars a barrel.

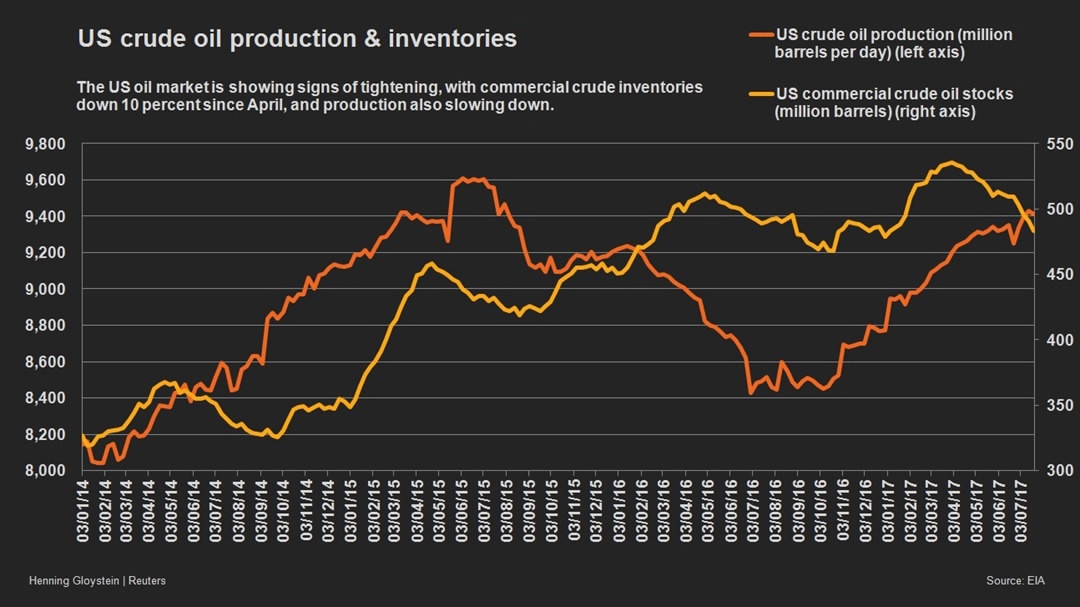

A graphics on US crude oil production /Reuters Photo

A graphics on US crude oil production /Reuters Photo

(Source: Reuters)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3