Business

19:52, 31-Oct-2017

China's benchmark treasury yields hit three-year high amid fears of liquidity squeeze

CGTN

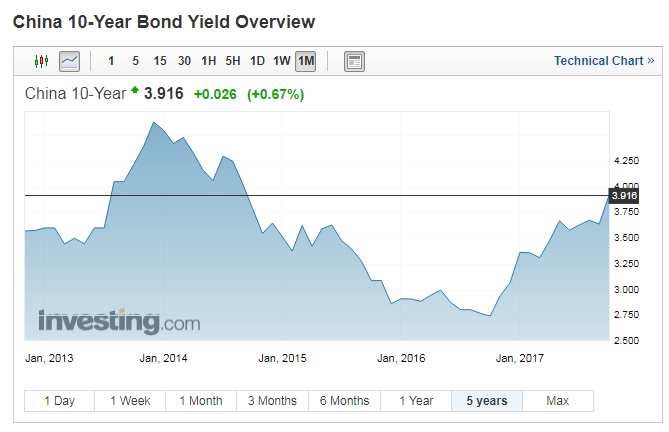

China’s 10-year treasury yields on Monday hit 3.917 percent, the highest level in three years, due to expectations that the country's central bank would keep its liquidity tight.

The benchmark yield climbed 28.7 basis points (bps) since the end of September, supported by signs of strong economy, market concerns about tight liquidity and rising US treasury yields.

Investing.com Photo

Investing.com Photo

The price of the most-traded China 10-year treasury futures for December delivery rose 0.3 percent in early trade Tuesday.

The yield uptick pressures come after a run of China’s strong economic data, such as a better-than-expected producer price growth, underlining that China's economy is resilient and has the capacity to maintain a long-term medium-to-high growth rate.

“Investors, who have always been concerned with tighter financial regulations, are now especially sensitive to news that’s negative for bonds, such as improvement in the economy,” said Liu Dongliang, a senior analyst at China Merchants Bank in Shenzhen.

VCG Photo

VCG Photo

Financial regulators’ deleveraging campaign has pushed China’s money market and short term rates gradually higher so far this year, but also triggered periodic fears of liquidity squeezes and spikes in financing costs.

Zhou Xiaochuan, governor of the People's Bank of China (PBOC), warned about the country’s leverage issue, noting that efforts to contain excessive risk-taking in the financial sector will continue next year, at a press conference on the sidelines of the 19th National Congress of the Communist Party of China (CPC).

"Zhou Xiaochuan’s comments signal that China will move further to rein in financial leverage," said Shen Zhengyang, a Shanghai-based analyst with Northeast Securities.

Qin Han, chief bond analyst at Guotai Junan Securities Co. in Shanghai, said bond yields could climb to as high as 4 percent this year.

China’s bond selloff is part of a global trend. US Treasuries are declining amid expectations of more Federal Reserve tightening after the Fed has raised interest rates four times since December, and this reduces the appeal of Chinese bonds to foreign investors.

PBOC offers ‘first aid’

The People's Bank Of China (PBOC) /VCG Photo

The People's Bank Of China (PBOC) /VCG Photo

China’s central bank has generally not responded as quickly to such market fears as in the past, it has still stepped in frequently and added funds if rate moves appeared too volatile and threatened to roil financial markets or curb economic growth.

The 10-year yields on Tuesday fell less than one basis point to 3.887 percent in morning trade, and closed at 3.916 percent.

The PBOC injected a net 80 billion yuan (12 billion US dollars) into money markets via open market operations on Tuesday.

In a further move to soothe market concerns, the PBOC has asked banks about their demand for medium-term lending facility (MLF) loans, and may inject money via the MLF on Friday, according to a source with knowledge of the matter.

The PBOC also injected 63-day money into the financial system for the first time on Friday, reassuring lenders about year-end funding availability.

A trader at an asset-management firm in Shanghai said, the moves had helped a little bit to calm market nerves, but money market rates are still high.

The net 80 billion yuan injection was "not enough" to significantly affect market sentiment, he said, adding the PBOC was probably unwilling to inject a greater amount due to the broader deleveraging push.

"The PBOC only offers first aid," he said.

China's yield-curve inversion does not predict recession

Zerohedge.com Photo

Zerohedge.com Photo

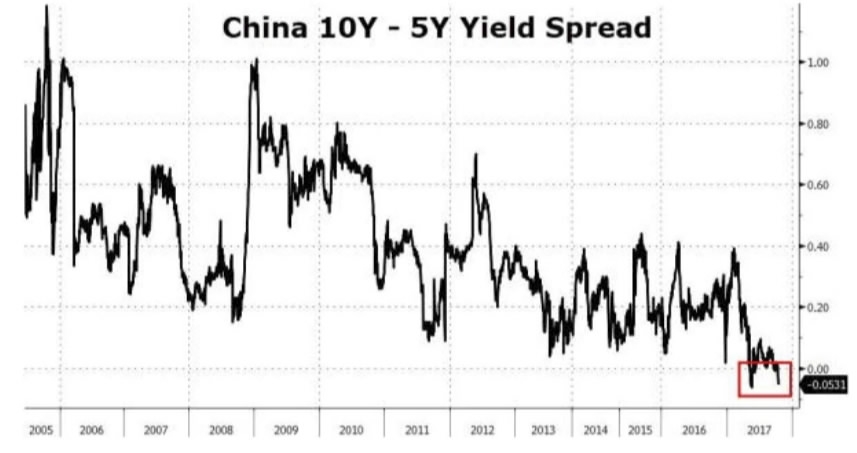

At the same time, yields of 5-year treasury bonds on Tuesday jumped to 3.963 percent, the highest level in over three years, prolonging China’s yield-curve inversion.

A so-called yield curve inversion first surfaced in China in May, when the yield on less actively traded five-year bonds broke above that on the popular 10-year bonds.

And later after that, the anomaly took on a rare, new form: the yield on the illiquid seven-year bonds rose above those on both the five-year and 10-year paper.

An inverted yield curve defies the common understanding that bonds requiring a longer commitment should compensate investors with a higher return. It usually reflects pessimism among investors about a country’s long-term prospects for growth and inflation.

But the curve inversion seen in China is pretty much government-driven, with the central bank driving short-term rates higher to tamp down excessive leverage.

It is different from the previous ones in the US.

The US treasury yield curve inverted before the recessions of 2000, 1991, and 1981, and it also predicted the 2008 financial crisis two years earlier.

The current development in the Chinese bond market is partly the result of mild inflation and expectations of a slowing economy, said Deng Haiqing, chief economist at JZ Securities.

“At the same time, short-term interest rates will likely stay elevated because the authorities will keep borrowing costs high so as to facilitate the deleveraging campaign,” he said.

4km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3