Business

20:53, 23-Nov-2017

News analysis: British budget labeled "cautious"

CGTN

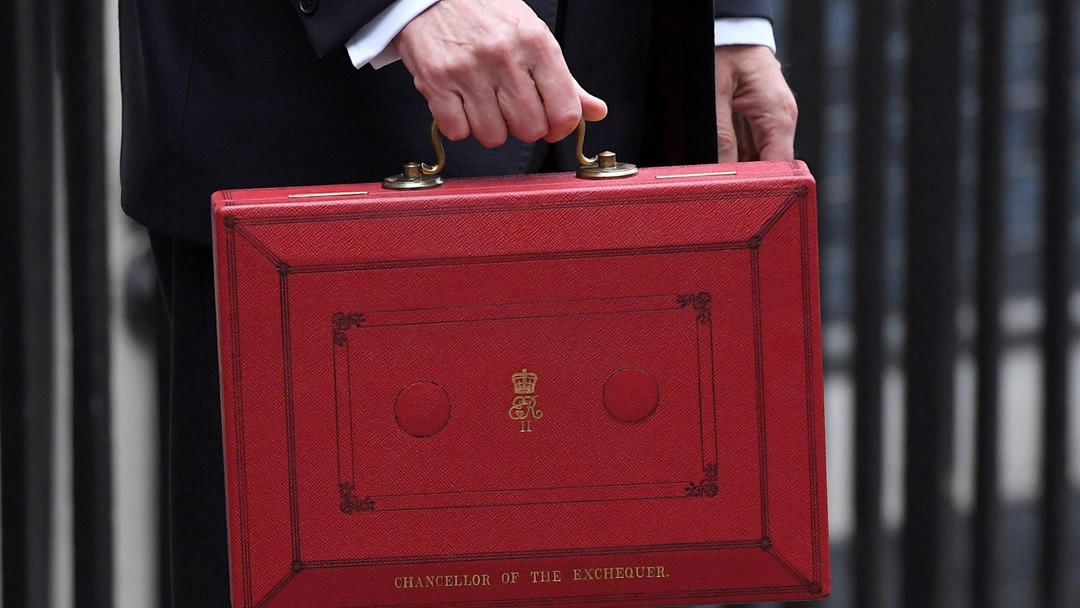

The autumn budget from British Chancellor of the Exchequer Philip Hammond was labeled "cautious" by experts.

Hammond unveiled the principal budget for the coming year on Wednesday against a backdrop of Brexit uncertainty and subdued economic growth.

Economic background is subdued

Amit Kara, head of UK macroeconomic research, National Institute for Economic and Social Research (NIESR) told Xinhua on Wednesday that Hammond had seen his room for manoeuvre narrow since the last budget in March this year, and growth was subdued.

The projected growth rate for 2017 was cut from 2 percent to 1.5 percent and future years have also been scaled down from forecasts made at the time of the last budget in March.

"Growth is averaging 1.4 percent over the next five years... so to that extent the budget is cautious because the Chancellor is under a lot of pressure to spend more money, or indeed to give more tax breaks," said Kara.

Hammond has been Chancellor since July 2016, and inherited a government budget that had been pruned by spending cuts and tax cuts over seven years by his predecessor George Osborne.

Public employees like police, fire and health workers had all had below-inflation pay rises for several years and the cut back of government services and spending has proved unpopular among some parts of the public.

However, Hammond had little cash to spend because a downward revision in the forecasts for productivity growth over the next five years meant that GDP growth was also revised down.

Hammond did spend on infrastructure and announced plans for research and development investment.

"He has done some of that (spending) but he still has a little bit of room on his fiscal rules," said Kara.

"So altogether I think I would say it was cautious, but of course we need to recognize that the UK is facing a major potential shock in the shape of Brexit, so it is prudent to be cautious at this point."

Less tax income because of the downgrade in forecasts for economic growth means that plans for government spending have taken a hit.

Kara said that the projections for the fiscal deficit had deteriorated significantly since the last budget in March.

"This revision is in spite of better-than-expected recent outturns and because of weaker GDP growth prospects and some modest relaxation of fiscal consolidation," said Kara.

"As a result, around half of the fiscal headroom that was available to the government under the 'fiscal mandate', which requires the government to achieve a structural deficit below 2 percent by 2020-21, has been wiped out."

Productivity puzzle

The low rate of improvement in productivity in Britain since the financial crisis has now been acknowledged by the economic forecasters and by the Chancellor.

The most significant outcome of Hammond's budget is that GDP growth and government spending have both been revised down as a result of lower forecasts for productivity growth.

The official statistics watchdog the Office of Budget Responsibility (OBR) on Wednesday explained why it had downgraded productivity expectations, after years of believing that the growth would return to the long-term trend of 2 percent per year.

Robert Chote, OBR chairman, told journalists at a press conference in London that a pattern of unexpectedly strong employment growth and unexpectedly weak productivity growth has been a consistent feature of our forecasts for some time.

"Productivity growth has been far weaker since the financial crisis than it was for decades beforehand. Output per hour has risen by just 0.2 percent a year since 2008, compared to an average of 2.1 percent a year over the preceding 35 years," said Chote.

Chote said it was now clear that more weight needed to be placed on the weak performance of the recent period as a guide to the outlook for the next few years, "but without abandoning hope of a recovery altogether".

Weak productivity growth has been, and remained, a global phenomenon and not purely a domestic one, although the performance in Britain was weaker than most, said Chote.

He added, "Back in March we assumed that potential productivity growth would pick up gradually to 1.8 percent a year by the end of the forecast, only a little below the historic average rate. But we now assume that trend productivity growth picks up to 1.2 percent by 2022, taking actual productivity growth up to 1.3 percent."

Kara said, "Productivity has just been a huge puzzle in Britain. That weakness has been on for such a long time that it is difficult to ignore that altogether. So the OBR have it growing at slightly above 1 percent. Our own forecast is 1 percent, so we are slightly more pessimistic than they are about productivity."

Kara said the government and the OBR had come closer to NIESR's own forecast, but it could not be certain who was right.

It is possible that productivity bounces back to its pre-crisis level, said Kara, and also that it could stay weak for longer.

"It is a huge judgment whichever way it goes," he said.

Reaction to budget measures

Hammond's plan for 44 billion pounds (about 58.5 billion US dollars) of investment, loans and guarantees over five years to boost the annual amount of new homes built to 300,000 in the middle of the next decade was criticized by some.

The industry magazine Construction News said it was unsure how much of the money would actually be spent.

"The budget documents themselves reveal a less exciting figure, stating that the government will be making available 15.3 billion pounds of new financial support for housing over the next five years.

This, together with previous announcements, brings total support to 44 billion pounds and the magazine commented that "re-announcing old money as new policy has become so commonplace that it's almost rude not to keep tradition."

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, a data analysis firm in London, said that the Hammond had been bolder than widely expected.

"He scaled back the fiscal consolidation planned for the next two years significantly," said Tombs.

Hammond was able to announce a series of measures which totalled a giveaway of 17 billion pounds over the next five years, said Tombs.

"The package was front-loaded, with a 3 billion pounds loosening next year and a 9-billion-pound loosening in 2019/20, relative to the March budget baseline," said Tombs.

The opposition Labor Party criticized the budget.

Shadow Chancellor of the Exchequer John McDonnell said: "Economic growth is the lowest since the Tories came to office, real wages lower than in 2010, and the failure to pause the botched roll-out of Universal Credit will cause real suffering."

"The Chancellor has completely failed to recognize the scale of the emergency in our public services and found no meaningful funding to address the crisis in our schools, hospitals or children's services," he added.

Source(s): Xinhua News Agency

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3