Business

16:58, 09-Apr-2018

Ten years on: The influence of the 2008 Global Financial Crisis

CGTN's Miro Lu

The openness of Singapore’s economy has seen the country rise from a third-world backwater to one of the richest nations in the world. But the dependence on exports also makes Singapore vulnerable to any negative economic conditions in its trading partners.

By the third quarter of 2008, the banking crisis in the US and its ripple effects put great stress on the Singaporean economy, causing it to be the first country in East Asia to fall into recession.

In the last three months of 2008, things were not looking good. Capital markets dried up. Jobs were cut. Ordinary working-class people, who had poured their life savings into financial products such as Lehman’s Minibonds, became angry when their investments turned bad. For weeks, they gathered every Saturday at Hong Lim Park, the only place in Singapore where citizens may demonstrate and protested after giving prior registration.

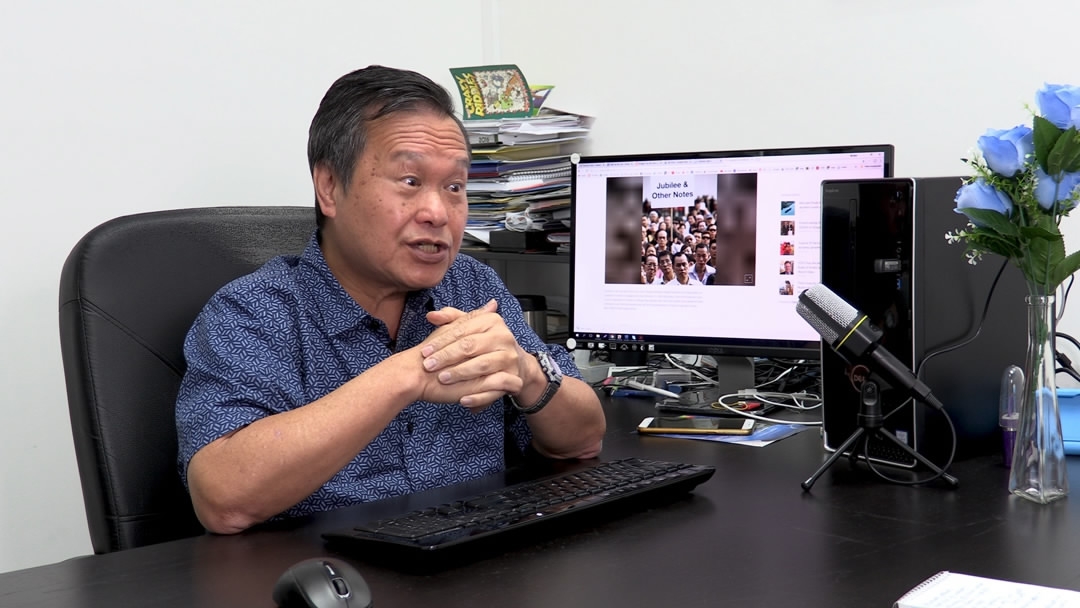

Mr Tan Kin Lian was the organizer of the gatherings that took place in 2008. Tan is a retired executive of a large insurance company. “I was horrified because I said these are very complicated products. How we see that they are being sold to ordinary people who didn’t understand their risk,” recalled Mr. Tan ten years later during an interview with CGTN. He said people were afraid that they would lose their life savings.

Tan Kin Lian recalls Lehman Brothers Minibond saga. /CGTN Photo

Tan Kin Lian recalls Lehman Brothers Minibond saga. /CGTN Photo

Have investors learned their lessons? Are they more educated and wiser when choosing financial products? The answer is no in Mr Tan’s opinion. He said investors will always want to look for a higher return and this is where they fall into the trap of buying riskier products without understanding the risk.

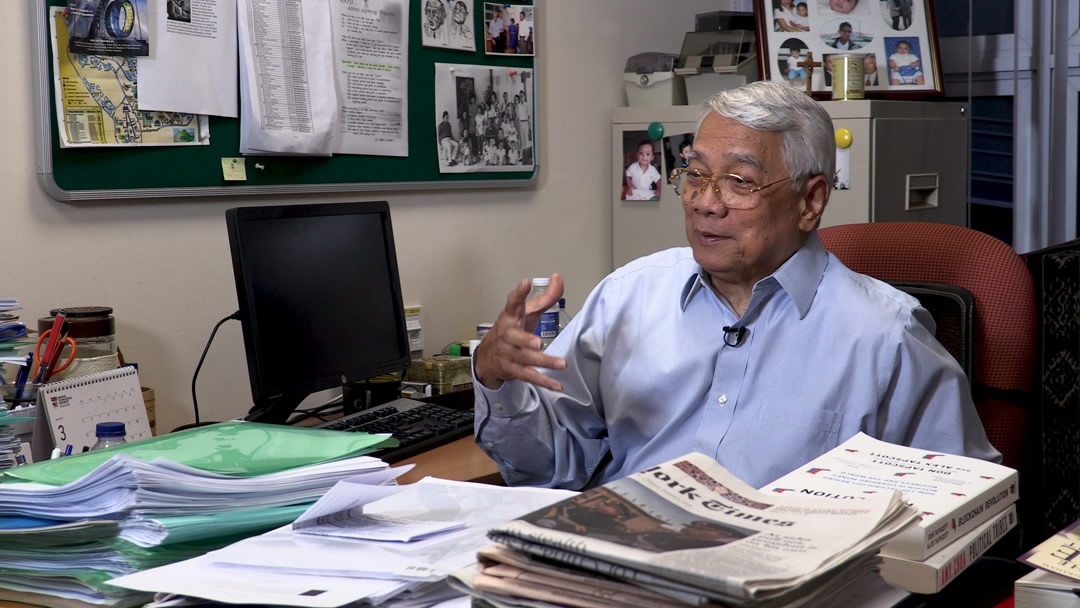

Professor J. Soedradjad Djiwandono is no stranger to risk. He was the Governor of Indonesia’s central bank during the 1997 Asia Financial Crisis. He currently teaches International Economies at the S. Rajaratnam School of International Studies at Nanyang Technological University in Singapore.

Professor J. Soedradjad Djiwandono says he is a student of financial crisis. /CGTN Photo

Professor J. Soedradjad Djiwandono says he is a student of financial crisis. /CGTN Photo

Professor Djiwandono considers himself a student of the financial crisis and he thinks the real cause of most financial crises is aggressive leveraging. “What’s disconcerting is the habit of leveraging. Of course, people do business with other people’s money, by borrowing. But relying too much on borrowing. That is always the danger.”

The professor notes that central banks around the world have used unconventional monetary policies since 2008. They have kept interest rates close to zero, in some places they're even negative. The US Federal Reserve took the unprecedented step of beefing up its government bond holdings and mortgage-related securities from 900 billion US dollars to 4.5 trillion US dollars in an effort to turn the economy around. It was not until October 2017 when the Federal Reserve began reducing its balance sheet. Have investors been gambling on this cheap money? Are they leveraging too much and being too daring? Only time will tell.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3