Business

23:11, 23-Mar-2018

Trump's obsession with trade deficits is distorted

CGTN

US President Donald Trump has long blamed the floundering economy for the ballooning trade deficit with other countries, China in particular. However, trade isn't a zero-sum endeavor and through trade both countries benefit even if one has a deficit.

Trade imbalances really have not been an impediment to the US economy while the country has been running trade deficits over the last 30, 40 years or so.

Not only with China does the US have a trade deficit, it has a deficit with many economies. The fundamental cause of such a deficit is the low saving rate and high consuming rate in the US.

The US dollar is a global currency. In order to allow US dollars to flow to other countries, America will not give its money away for free, it has to pursue a trade deficit. The US prints money in exchange for others’ goods and services.

Such unique standing and role of the US means that it has to bear a trade deficit, and the problem is called the Triffin Dilemma.

The Triffin Dilemma, given to the drawback of having the world’s reserve currency, was identified in the 1960s by a Belgian-American economist named Robert Triffin.

The dilemma, in brief, is that if you have the world’s reserve currency, you must run a current account deficit to supply the world with liquidity.

Trump wants to turn America into a surplus country as part of making it a winner, but that is going to collide spectacularly with the Triffin Dilemma.

Trade deficit is widely misrepresented

"By adopting the global value chain approach the trade imbalance with China would be halved", said former Director-General of the World Trade Organization, Pascal Lamy.

The reported trade balances of the US, and all other countries for that matter, are based on the gross commercial value of the goods and services as they depart and enter the country.

What these reported trade balances don’t adequately capture is a comprehensive and detailed picture of the dynamic network structure of the global economy today.

Quite often goods and services move across multiple national borders to produce a final product that is then exported. Lamy has described this phenomenon as goods being “Made in the World”.

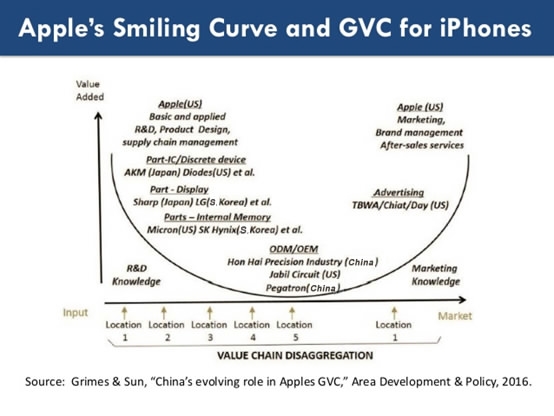

Viewing trade this way requires a revised approach, the value-added trade, which has become a more relevant measure of trade within global value chains (GVCs). GVCs break up the production process so different steps can be carried out in different countries.

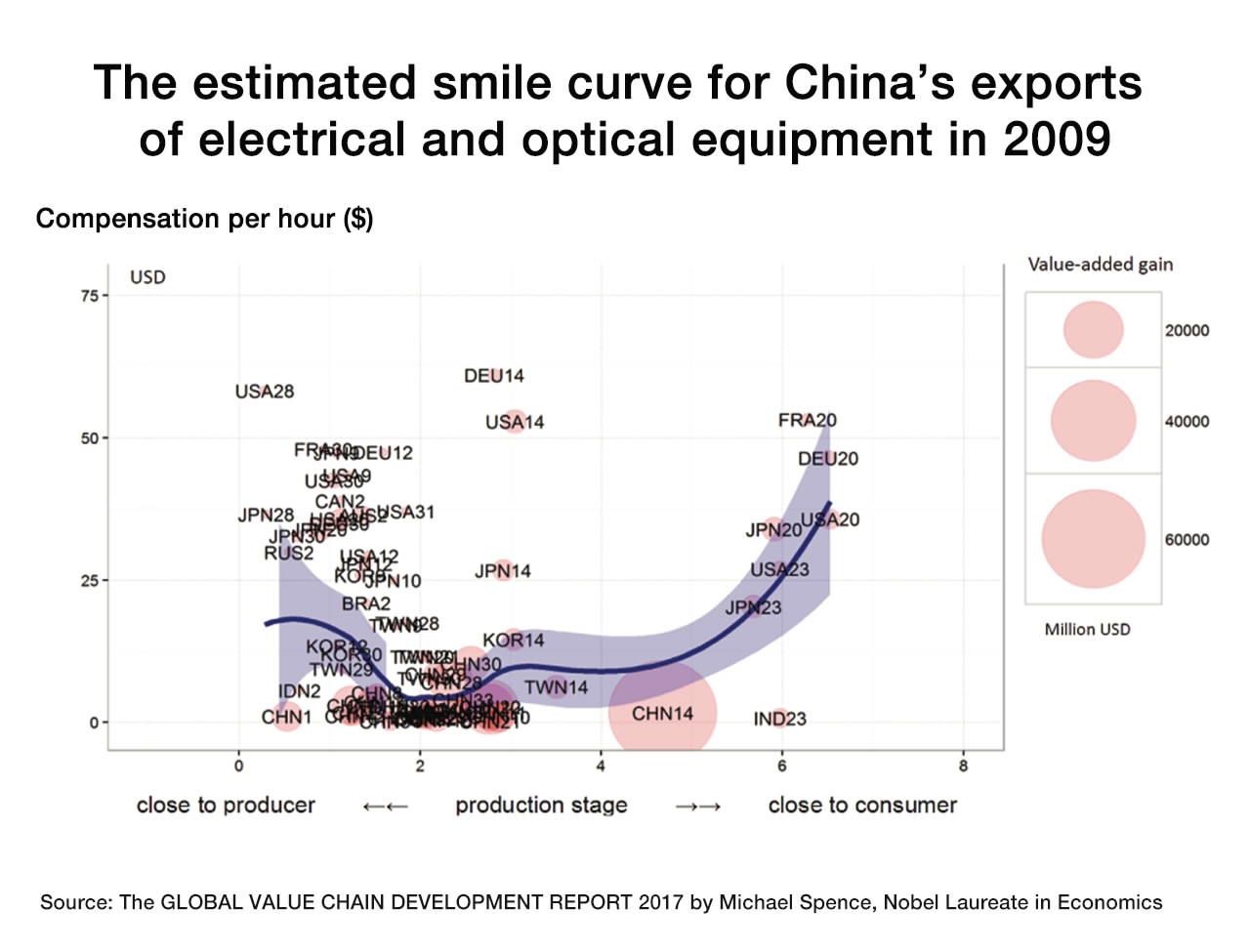

Advanced economies where the higher valued-added components tend to be located, thus show up in GVCs in the upstream and downstream components. This gives rise to a picture of GVCs composed of the participants along the value chain correlated with their stage of development, referred to as a “smile curve” because of its shape.

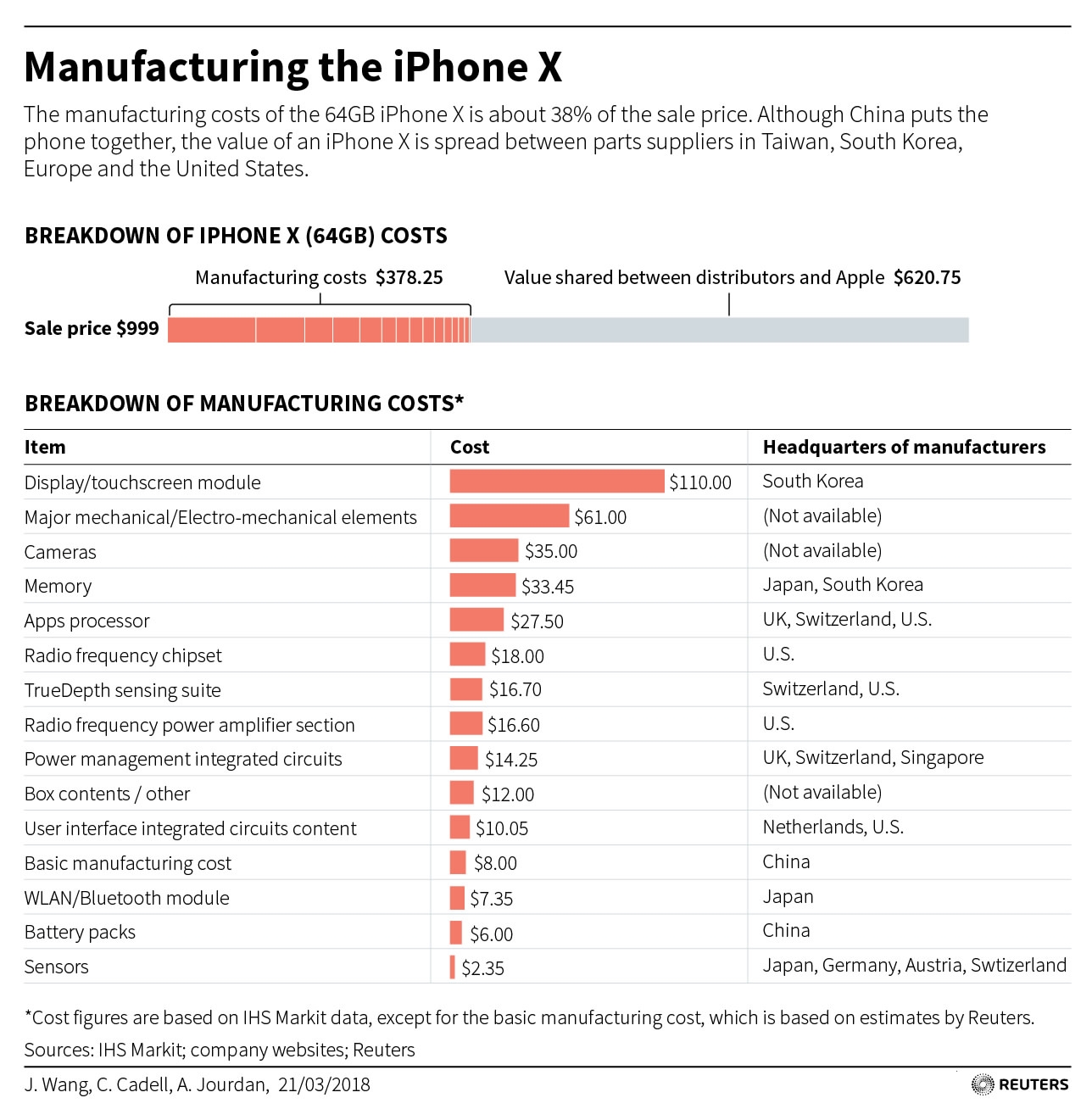

The big trade imbalance between US and China exists in large part because of Electrical goods and tech, the biggest US import item from China.

Of the 70 billion dollars in cell phones and household goods the US imported from China, Apple’s iPhone, US imports of US-branded products, accounted for about 22 percent, based on a rough calculation using Apple's 61 million iPhone shipment to the US last year multiplying the 258 US dollars average to make each iPhone.

With an iPhone, where China is just the final assembler, most of the value contributed by China is just the labor rather than the components themselves.

US companies, like Apple, using global supply chains to manufacture products in China means other economies would be caught in the crossfire of a trade war.

Most impacted by Trump's latest action will be the US, South Korea, and China's Taiwan as companies domiciled in these markets make up a significant portion of the global production chain of Chinese exports, said Hannah Anderson, JPMorgan Asset Management global market strategist.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3