China

09:30, 17-Oct-2017

Restructuring China’s local government debt underway

CGTN's Luo Yu

One of the biggest threats to China's financial stability is local government debt. Last year, local governments issued new debt worth 6 trillion yuan, or 920 billion US dollars, up 60 percent on last year.

It's a side effect of the country's post-global financial crisis construction binge. Local government financing vehicles (LGFV) issued chengtou bonds, or “urban construction and investment bonds,” using the land-use right as collateral to raise funds.

Professor Laura Liu Xiaolei, dean of the Department of Finance at Peking University's Guanghua School of Management said, “For this LGFV bond, one very unique feature is the government implicit guarantee. We have done a research paper, and we find the local government implicit guarantee played a very important role in this. So basically, investor purchased this bond, and believed this would be implicit government guarantee.”

Aware of the risks, authorities have begun rolling out measures to reduce local government debt.

Professor Laura Liu Xiaolei had an exclusive interview with CGTN. /CGTN Photo

Professor Laura Liu Xiaolei had an exclusive interview with CGTN. /CGTN Photo

Liu said “The main thing is the Budget Law. Before the local government is now allowed to issue debt, so they are not allowed to borrow basically."

"That’s why they borrow through LGFVs. They set up LGFVs and borrow through this. Basically borrowing in a disguised form. But right now, the new Budget Law allows certain local governments to borrow directly, making it more transparent."

"And also, the new regulation put up the disclosure provisions. So these local government bonds have to disclose clear information, and we have this pilot program of revenue bonds. So all these measures or steps are towards the marketization direction,” she said.

Meanwhile, experts also urge better disclosure and reforms to the tax distribution system.

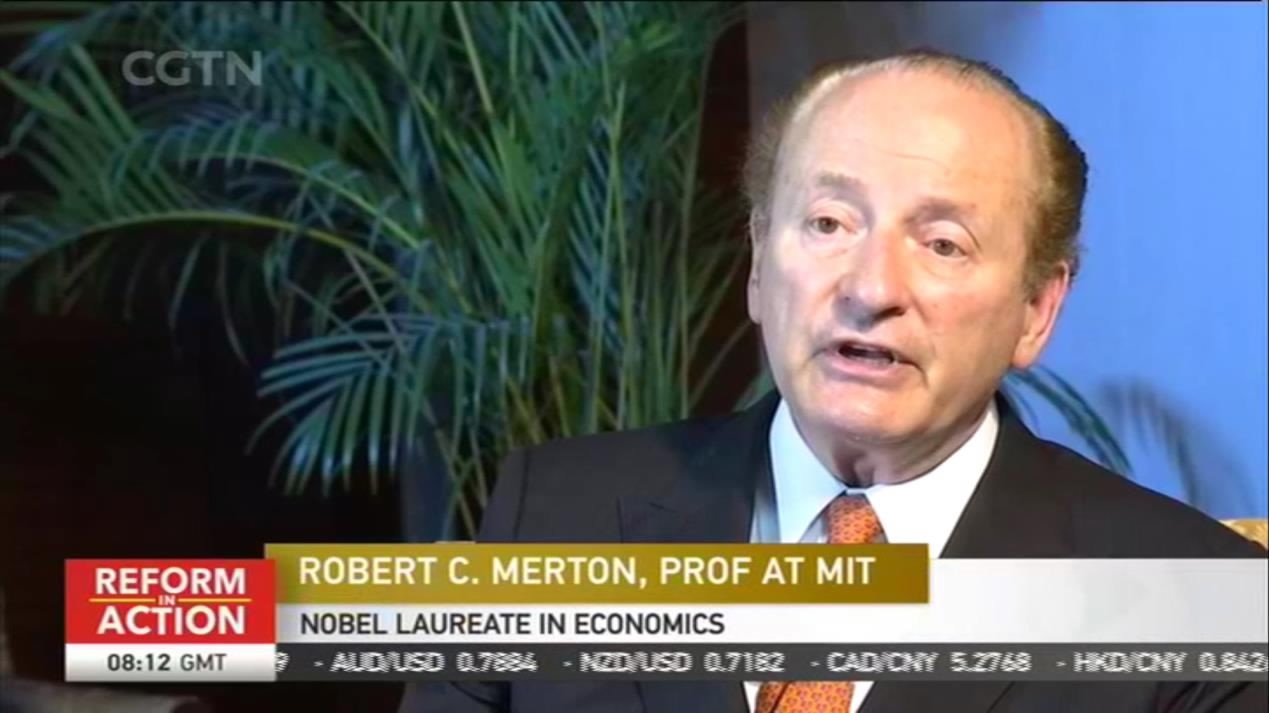

Nobel Laureate in Economics Robert C. Merton told CGTN, “Make it transparent to entities that can understand it. That may not be me as a citizen of a town. So the key is somebody is going to have to say we’ve got a problem of the debt. No, it’s OK. We have to trust to that is. And second, these are the competent people that have the skills, knowledge and resources to evaluate it.”

Robert C. Merton, Nobel Laureate in Economics spoke with CGTN on local government debt. /CGTN Photo

Robert C. Merton, Nobel Laureate in Economics spoke with CGTN on local government debt. /CGTN Photo

“One way is probably to take some of the administrative responsibility to the upper level, like social welfare. Take those issues to the upper level and reduce the responsibility of the local government," added Liu.

"Another way is increasing the tax revenue of the local government. For example, in the long run, we may consider starting property tax, and if the tax could be kept at the local governments, it can partially solve the problem. This is our internal debt. I don’t think it’s a big deal. We don’t have to worry too much about it,” she said.

Although experts say the risk of China’s local government debt is under control, and much progress has been made in deleveraging and maintaining economic stability, the Henan provincial government still rejected CGTN’s request for an interview, saying the topic was too sensitive.

Looking ahead, concerted efforts from both the central and local governments are necessary to solve this lingering problem.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3