Business

15:32, 02-Sep-2017

BRICS's NDB: a sustainable bank for emerging economies

By CGTN's Yang Jing

BRICS countries launched the New Development Bank (NDB) in 2015 to mobilize resources for infrastructure and sustainable development projects at home and in other underserving emerging economies.

The bank rules specify that all the five founding partners - Brazil, Russia, India, China and South Africa – have equal powers. Each member has 20 percent of the shares and voting rights in the bank. And none of them have any kind of veto power. The structure is different from that of World Bank and IMF that gives veto power to the US.

Key positions have also been distributed equitably, with the NDB's first president - K.V. Kamath, former CEO and managing director of ICICI, India's largest private bank - coming from India; the first chair of the board of governors from Russia and the first chair of the board of directors from Brazil. The bank is headquartered at Shanghai andhas a regional office in Johannesburg.

Any UN member state can join the bank as long as the founding members' share does not fall below 55 percent.

In a 2016 speech, NDB vice president and chief risk officer Paulo Nogueira Batista pointed out that unlike some other financial institutions, the NDB will not issue loans based on political factors and will not intervene in other countries’ policy making.

The NDB also holds a unique focus: sustainable development and sustainable infrastructure. As much as 60 percent of its lending will be earmarked for renewable energy. In 2016, bank issued its first Green Financial Bond in China's onshore bond market with an issue size of 3 billion Yuan (449 million US dollars).

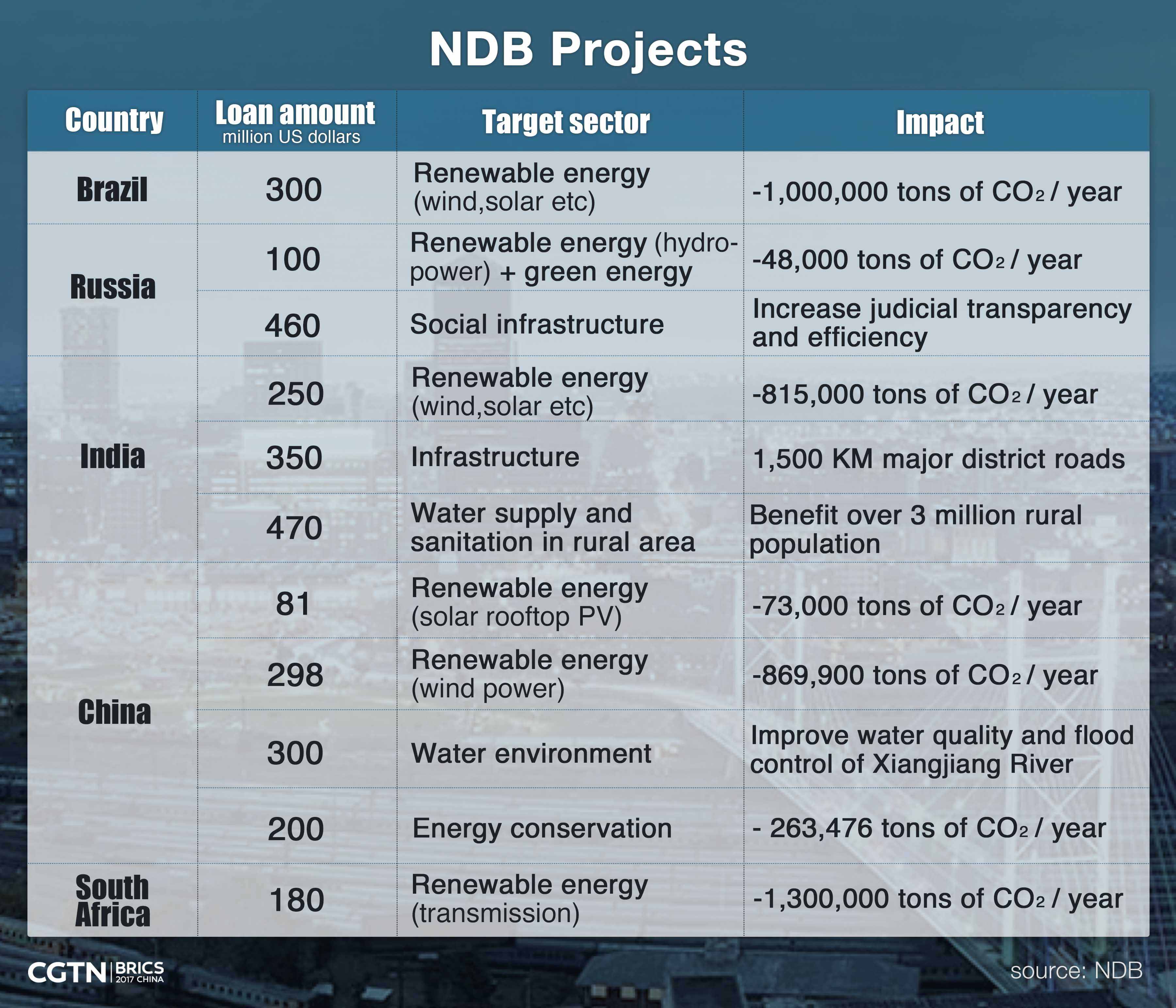

Since the constitution of NDB, it has approved a set of loans involving financial assistance of more than 2.9 billion US dollars for renewable energy, water sanitation, rural development and infrastructure projects.

These projects will reduce more than 4 million tons of CO2 emissions each year and will drastically improve air quality and environment.

For 2017, the bank has set a target of lending 2.5 billion US dollars.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3