Business

13:27, 27-Sep-2017

BHP Billiton: Belt and Road Initiative to boost steel demand by 150 million tons

by Nicholas Moore

The Belt and Road Initiative will see China’s steel output maintain its current high levels, with production set to peak by the middle of next decade, according to BHP Billiton, the world’s biggest steel and mining company.

BHP estimates that various projects being implemented under the flag of the Belt and Road will push incremental steel demand up by 150 million metric tons over the next decade. In the 68 Belt and Road countries and regions, this would represent growth in local demand of three to four percent per year, double the rate seen since 2011.

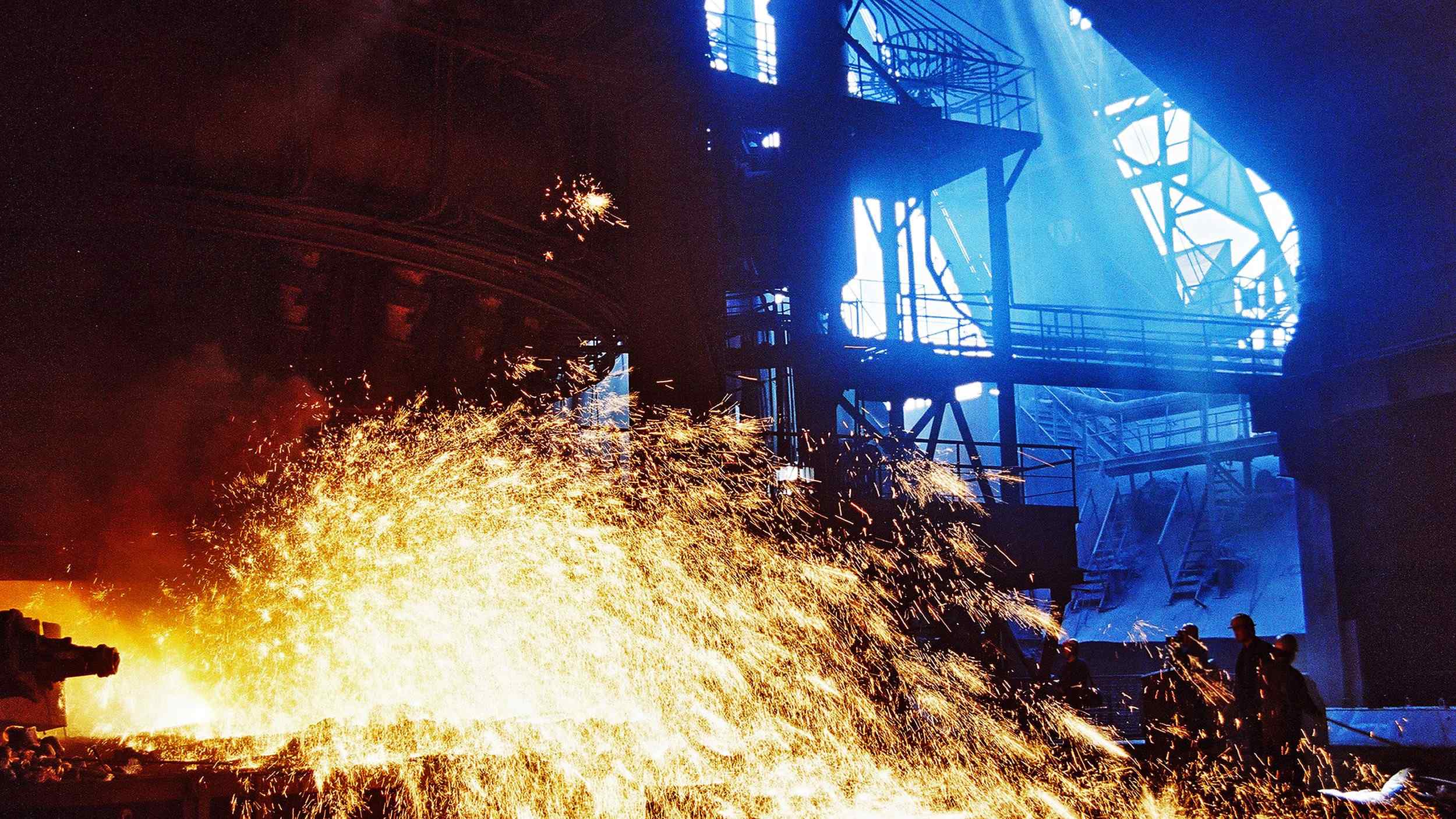

VCG Photo

VCG Photo

BHP’s report, compiled by analyzing 2,000 projects linked to the initiative and focusing on what it identifies as 400 core projects, states that Chinese mills are “in prime position to supply” the steel required along the Silk Road Economic Belt and the 21st Century Maritime Silk Road.

BHP’s report finds that of the 68 countries and regions that make up the Belt and Road countries, only 10 are net exporters of steel, and 20 don’t have any steel smelting capacity at all. This puts China, which is still looking to cut overcapacity in its steel sector as part of ongoing supply-side reform, in pole position to provide steel for projects that BHP estimates will cost 1.3 trillion US dollars.

BHP’s report suggests that of the 150 million tons of extra steel required by the Belt and Road, “80 percent would be used in structures and reinforced concrete, with 20 percent going into machinery and other equipment.”

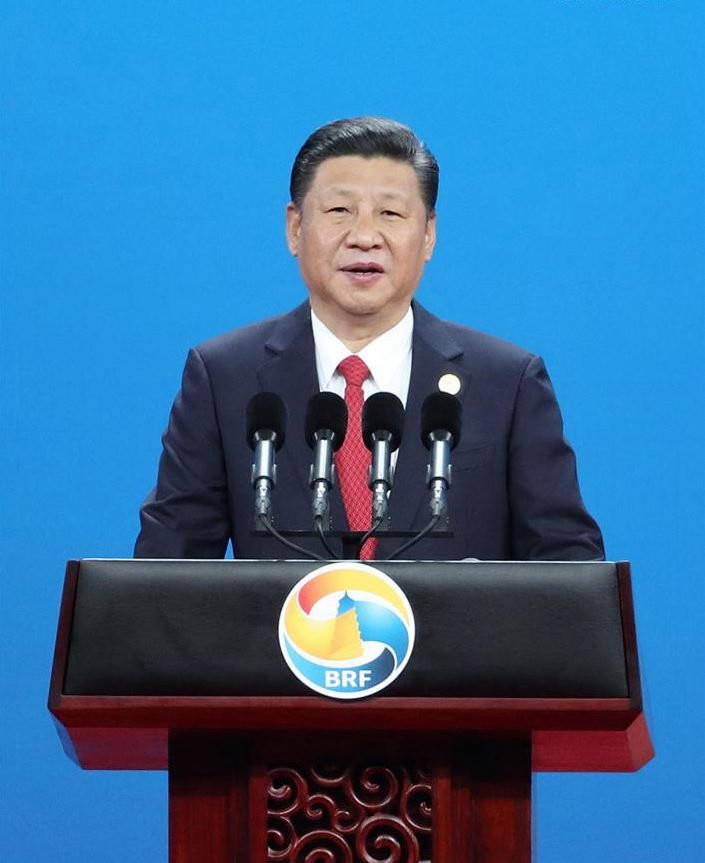

At the Belt and Road Forum earlier this year, Chinese President Xi Jinping said, “We should strengthen international cooperation on production capacity and equipment manufacturing, and seize new development opportunities presented by the new industrial revolution to foster new businesses and maintain dynamic growth.”

BHP’s research finds that 70 percent of Belt and Road projects are focused on developing infrastructure like “power, railways, pipelines and other transport projects.”

Chinese President Xi Jinping delivers a keynote speech at the opening ceremony of the Belt and Road Forum (BRF) for International Cooperation in Beijing, May 14, 2017. /Xinhua Photo

Chinese President Xi Jinping delivers a keynote speech at the opening ceremony of the Belt and Road Forum (BRF) for International Cooperation in Beijing, May 14, 2017. /Xinhua Photo

BHP suggests that the 1.3 trillion US dollar Belt and Road Initiative will be a “a catalyst for a virtuous cycle of economic development” rather than providing funding for “everybody’s infrastructure needs,” citing the Asian Development Bank’s estimate that Asia needs 26 trillion US dollars in infrastructure investment by 2030, implying “1.7 trillion US dollars in spending per year.”

In August this year, China’s monthly steel output hit a record 74.59 million tons, with production up by 5.6 percent in the first eight months of the year. BHP estimates that “China will ultimately double its accumulated stock of steel in use, which is currently about 6 tonnes per capita.”

However, if China is going to be the main source of steel for Belt and Road projects, it remains unclear how the continued demand for its output will play out alongside the government’s pledge to tackle air pollution.

The Ministry of Environmental Protection has said the concentration of PM2.5 pollutants needs to be reduced by at least 15 percent from October to March 2018, with Beijing, Tianjin and Shijiazhuang in Hebei Province facing tougher targets of 25 percent cuts.

Hebei is a major center for steel production, but in August its environmental bureau announced plans to cut output by as much as 50 percent over the coming winter, potentially sinking daily output by eight percent, according to Citigroup.

Men sit outside a steel factory in Wu'an, Hebei Province, February 23,

2017. /Reuters Photo

Men sit outside a steel factory in Wu'an, Hebei Province, February 23, 2017. /Reuters Photo

Beginning this week, the industrial city of Tangshan will enforce measures halving steel production, potentially affecting 7.5 percent of national production, according to Financial Times. Other steel cities including Shijiazhuang, Handan and Anyang are expected to follow suit by cutting production.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3