Business

18:29, 10-Nov-2017

Companies prep for China’s ‘Double 11’ shopping extravaganza

By CGTN's Yao Nian

Companies are gearing up for China’s “Double 11” shopping festival, the equivalent of Black Friday in the US, which is to kick off Saturday, with e-commerce titans mobilizing resources for a sales battle.

Launched in 2009, the annual spree has gradually turned Singles’ Day into a global frenzy of consumption both online and offline. The 2017 event is expected to hit more records, as over 60,000 international brands, such as Adidas, Nike, Gap, and Mac Cosmetics, are all set to participate.

Alibaba and JD.com in battle

Alibaba’s brainchild “Double 11” grossed 17.8 billion US dollars in sales last year, triple the 5.9 billion US dollars spent on Black Friday, Cyber Monday and Thanksgiving combined in the US. This year, 15 million product listings from over 140,000 brands are promised.

VCG Photo

VCG Photo

Alibaba’s Taobao and Tmall are no longer the only destinations for “Double 11” sprees, as JD.com has emerged as a key competitor.

JD.com has sought 50 data-sharing deals with tech groups such as Tencent, Baidu, Toutiao, Sogou, and NetEase to target individual customers, and to counter the more than half a billion customer base of Alibaba – double the base of JD.com

The two companies are covering the luxury sector, with JD.com launching a “white gloves” high-end delivery service and buying into online fashion retail platform Farfetch while Alibaba’s Tmall working with luxury brands like Jason Wu, Opening Ceremony and Robert Geller.

Both companies are providing subsidies to their merchants and couriers, with Alibaba’s logistics firm Cainiao costing 226.1 million US dollars, while JD.com putting up 316.6 million US dollars. However, 40-odd brands have reportedly moved from JD.com to Alibaba.

From online to offline shopping

VCG Photo

VCG Photo

The battle between e-commerce giants is spreading from online to offline. This year’s bonanza won’t just be about special offers online. Alibaba has set up around 100,000 offline smart outlets throughout the country, especially for “Double 11."

Meanwhile, Alibaba has taken stakes of offline retailers like Suning, Sanjiang, Lianhua Supermarket, and Yintai Retails, while JD.com has become a shareholder of Yonghui Superstores and cooperated with Walmart.

A blend of online and offline shopping “will be the new trend going forward, so ‘Double 11’ in the original format is not that relevant any more,” said Jason Ding, a partner with consultancy Bain & Co.

Global frenzy of consumption

VCG Photo

VCG Photo

The e-commerce platforms are also increasing efforts to go global. A rise in exports is recorded by a Chinese pilot zone handling cross-border e-commerce logistics, as Tmall International and others run sales for the “Double 11” consumption carnival this year on their global website.

“It (‘Double 11’) has tremendous staying power…I think we’ll see much more ‘Double 11’ activities in the US as it continues to grow,” said Alibaba vendor John McPheters, co-founder and CEO of the US streetwear retailer Stadium Goods.

The pilot zone in Hangzhou also reported that 31 million items of imported consumer goods have been stocked up by firms like Tmall International, Kaola.com, and Beibei.com as of Tuesday, over twice of the figure last year.

In October, the value of the imported goods in the zone reached 1.11 billion yuan (168 million US dollars), with a year-on-year increase of 95.5 percent.

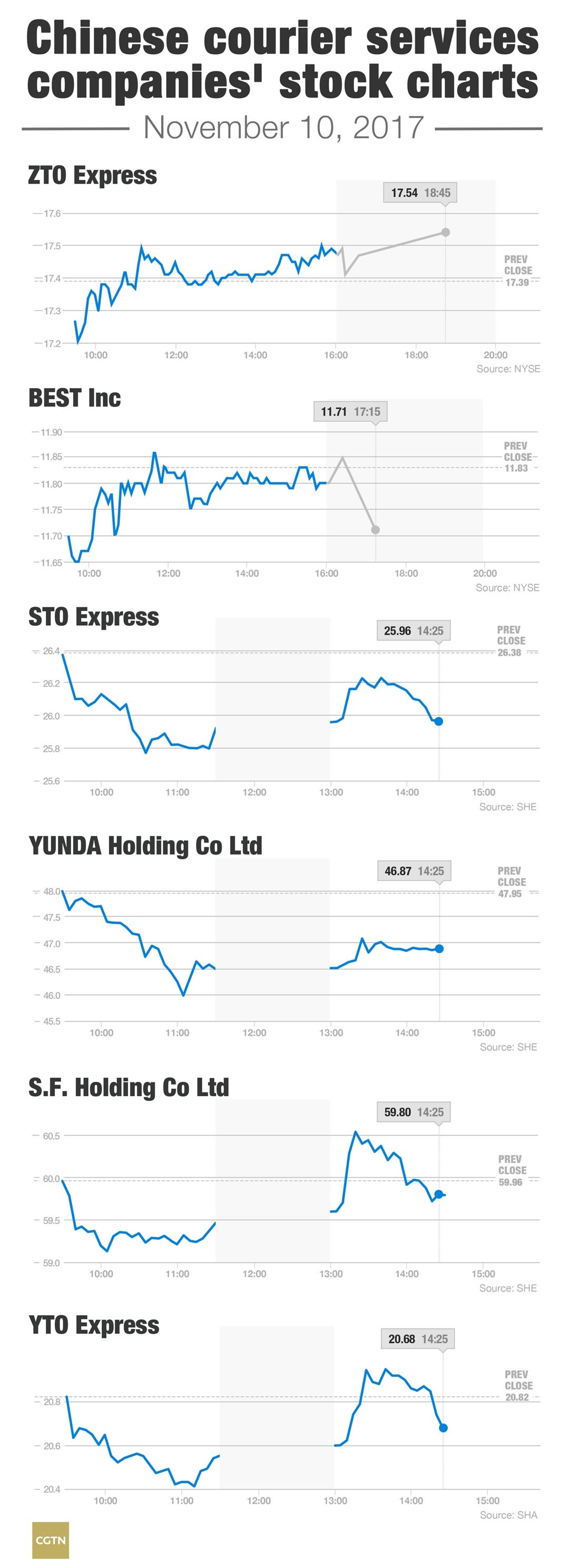

Courier services shares fluctuate

VCG Photo

VCG Photo

This is the first “Double 11” since the big six Chinese courier services companies – ZTO Express, STO Express, YTO Express, BEST Inc., YUNDA Holding Co. Ltd., and S. F. Holding Co. Ltd. – all went public.

The courier services shares are fluctuating in countdown celebration, as the companies meet the challenges of smart logistics upgrade and large-scale application, and embrace the future trend of automated logistics storage.

The number of packages to be handled between November 11 and 16 is expected to rise to 1.5 billion, up 35 percent from last year, according to the State Post Bureau. The daily volume during the period may hit 340 million, three times the routine level.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3