12:56, 06-Apr-2018

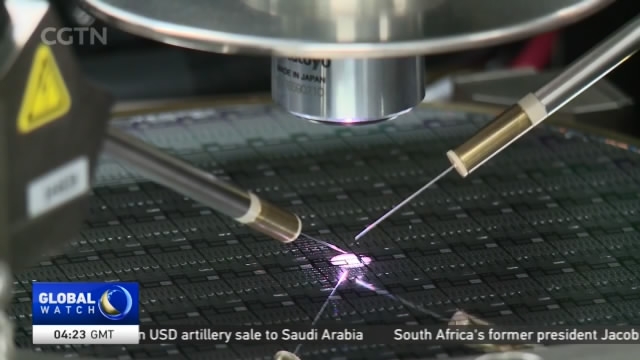

China-US Trade Tensions: Malaysian electronics sector deeply integrated with China

Malaysian stock prices tumbled when the US announced tariffs on aluminium and steel imports last month.

And in reaction to US tariffs targeting China, the technology index on the stock exchange dropped seven percent on Wednesday alone and is down by a quarter so far this year.

Worst hit have been companies tied to the semi-conductor industry, worth some 35 billion dollars a year to Malaysia.

WAN AZLI WAN ISMAIL SEMICONDUCTOR FABRICATION ASSOCIATION OF MALAYSIA "It's huge and the biggest exports if you look at the trading partners, the biggest right now, it's China because China is the manufacturing centre of the world, and as a component manufacturer in Malaysia this is the country that we export to the most."

Those components end up being assembled into finished products in China and elsewhere. So the prospect of a trade war is causing jitters here.

Malaysia is also one of the countries that the Trump administration has singled out for having a trade surplus with the US.

PROF. MAHENDHIRAN NAIR MONASH UNIVERSITY MALAYSIA "While China is the target at the present moment I'm sure that focus will come to other countries who are running trade surpluses with the US. That is always in the mind of the policy makers here, and that is why you see in the past few years there is a major push towards pushing asean as a market, diversifying the markets."

But Malaysia's semi-conductor sector is likely to remain highly integrated with China and dependent on global demand for consumer electronics products.

The semiconductor sector here grew 21 percent last year and the industry says it's not overly worried about the trade tensions.

WAN AZLI WAN ISMAIL SEMICONDUCTOR FABRICATION ASSOCIATION OF MALAYSIA "What will happen is more on an emotional reaction, rather than the fundamentals. It will set back a little bit on the growth but I do not think it will be a very long period of time."

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3