Business

17:15, 12-Oct-2017

Electric cars in India by 2030, a bumpy ride ahead

Alok Gupta

India has decided to turn all new passenger car sales electric by 2030 and placed first order of 10,000 cars to Tata Motors. Amidst plans to boost electric car sale, inadequate charging stations and quality issues are posing to be a serious problem for electric vehicles (EVs) in the country.

The automobile major, Tata Motors outbid its rival Mahindra and Mahindra (M&M)to clinch the electric car deal. M&M management had questioned the viability and profitability of the electric cars that would be manufactured by Tata Motors. In the bidding, Tata Motors bid the lowest price of rupees 1.12 million (17,202 US dollar) for the EV.

"We have been selling EV in the country for the last five years. We have an idea about the costing of various components. So, we find it difficult to comprehend the pricing offered by the other bidder (Tata Motors),'' M&M's Managing Director Pawan Goenka said in a television interview.

India which is the world’s fifth largest automobile market that mainly sells fossil fuel-run vehicles. It intends to sell electric cars by 2030 to control its 20 billion US dollar expenditure on oil and to reduce emissions by 33 to 35 percent.

Charging Points

India has an extremely low number of charging stations: IEA Data

India has an extremely low number of charging stations: IEA Data

However, there is a massive gap between the government announcement and implementation.

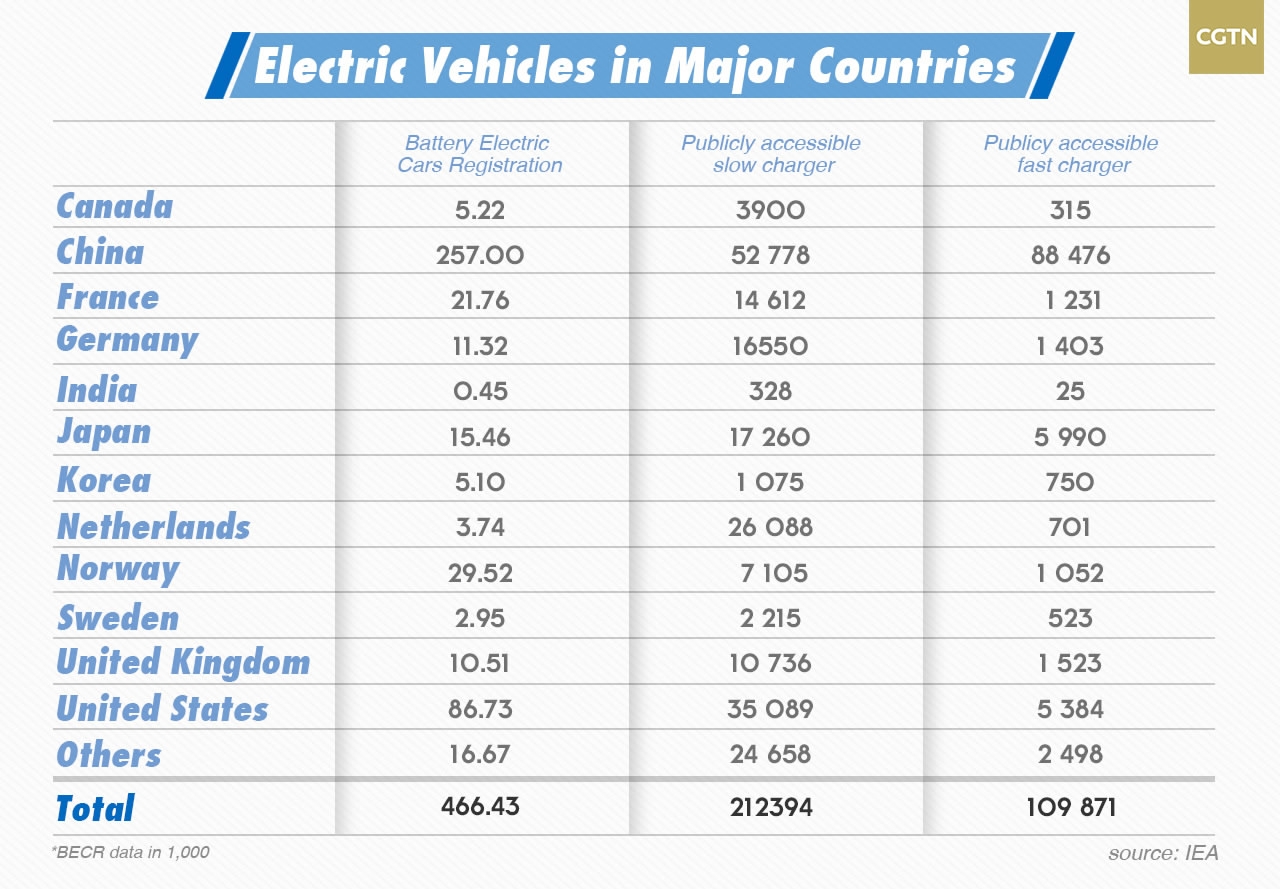

According to International Energy Agency report Global Electric Vehicle Outlook 2017, India has the lowest number of charging station. It has only 328 slow charging stations and 25 fast charging stations.

China races ahead with 52,788 slow charging stations and 88,476 fast charging stations.

There is confusion over how the first batch of 500 EV that is likely to be delivered by the end of this year would be charged.

In terms of new registrants for electrical cars, India fares too low with only 450 new registrants while China has world highest 336,000 registrants. Also, according to Niti Aayog, a government body National Institution for Transforming India, automobile ownership in India remains low, with just 18 cars per 1,000 citizens compared to nearly 69 in China and 786 for the US.

Low new registrants for EV coupled with low automobile ownership is seen as a hurdle to scale up the demand for electric cars in India. Automobile giants are banking on high demand that may lead to reducing the cost of EVs.

Quality Issues

Experts feel that there are many policy gaps that India needs to resolve to make the EV a success. According to a study, ‘The electric vehicle industry in China and India: The role of governments for Industry development’ underlines that cost and quality remains underlying bottlenecks of India’s automotive industry expansion in the global marketplace.

China's Chang'an electric car is displayed at 2015 Shanghai International Automobile Industry Exhibition in Shanghai, China, April 22, 2015. /Xinhua Photo

China's Chang'an electric car is displayed at 2015 Shanghai International Automobile Industry Exhibition in Shanghai, China, April 22, 2015. /Xinhua Photo

“Especially, rising labor cost is rising steadily due to a skill shortage, while logistics remains the main hurdle due to the poor infrastructure,” researchers say.

The study also reveals that Tata Motor’s rival M&M’s Reva electric car does not technically fit into the definition of a car. Reva is exempt from most European crash test rules due to its low weight and power, and it is classified as a heavy quadricycle.

While China had invested in research and development of EV a decade back, it thoroughly tested the viability of EV through ‘Ten cities one thousand cars' put 1,000 cars hybrid cars on the roads in 13 cities each in 2009.

India is slowly taking similar steps; it has decided to invest 60 percent of the research and development expenditure in developing an indigenous low-cost electric technology. It has also announced incentives to electric car buyers.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3