Business

10:23, 07-Dec-2017

Bitcoin zooms above $13,000 to record high on relentless demand

CGTN

Bitcoin's record-breaking rise continued on Wednesday as the cryptocurrency broke above 13,000 US dollars even as questions swirled about its real value and sustainability.

The payment system received a boost after Friday’s announcement by the main US derivatives regulator that it would allow CME Group Inc and CBOE Global Markets to list bitcoin futures contracts.

Bitcoin was up 12.42 percent at $13,127.01 on the Luxembourg-based Bitstamp exchange BTC=BTSP after surging to the record peak of $13,127.01.

“Simply the perception in households around the world that the CME and the CBOE are providing legitimacy to bitcoin is really what is driving the massive rally here,” said Karl Schamotta, director of global product and market strategy at Cambridge Global Payments in Toronto.

The regulator's move opens the door to added regulation but also more mainstream adoption, as bitcoin futures and other derivatives would make it easier to trade the new asset class.

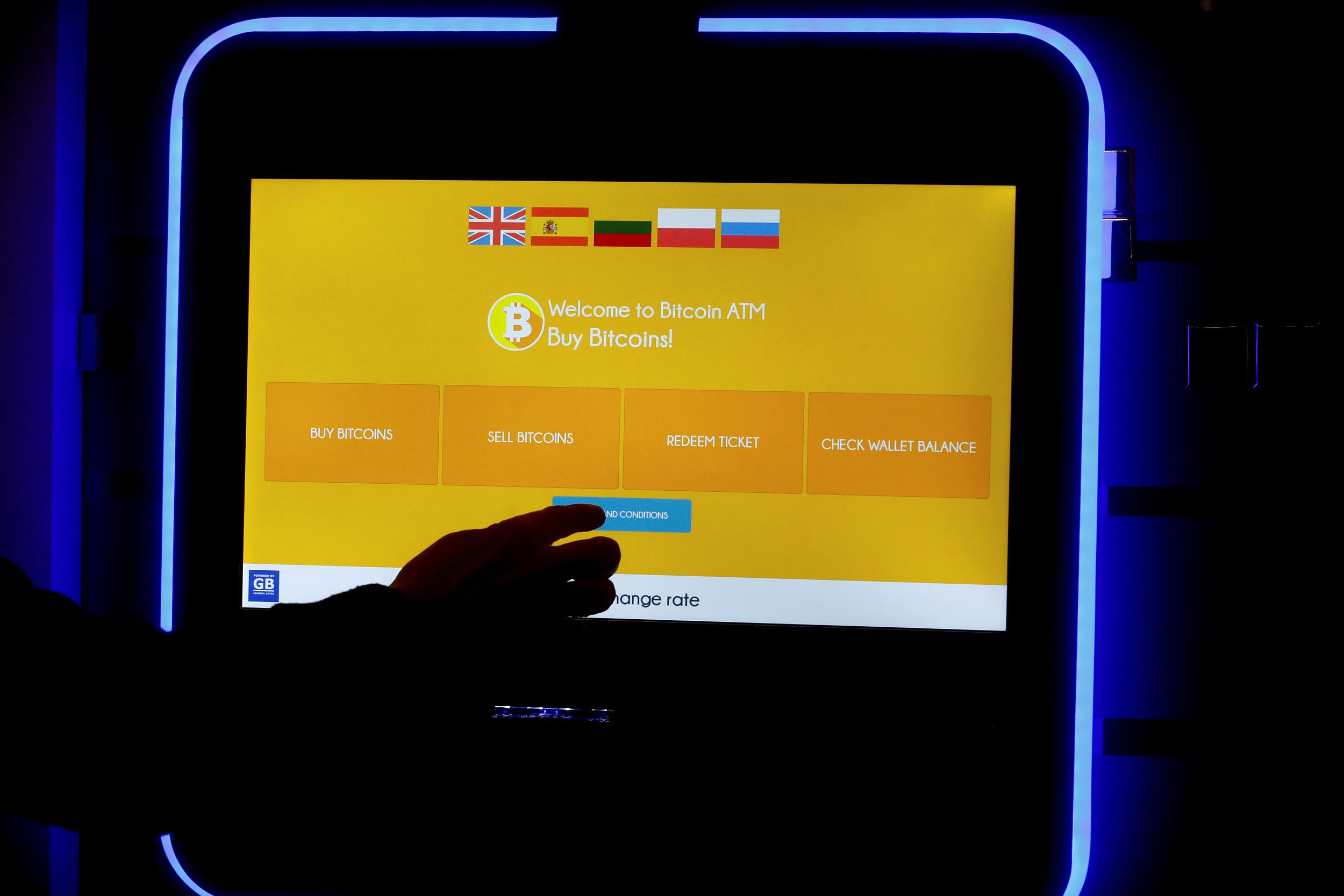

A bitcoin ATM in Vilnius, Lithuania, December 6 /Reuters

A bitcoin ATM in Vilnius, Lithuania, December 6 /Reuters

Bitcoin’s ascent of over 10-fold from below $1,000 at the start of the year has drawn regulatory scrutiny around the world.

Some high profile individuals such as Nobel Prize-winning economist Joseph Stiglitz have said the cryptocurrency should be outlawed.

“It took a long time to establish the methodology and the way bitcoin was traded. The original appeal came from the fact they were unregulated. However it’s clearly moved out of those shadows and into center stage,” said Mick McCarthy, CMC Markets’ chief market strategist in Sydney.

“We are in the throes of a bubble market, and one of the characteristics of a bubble market is that there is no way to know when the bubble will burst.”

/VCG photo

/VCG photo

“If you look at this sort of pattern it has repeated itself many, many times. The only way it ends is when sentiment shifts and that’s a deeply unpredictable thing,” Cambridge Global Payments’ Schamotta said.

“There is a lot of money flowing into bitcoin right now, mostly motivated by 'fear of missing out' and greed,” said Leonhard Weese, president of the Bitcoin Association of Hong Kong.

Source(s): Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3