13:34, 30-Apr-2018

Beijing Auto Show 2018: More open auto market to accelerate competition

04:09

There's never been a more interesting time for China's auto market. China will phase out joint-venture restrictions for foreign automakers in five years, and import tariffs are set to be cut soon. How will it redefine competition in the world's largest auto market? Xia Cheng reports from the Beijing autoshow 2018.

"In China, for China", a catch phrase among auto executives at the Beijing autoshow. And with policies for wider access, there will be "more in China, for more of China". When full ownership is no longer a no-go, the question is whether to go solo or expand partnerships.

PETER FLEET ASIA PACIFIC PRESIDENT, FORD MOTOR COMPANY "Already have strong 2 JVs 3rd with Zhongtai need approval though, the new one focus on battery e cars plus import export strong in China invest in mantra in China for China, bringing Chinese talents national distribution service new."

Wider market access means more competition--for example, the new breed of automakers claiming their internet mindset helps capture the digital generation.

XIA CHENG "Tesla--everyone's benchmark is here. It is expected to set up a fully owned China factory, as the country opens up its auto sector-- that is, if Tesla can get over the current cashflow and supply snags."

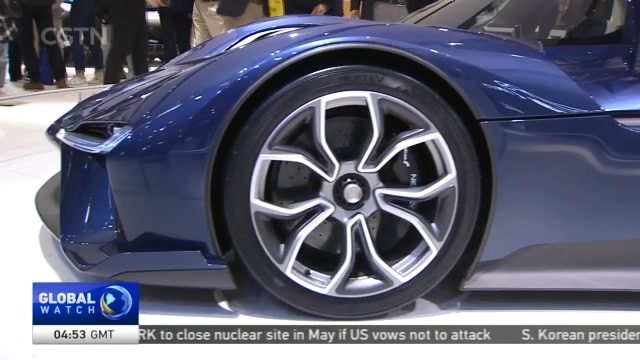

Those are not top concerns for traditional automakers--they don't rely on rounds of funding from venture capitalists, and their long-term operation has built up strong supply chains. They are more pressured on winning the tech race. Jaguar Land Rover is teaming up with 5 Chinese companies in fields like telecom, mapping, autonomous driving.

RALF SPETH, CEO JAGUAR LAND ROVER "It means we have to bring with all, autonomous drive electrification.

And Alibaba plays a role in Ford's plan to reverse declining sales in China.

PETER FLEET ASIA PACIFIC PRESIDENT, FORD MOTOR COMPANY "I would say look around at Ford, yes our sales off a little bit. Some of our cars end of cycle. Huge wave of new exciting props starting with all new focus and escort cars that are optimized and tailored for Chinese customers bringing new features to cars with association with Alibaba, we have new trucks we've gone public about ambition to gain revenues base by 15% by 2025."

But not all automakers would move in the direction of getting more JVs on board.

DOUG BETTS SENIOR VP OF GLOBAL AUTOMOTIVE, J.D. POWER "Interesting, unexpected involved in JVs a lot of that has done, a lot of factories are built, I think honestly, foreign automakers didn't need to support of local partners for understanding the domestic market, setting dealers dealing with governments, they need to know if they can do it on their own before making decisions whether to go solo."

As for premium brands selling only imported cars in China, the upcoming tariff cut is welcome move for dealers -- who may not have to pass on the savings to consumers because demand is so strong.

For now, auto imports and exports are only a fraction of total sales, auto executives do not see material impact from the China-US trade tensions. The pressure on Chinese own auto brands is real--but if competition drives better quality of products, and diversity gets consumers' adrenaline running, a more mature China auto market would move to the inside track of mobility.

XIA CHENG, CGTN, BEIJING

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3