22:55, 18-Jul-2018

Fintech Fraud: Peer-to-peer lending involves high risks

Updated

22:46, 21-Jul-2018

03:12

Six Peer-to-peer lending platforms have been shutdown, leaving users about a hundred billion yuan out of pocket. P2P lending services have become increasingly popular in China in recent years, and work by directly connecting businesses and individuals to investors resulting in low-interest loans. The industry has reported more than a dozen fraud cases since June and is now expected to face even stricter scrutiny from regulators. Mi Jiayi reports.

More than 50 peer to peer lending companies have run into major problems in less than half a month -- founders fleeing with money, platforms accused of fraud or suddenly closed, or facing outright default. One of the latest in Shanghai was Yonglibao. It sent alert messages late Monday night on its APP and social media account, telling investors to call the police because the employees had lost contact with the company's founders. Yonglibao later issued an announcement saying it has suspended all online lending services and set up a team to return money to investors. Data show that as of June 16, the platform had outstanding debts of 1.1 billion yuan. It's all made the Shanghai street cautious every time someone mentions online lending.

"I've invested in P2P platforms before. I think I need to pay more attention to the risks and problems."

Data from research company Yingcan Group show that July alone saw 63 P2P platforms reporting new problems - 58 declaring defaults, and five admitting that someone has run off with all the money. Financial regulators held emergency meetings about all this Monday night, urging local financial watchdogs to pay more attention and prevent companies with problems from suddenly just shutting down. But what are the reasons for all the recent problems?

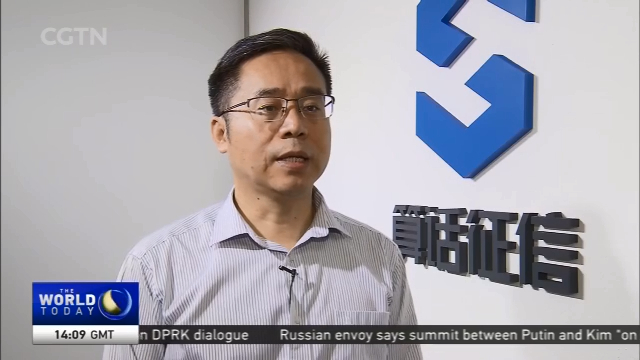

JIANG QINGJUN, CEO SUANHUA "There are two main reasons. One is that China is deleveraging its financial system, and market liquidity is tight. Some platforms raise money from investors and loan it to corporations, rather than to individuals. So if these companies taking the loans are having trouble making repayments, the platform will have trouble cashing out. The second is that some platforms have raised money but have never loaned it to anyone. On the contrary, they have embezzled the money and then put it into other investments to improve their profits."

Since this year the government has prohibited companies from offering guaranteed returns, saying instead they should warn investors about any possible risks.

And even though it's been prohibited, many peer to peer lending platforms are still hinting to investors that they will guarantee a return on investments. Analysts warn that investors need to understand that no investment is without risks. It's estimated that China's P2P platforms have about 50 million registered users and 1.3 trillion yuan of outstanding loans.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3