Business

20:34, 14-Sep-2017

IMF forecasts sustainable growth in Asia but with challenges

By CGTN’s Jack Barton

Seoul has just played host to an international conference on economic sustainability in Asia. The International Monetary Fund (IMF) says the region is growing faster than expected but faces many challenges including high debt, low productivity and an aging population.

Since the Global Financial Crisis in 2008, low economic growth has sometimes been recognized as the “new normal” or “new mediocre”, particularly in developed countries. That being said, when two of the main economic engines in Asia faced slowdowns and faltering economic recoveries (China’s growth rate stood at 6.7 percent in 2016 and India’s at 6.8 percent), a few worried whether the crisis would make a comeback.

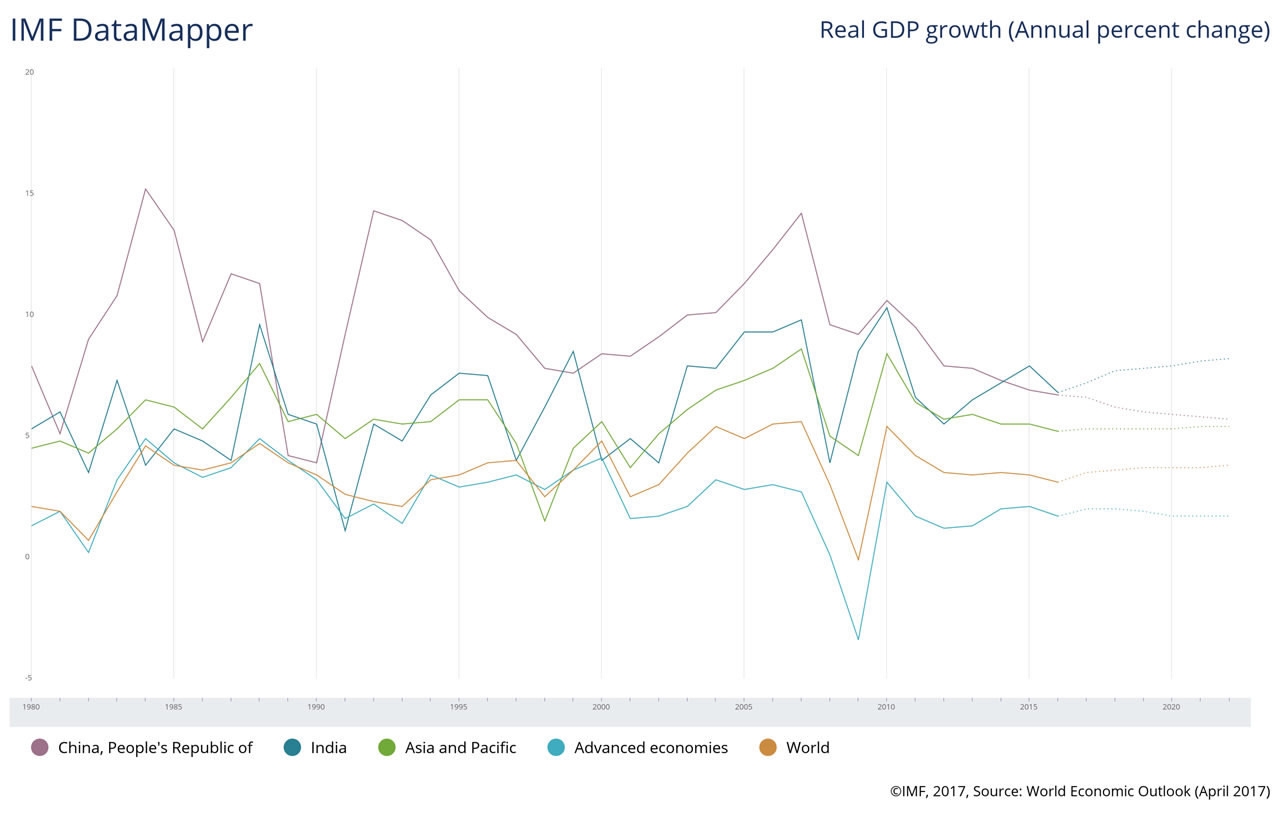

GDP growth rates of major economics /IMF Photo

GDP growth rates of major economics /IMF Photo

At opposite poles, Changyong Rhee, director of the Asian and Pacific Department at the IMF, said that he has seen “positive signs that we are coming out of the tunnel”.

“After the global financial crisis for almost 10 years, we hadn’t seen growth pick up and we were worried about the new mediocre. But one good news is that from this year we are actually observing that the growth is forming globally and particularly in Asia,” Rhee said.

The IMF increased its estimate for China’s average annual growth rate through 2020 – from 6 to 6.4 percent then to 6.7 percent annually. And China’s growth rate in the first half of 2017 was 6.9 percent, “well over the expectation”, according to Rhee.

As China is currently attempting to transition the economy away from an export-driven model to one more reliant on domestic growth. Rhee, from the IMF’s perspective, gave China’s external sector rebalancing an A grade, saying that “in some sense they have made significant progress.”

Changyong Rhee, director of the Asian and Pacific Department at the IMF /VCG Photo

Changyong Rhee, director of the Asian and Pacific Department at the IMF /VCG Photo

But internal rebalancing, which “is not as dramatic as we see in the external sector”, just got a B grade. And over-investment in some sectors might be the major reducing score, Rhee warned.

He explained, “If you look at the internal rebalancing in China, the investment rate is very high. If it’s too high now they have to continue investing in some sectors which don’t have that much productivity gain. That will definitely waste a lot of resources. So internal rebalancing I may give a B grade.”

VCG Photo

VCG Photo

Moreover, the economist also warned that cost of rising debts would increase short-term risks to growth for both China and the whole Asia, elaborating that “The short term risk after the global financial crisis, in Asia, China, and many others, heavily rely on the leveraging increase, borrowing to cover the growth slowdown. If the global financial conditions become tighter together with US monetary policy normalization, this will definitely increase the vulnerability of Asia countries.”

“But I’m more concerned at this moment by the medium-term risks Asia is facing. One is an ageing problem,” Rhee added, “Many Asian countries when they reach the ageing society point their income levels will be 20, 30 percent of the advanced economies and productivity. Once you reach a certain stage unless you have productivity growth you won’t become rich, so a so-called middle income trap becomes a real issue in Asia.”

(CGTN’s Wang Yue also contributed to the story.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3