Business

22:55, 14-Feb-2018

China broadens the definition of M2 money supply

CGTN

China’s central bank has quietly expanded the definition of M2 money supply to take banks’ off-balance sheet financial activities under its scrutiny as the need to make a quick adjustment has risen.

This move is consistent with the Chinese regulators’ crackdown on risky shadow lending that has forced banks to shift some loans back onto their balance sheets.

The new M2 money supply grew 8.6 percent in January from a year earlier, 0.1 percentage points higher than the previous M2 measure, data from the People’s Bank of China (PBOC) showed on Monday.

The People’s Bank of China (PBOC) in Beijing /VCG Photo

The People’s Bank of China (PBOC) in Beijing /VCG Photo

Broad M2 data generally refers to the entire stock of liquid assets in an economy, such as cash and current account deposits, as well as “near money” indicators that are less liquid, such as savings deposits.

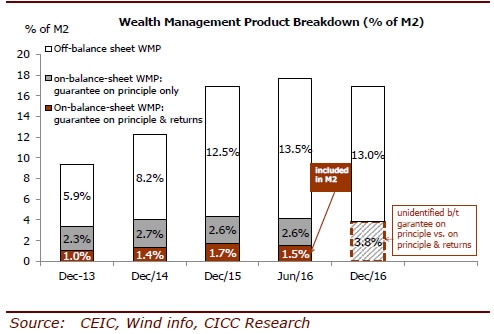

In China, M2 growth has been seen as the most representative gauge of monetary expansion in the context of the country’s bank-dominant financial system. However, the relevance of the previous M2 definition has declined as household and corporate savings started to diversify away from traditional bank deposits.

The money and credit readily available to the economy mainly come from depository institutions – banks – that accept deposits and contribute to the economy by lending much of the money saved by depositors.

VCG Photo

VCG Photo

Non-depository institutions, sometimes referred to as the shadow banking system, resemble banks as financial intermediaries, but they cannot legally accept deposits. Consequently, their regulation is less stringent, which allows some non-depository institutions to take greater risks for a chance to earn higher returns.

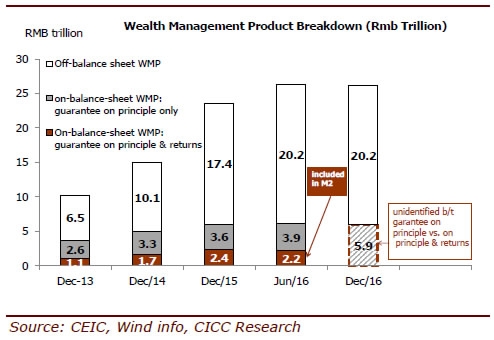

While deposits of non-depository institutions have been included in M2 since the last M2 definition adjustment in October 2011, there are still some significant quasi-deposits left out, such as a sizable portion of wealth management products (WMPs) and money market funds (MMFs).

WMPs have drawn a significant amount of savings away from traditional bank deposits. Only WMPs that guarantee both the principal and the returns are counted in the previous M2 gauge.

WMPs that are not included in the previous M2 amounted to over 24 trillion yuan by then end of June 2017, according to China International Capital Corporation Limited (CICC).

Although MMF is essentially no different in nature from deposits for individual investors, only the part of MMFs that is invested in deposits or inter-bank certificates of deposit (CDs) is included in the previous M2. By June 2017, the left-out MMFs amounted to 1.3 trillion yuan, said CICC.

To reduce banks’ riskier activity and leverage, Chinese regulators have announced a slew of new regulations since the start of 2017.

These efforts appear to be bearing fruit. The outstanding amount of WMPs grew just 1.7 percent last year, compared with a near 24 percent rise in 2016. The growth of total social financing (TSF), a broad measure of credit and liquidity in the economy, dropped to 11.3 percent in January from 12 percent in December.

4km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3