Business

10:35, 09-Aug-2017

China's July consumer inflation slows, factory gate inflation remains steady

CGTN

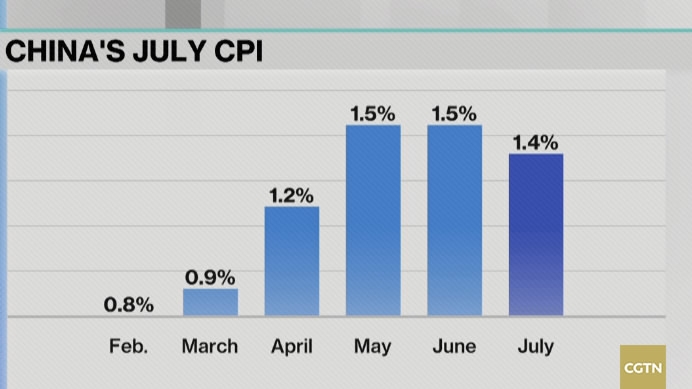

China's consumer price index (CPI), a main gauge of inflation, rose 1.4 percent year on year in July, the National Bureau of Statistics (NBS) said Wednesday.

It was slightly down from June's 1.5 percent. On a month-on-month basis, the index was up 0.1 percent, according to the bureau.

This mild consumer inflation level suggests policymakers still have room to tighten controls of the money supply, in a bid to rein in financial risks from years of debt-fueled stimulus. China's 2017 inflation target is 3.0 percent, and economic growth around 6.5 percent.

"We expect the central bank to keep liquidity either as tight as in July or even slightly tighter, and push interbank interest rates higher, especially at the short-end to reduce leveraging activities by interbank participants, which include banks and non-bank financial institutions." Iris Pang, ING economist told Reuters.

The producer price index (PPI), which measures costs for goods at the factory gate, rose 5.5 percent in July from a year earlier according to NBS, the same rate as the previous two months.

On a month-on-month basis, the PPI rose 0.2 percent in July, after three months in the red, with the NBS attributing this to a rise in prices of commodities including steel and non-ferrous metals.

VCG Photo

VCG Photo

"The rise in PPI suggests that corporate profitability should continue improving in the coming months, especially for upstream industries," David Qu, a Shanghai-based market economist at Australia & New Zealand Banking Group Ltd, told Bloomberg.

"With the authorities’ strong determination for capacity reduction, it should continue to support the PPI" though the base effect still forms downward pressure year-on-year, he said.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3