Business

21:01, 13-Mar-2018

China steel sector reforms: CPPCC member proposes greater industry concentration

By CGTN's Tao Yuan

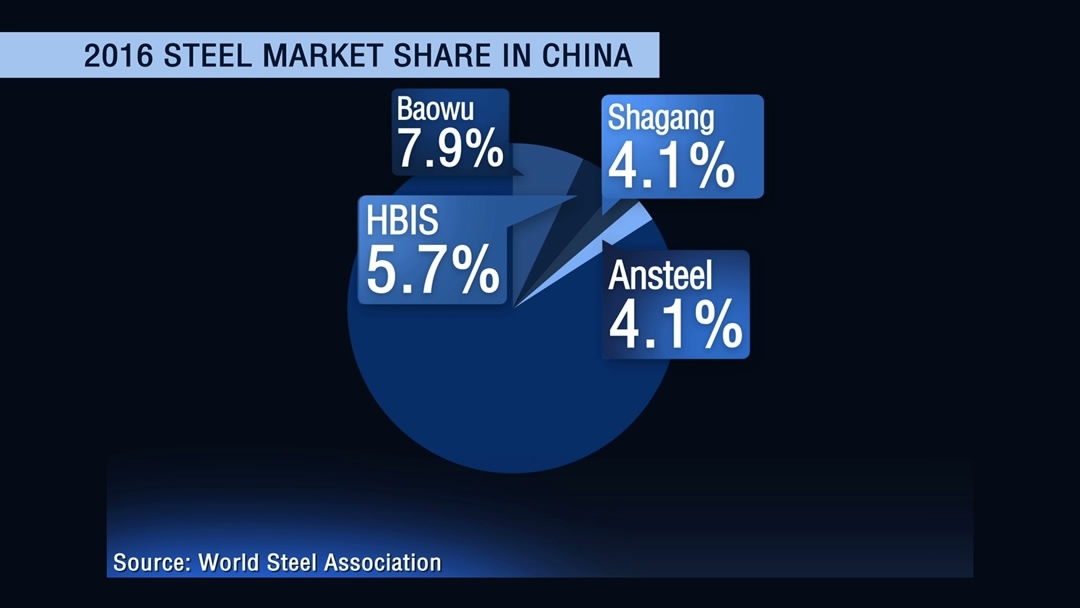

China produces half of the world’s steel, but the country’s steel industry has long been seen as fragmented, with too many companies competing with each other for a market share. Together, China’s four biggest steelmakers, Baowu, HBIS, Shagang and Ansteel produce only 21.8 percent of the country’s total steel output.

2016: China’s top four steelmakers produce 21.8 percent of the country’s total steel output. /CGTN Graphic

2016: China’s top four steelmakers produce 21.8 percent of the country’s total steel output. /CGTN Graphic

“Low industry concentration can lead to vicious competition, which is bad for a country’s sustainable development,” said Sun Zhaohui, a member of Chinese People's Political Consultative Conference.

He has worked at southwest China’s Panzhihua Steel (Pangang) for more than three decades, researching on vanadium and titanium resources. At this year’s “Two Sessions” in Beijing, he is proposing greater consolidation in China’s steel industry.

CPPCC member Sun Zhaohui calls for greater consolidation in China’s steel industry. /CGTN Photo

CPPCC member Sun Zhaohui calls for greater consolidation in China’s steel industry. /CGTN Photo

“In a healthier, more matured market, an industry’s concentration ratio measured by the top four biggest companies can reach 50 percent or more,” said Sun, adding that too much competition can lead to bad blood – companies lowering standard for profit, creating low-quality products and high levels of environmental damage.

“Vicious competition reached a boiling point a few years ago,” Sun added. “It was a time when people crossed all limits. There were no moral boundaries. Companies tried to pull each other down. This was the only way to survive in a market without order,” he said.

For years now, China has felt the environmental impact. The country’s notorious smog is just one example.

Beijing has been on a drive to cut its steel production, partly to clear its water and air, and partly because years of breakneck growth has caused overcapacity in its heavy industries.

The world’s top steelmaker produced 831.73 million tonnes of crude steel in 2017.

In a push to upgrade its steel industry, Beijing initially aimed to eliminate production capacity by 150 million tonnes by 2020. Last month, it said it would meet its target two years earlier than planned. Tens of thousands of illegal and low-tech mills have already been shut down.

China shuts down illegal, outdated mills in a bid to upgrade its steel industry. /CCTV Photo

China shuts down illegal, outdated mills in a bid to upgrade its steel industry. /CCTV Photo

“Our supply-side reform has already achieved leaps and bounds,” said Sun. “So I think the time is right now to push for greater industry concentration. This will lead to healthier competition.”

One benefit of higher industry concentration, said Sun, is what he calls “parallel development” – with less competition, companies can stop churning out the same products, and instead focus their energy on developing specializations.

Pangang merged with Anshan Steel in 2010. Now, it specializes in vanadium and titanium research.

Sun asserted it’s high time that the country encourages more companies to follow the pattern. He also called on China’s leadership to do better regional planning, to better resource steelmakers to produce more high-quality products.

(Video by Zhang Kai)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3