Business

21:02, 25-Dec-2017

Movers and shakers: How did China and India's economy fare in 2017?

CGTN’s Guan Xin and Radhika Bajaj

Asian countries rode a global trade boom in 2017 and saw the fastest trade growth in the world with exports growing by 7 and 6.5 percent for the first and second quarters respectively year-on-year.

Last month, Asia’s major manufacturing economies also saw their fastest expansion in factory activity in years, driven by a robust demand for electronics.

Export-reliant Southeast Asia is concluding the year on a high note, while India's economy continues to feel the repercussions of the 2016 currency ban and tax reform. So, what does the report card look like for two of Asia’s biggest economies?

China’s economy: No hard landing in sight

China managed to maintain stable growth, improving its quality and efficiency this year. The country registered above expectation GDP growth in the first three quarters of 2017.

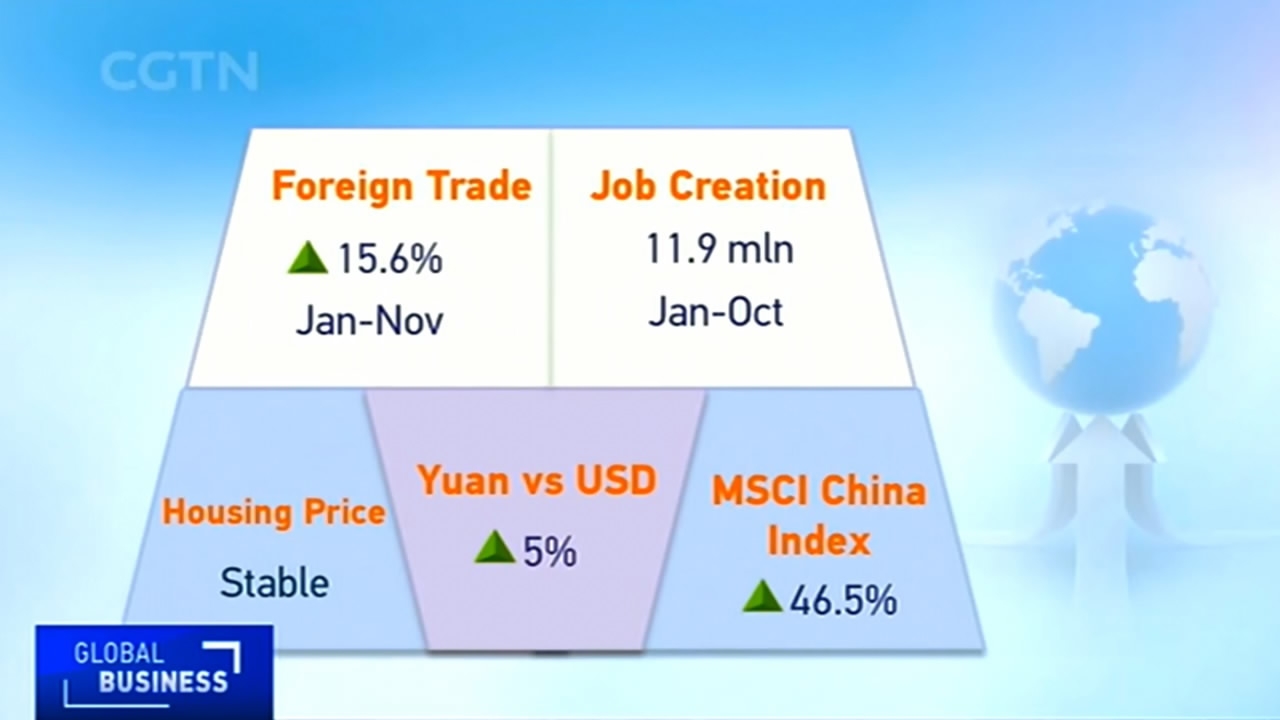

China’s foreign trade volume for the first 11 months of this year rose by 15.6 percent to 25.14 trillion yuan, around 3.82 trillion US dollars, yet another signal that growth remains steady and strong.

Employment also appears robust. In the first 10 months of 2017, job creation reached 11.9 million, while the unemployment rate in November sank below 5 percent.

Housing prices were also reined in, with new home prices increasing by 5.1 percent year-on-year in November, down from October’s 5.4, the pace of growth slowing in the face of government efforts to keep prices in check, tightening up against the risk of a real estate bubble.

CGTN Photo.

CGTN Photo.

On the investment front, the MSCI China Index was up nearly 50 percent this year, the inclusion of China’s A-shares into the MSCI emerging market index a major milestone for China’s capital market.

Joe Ngai, managing partner for McKinsey’s greater China office, said China’s economic performance in 2017 was in accordance with expectations, but took on the appearance of being “more robust than previously anticipated."

The International Monetary Fund (IMF) and World Bank both raised China's growth outlook in 2017 – the latest forecast from both institutes expected GDP growth to reach 6.8 percent. And according to the UN's latest economic prospect report, China contributed one third of global growth this year.

CGTN Photo

CGTN Photo

Financial risks also appear to be under control. Authorities have been keeping bank’s credit growth on a shorter leash, particularly clamping down on smaller lenders and wealth management firms. China's M2 money supply, an indicator of monetary policy, has slowed to single digit growth this year.

A slowdown in the rate of growth in riskier sectors of the financial system is encouraging, said James Daniel, assistant director for IMF’s Asia and Pacific Department. “We've seen a range of measures across the financial sector, by all the various regulators, and we've already seen success.”

Favorable economic conditions make this a good time to shift gears. Going into 2018, Hong Hao, chief strategist of BoCom International says that “even though growth is bound to be slower, I would say quality will continue to improve, consumption will contribute even more to the economy, and quality of life and better environmental conditions will be a trend in the coming year.”

And Wang Jianhui, general manager of the research and development department at Capital Securities expects to see more reforms in certain industries, such as energy and transportation logistics, since “the government hopes to lower manufacturing cost."

“The restrictive policies against the property market and finance industry will continue,” predicts Wang.

India’s Economy: Reforms hurt growth in 2017, payoff expected in 2018

India lost its title as the fastest growing emerging economy in 2017. Big ticket economic reforms introduced by Prime Minister Narendra Modi's government have hurt the country's growth rate this year.

India's economy grew at 6.3 percent in the third quarter, higher than the 5.7-percent growth in the second quarter. But it is much lower than the 7-percent-plus growth rate which was the norm in 2016.

However, Modi is undeterred by the slump and continues to roll out lavish reforms. After a widely criticized note ban in 2016, Modi’s government implemented the country’s biggest tax reform in decades in July. A national goods and services tax, which meant to simplify business procedures, may boost tax collections, adding to fiscal revenue and growth, but in the short term at least, that hasn’t been the case.

VCG Photo.

VCG Photo.

The results of a 32.4-billion-US-dollar plan to recapitalize India's state banks will roll out over the next two years.

While the effects of several such reforms and policies have yet to manifest, they have not gone unnoticed globally. Moody's recently upgraded India's sovereign rating after13 years. India also jumped 30 places to 100 on the World Bank's ranking of countries for Ease of Doing Business. While the 2018 outlook for India is anything but bleak, there are major hurdles yet to be conquered.

"You have to have a better quality of labor force, a labor force that is educated, a labor force which is able to adapt to new technology," said Devendra Kumar Pant, chief economist for India Ratings.

(CGTN’s Wang Yue and Yan Yunli also contributed to the story.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3