Business

18:49, 21-Sep-2017

What’s behind Fed’s rate hike pause?

By CGTN’s Daniel Ryntjes

The massive impact of hurricanes Irma and Harvey has been factored into the Fed's decision to hold rates steady. But analysts say markets still expect a rate hike in Fed's December meeting.

Infrastructure, crops, businesses, homes and lives – the economic impact of hurricane Harvey in Texas and hurricane Irma in Florida is still being assessed.

Without knowing the full extent of losses, economists are predicting a significant reduction in third quarter growth.

But they note that in 2005 the rebuilding following hurricanes Rita and Katrina in Louisiana and the wider Gulf Coast region ended up stimulating growth overall.

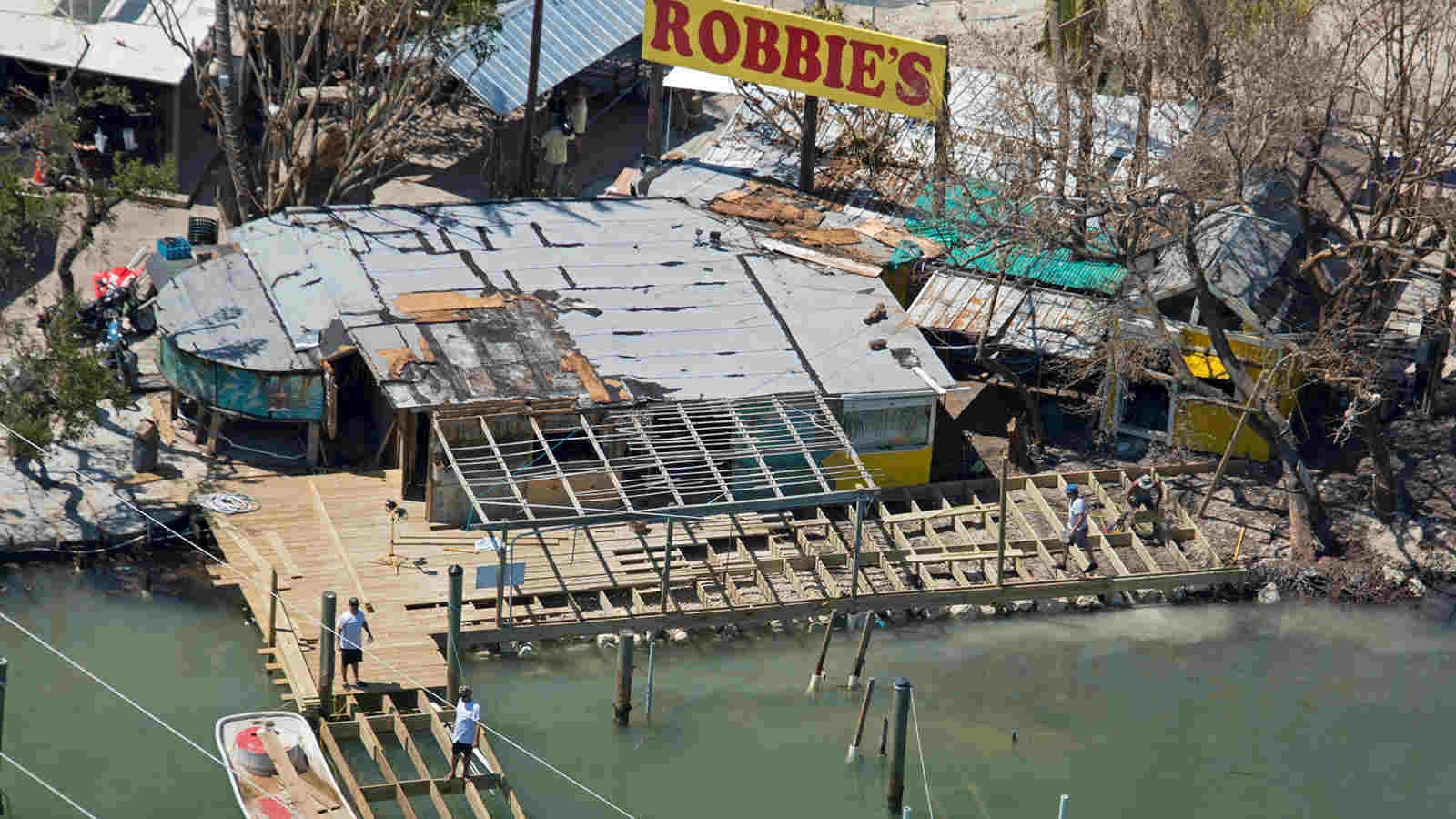

Repairs underway to a dock at Robbie's Marina washed away by Hurricane Irma in Islamorada, Florida, US. /VCG Photo

Repairs underway to a dock at Robbie's Marina washed away by Hurricane Irma in Islamorada, Florida, US. /VCG Photo

“People have to buy the cars, replace the cars that were damaged, rebuild the houses that were wiped out," said Richard Dekaser, corporate economist at Wells Fargo.

The more complex issue Federal Reserve Chair Janet Yellen and her colleagues may be puzzling over is why, when US household incomes have risen, the price of goods and services – known as inflation – has not.

That situation, Dekaser said, is also making the Fed stop to wonder if the inflationary environment has had a fundamental shift, or is it simply a short-term variance.

“As this uncertainty persists, it's likely to keep them (Fed) on pause," said Dekaser.

Markets also don't expect a rate rise at this week’s Fed meeting, but do agree with the decision to trim down its massive 4.5 trillion US dollars in holdings of mortgage-backed securities and US Treasury bonds.

The process will soon begin in October.

Fed Chair Janet Yellen speaks during a news conference after a two-day Federal Open Markets Committee (FOMC) policy meeting in Washington, on Wednesday. /VCG Photo

Fed Chair Janet Yellen speaks during a news conference after a two-day Federal Open Markets Committee (FOMC) policy meeting in Washington, on Wednesday. /VCG Photo

“We're working down our balance sheet. Because we feel that stimulus in some sense was no longer needed. So the basic message here is the US economic performance has been good,” said Yellen.

On balance, the markets do still expect a rate rise at December's meeting. But given the still low inflation environment, the path of future rate hikes is expected to remain gradual.

(Owen Fairclough contributed to the story)

11146km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3