Business

12:52, 16-Jul-2017

China to strengthen central bank's role in avoiding systemic risks

China will set up a financial stability and development committee under the State Council to coordinate between the country's main financial regulators, while the central bank will take on a stronger role guarding against systemic risks in the country's financial markets, said President Xi Jinping on Saturday.

"We will strengthen the role of the People's Bank of China in macro-prudential management and in averting systemic risks," said Xi at the National Financial Work Conference, a closed-door meeting of top Chinese finance officials held in Beijing from Friday to Saturday.

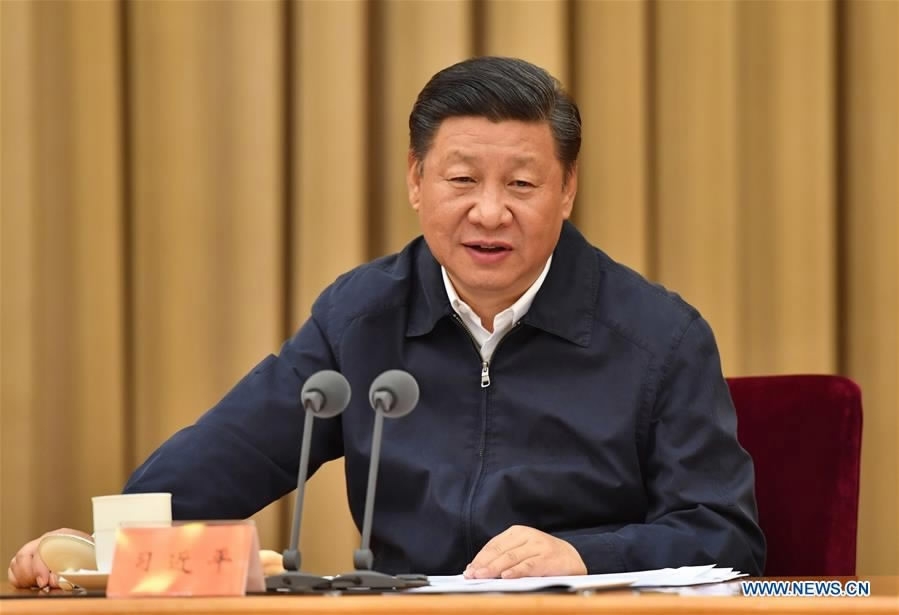

Chinese President Xi Jinping addresses the National Financial Work Conference, which was held from July 14 to 15, in Beijing. /Xinhua Photo

Chinese President Xi Jinping addresses the National Financial Work Conference, which was held from July 14 to 15, in Beijing. /Xinhua Photo

The gathering occurs every five years, discussing how to better tackle weakness in the financial system and help support economic growth. It started in 1997 in the wake of the Asian financial crisis.

Focus on improving regulatory coordination

This year's conference focused on reining in risks and improving coordination among regulators.

The main regulators include the China Banking Regulatory Commission (CBRC), the China Securities Regulatory Commission (CSRC) and the China Insurance Regulatory Commission (CIRC).

China's central bank and the three regulators have previously acted in isolation, even at cross-purposes, overseeing the banking, securities and insurance industries.

Ahead of the meeting, speculation is rife that China could create a "super regulator", and investors have long supported the idea of a unified body to oversee the regulators that oversee the different parts of China's financial system.

Instead of a super-merger of the regulators, the financial stability and development committee will be set up to curb regulatory arbitrage and tackle regulatory loopholes head on.

Market expectations

Headquarters of the People's Bank of China /VCG Photo

Headquarters of the People's Bank of China /VCG Photo

No detail was given about the composition of the committee.

The financial stability and development committee is a cabinet-level decision maker which should be headed by a cabinet-level official, and the group is likely to be placed within the People's Bank of China (PBOC), said Lian Ping, chief economist with Bank of Communications.

"On account of the fragmented financial regulation, regulatory gaps, even regulatory conflicts, exist in certain areas, such as Internet finance, liquidity risks, off-balance-sheet businesses, inter-bank businesses, and the establishment of the committee would be able to close the regulatory loopholes," Lian added.

Chen Jianheng, an analyst with China International Capital Corporation Limited, noted, "the financial stability and development committee will step up policy coordination, and policies that influence multiple fields will have to be countersigned by the PBOC plus the three regulators and finally approved by the committee.

An upgrade of existing financial coordination mechanism

VCG Photo

VCG Photo

Compared with the existing financial coordination mechanism, this committee is a high-level and comprehensive regulatory body, and it's expected to function well in the future, commented Dong Ximiao, a researcher at Chongyang Institute for Financial Studies, Renmin University.

The financial coordination mechanism was approved by the State Council and created in 2013, including the chiefs from all the regulators.

"The US and the major EU countries have given broader powers to their central banks in recent years, and China's introduction of this committee just conforms to the trend while the country's basic framework of PBOC plus three regulators remain unchanged," Dong added.

1km

Related Stories:

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3