Business

09:26, 29-Jun-2017

Report: Chinese spending will increase thanks to a spike in earnings

China’s consumer spending is expected to surge for years to come as a result of a robust increase in household earnings according to a report issued on Wednesday during the 11th Summer Davos Forum.

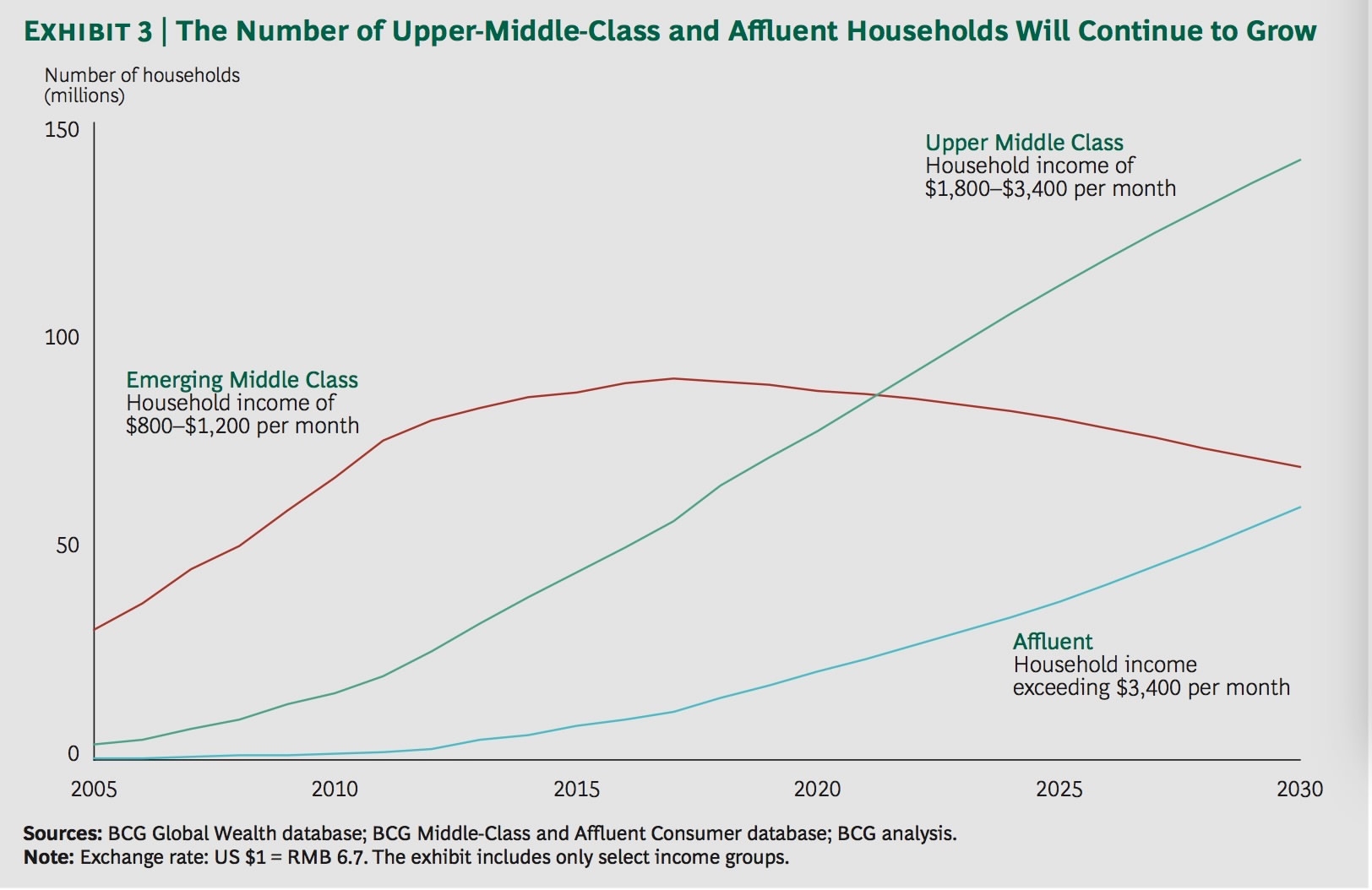

By 2030, the number of high income households, with monthly income exceeding 1,800 US dollars, could rise from around 60 million in 2016 to more than 200 million, estimates the report from the Boston Consulting Group, a managing consultancy, and Aliresearch, an affiliation to the Chinese e-commerce giant Alibaba.

The extra wealth thus accumulated is likely to translate into “non-essential spending” such as travel and entertainment as Chinese people are “increasingly buying services and experiences”, according to the report.

“Consumption of mid-level to high-end products on Alibaba’s retail site reached $174 billion in 2016”, the report said, citing Alibaba’s data.

Digital purchases could account for 90 percent of all shopping activities by 2021, up from 70 percent last year, the report adds.

The graphic is made and issued jointly by the Boston Consulting Group in the report Five Profiles that Explain China's Consumer Economy.

The graphic is made and issued jointly by the Boston Consulting Group in the report Five Profiles that Explain China's Consumer Economy.

What creates Chinese consumer’s optimism and their purchasing power is “continued income growth”, said Jeff Walters, leader of BCG's China Center for Customer Insight. He says, “So the incomes have to continue growing for the (the number of) heavy consumers to rise.”

According to the data from the World Bank, China’s per capita gross national income (GNI) of $290 in 1985 had quadrupled to $8,100 by 2016. Morgan Stanley, an American bank, forecasts that “China will break out of the middle-income trap and join the high-income society by attaining per capita GNI of above $12,500 by 2027”.

The structural shift in China’s economy is responsible for the income rise, the BCG notes at the beginning of its report, referencing the results of earlier research conducted by the firm.

The consumers’ confidence has huge impact on the country’s economy as a whole. Official data from the Ministry of Commerce showed that China’s retail sales had reached to around $4.9 trillion in 2016, accounting for 44 percent of the year’s total economic output.

Morgan Stanley predicted that China’s private consumption could grow from its current $4.4 trillion to $9.7 trillion by 2030. The BCG had made a relatively conservative projection in 2015 that eyed at an addition of $1.8 trillion by domestic consumption towards the end of 2021.

China’s GDP registered at $11.065 trillion in 2015.

The new generation of Chinese consumers are "more savvy and demanding with more specific and granular needs", the report says. Shown here are Chinese fans gather around in front of a store for the then Apple's newly-issued IPhone 5, Shenzhen, Guangdong Province, December 14, 2012. CFP Photo

The new generation of Chinese consumers are "more savvy and demanding with more specific and granular needs", the report says. Shown here are Chinese fans gather around in front of a store for the then Apple's newly-issued IPhone 5, Shenzhen, Guangdong Province, December 14, 2012. CFP Photo

Several studies into China’s consumption pattern have been published in recent months by different institutions, which, though looking at different aspects, have echoed a similar tone of optimism about the future growth of consumption in the world’s second largest economy.

Oliver Wyman Global Management Consultanting Firm has forecast a similar rise in relation to China’s high-spending community during the next five years. In its report published earlier in June, Oliver Wyman anticipated that the high-spending community will “account for more than 75 percent of the country’s total consumption by 2020.”

Findings by the Confidential Research of the Financial Times (FTCR), a British newspaper, into the prevailing attitude among Chinese consumers about their economic life suggests a confidence rally. The newspaper’s China Consumer Index illustrated that the economic sentiment and the economic outlook in May were “both at their highest level since our survey began in July 2011”.

“Appetite for buying cars, luxury goods and travel in China and abroad all improved in May, as cost-of-living growth moderated,” the FT’s analysis read.

The FTCR’s Household Income Outlook Index for China had also risen to the highest in May since 2013, suggesting stronger perception for future income by surveyed consumers could boost today’s spending.

This is the development path that China’s top policymakers want to encourage its economy to set upon in the face of grueling global demand which has put pressure on China’s export and worn thin the motive for state-investment.

Consumption is significant in adding new momentum to China’s growth, said Chinese Premier Li Keqiang in his keynote speech at the Summer Davos on Tuesday.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3