Business

17:55, 22-Dec-2017

What are fruit futures, and are they the future for Chinese apple farming?

CGTN's Nicholas Moore

The world’s first fresh fruit futures market launched in central China’s Henan Province on Friday, with authorities looking to stabilize incomes for farmers as part of the wider national poverty alleviation strategy.

So what is a fruit futures market, how will it help China’s farmers, and why has nothing like this been attempted before?

What are futures, and what do they have to do with apples?

A futures contract is an agreement between two parties to buy and sell a certain product at a certain time and at a certain price in the future. For seasonal produce like corn, grains and now apples, prices can fluctuate based on supply and demand – a poor harvest or a sudden downturn in exports can really hit farmers hard.

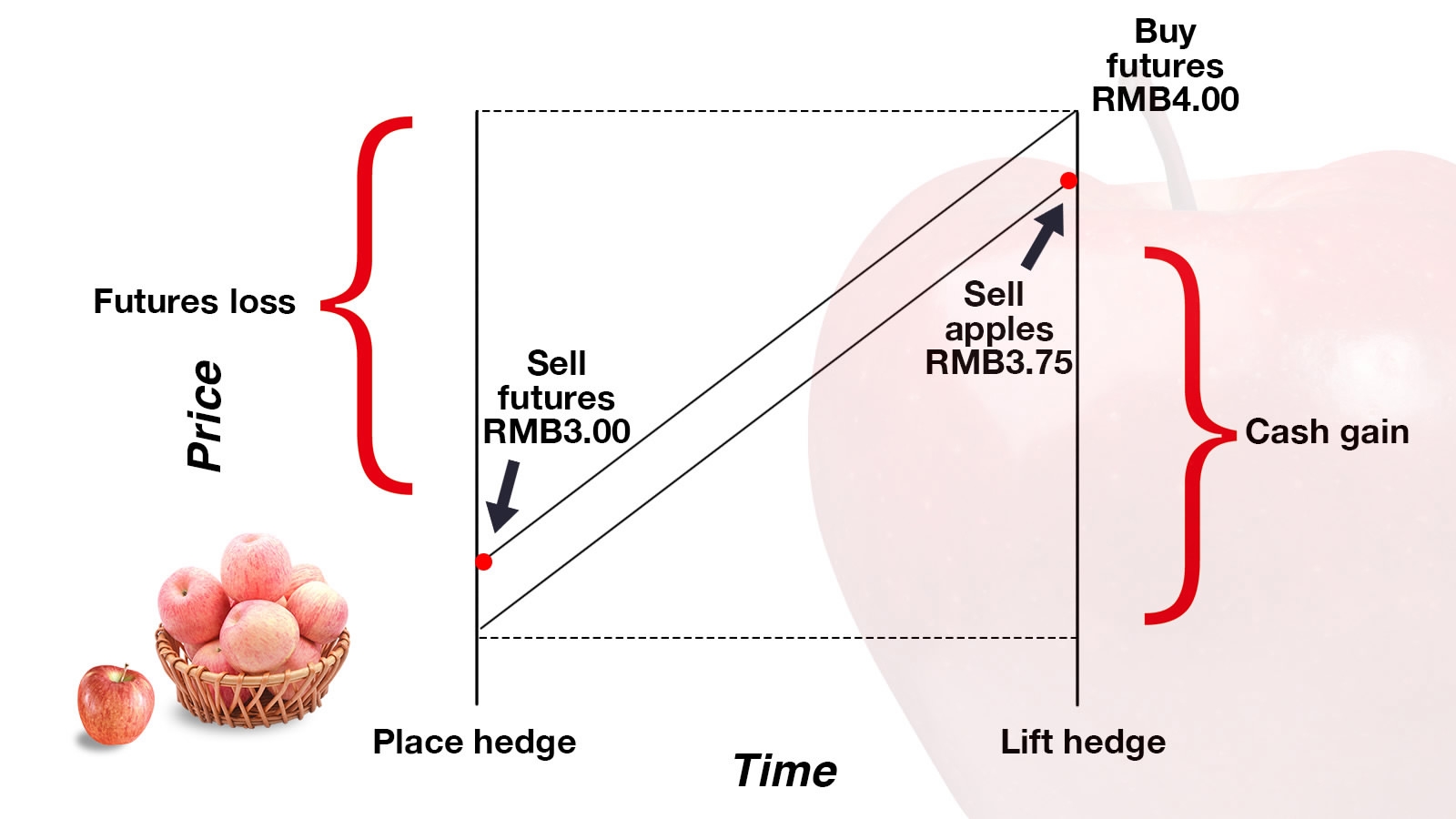

Futures allow farmers to hedge – meaning they can buy and sell physical produce and future contracts at the same time. Losses or gains made on the futures or on the market price generally offset each other, minimizing the risk of being financially squeezed by a surprise in the market.

For example, an apple farmer sells apple futures for three yuan, with the market price currently at 2.75 yuan. There’s been a bad harvest and demand is high just as the futures contract expires three months later – the market price for apples is now 3.75 yuan, while the futures price is four yuan. The farmer buys the same position in futures again, losing one yuan, but the market price increase means his net sale price is 2.75 yuan.

CGTN Photo

CGTN Photo

Switch that around, and start again with the same scenario (2.75 yuan market price, three yuan futures price). The farmer sells apple futures at three yuan, and a strong harvest means oversupply and poor demand. The market price is now just 1.75 yuan, and the futures price is two yuan. The farmer this time has made a profit on futures of one yuan, this offsets the low market price and again means a net sale of 2.75 yuan per apple.

In both cases, if the farmer had not hedged, he risked making a loss. Buying and selling futures may have reduced his potential profit in the first example, but he insured himself against a potential downturn by hedging.

Why has China introduced apple futures?

China already produces more apples than the rest of the world combined, and exported some 1.32 million tons in 2016.

90 percent of China’s apples come from Shandong, Shaanxi, Gansu, Hebei, Henan, Shanxi and Liaoning Provinces, regions which are home to some of China’s poorest population. More than 80 percent of China’s apples come from smallholdings of less than one third of a hectare, and introducing apple futures aims to provide greater stability and boosted incomes for these producers.

A bumper apple harvest in Qingshui county, northwest China's Gansu Province, November 11, 2017. /VCG Photo

A bumper apple harvest in Qingshui county, northwest China's Gansu Province, November 11, 2017. /VCG Photo

Volatility in the market in recent years has meant big winners as well as big losers – the lowest swing in prices since 2010 has been 57 percent, while a 150 percent swing in 2015 would have hit producers hard. Chinese media reports that farmers previously would take big risks as they waited for prices rises that never came – meaning tons of apples left in storage simply rotted away.

Why has no one tried this out before?

No other country produces apples on the same scale as China – 43.8 million tons were produced last year. Apples represent a 232 billion yuan (35.3 billion US dollar) industry, and introducing futures is expected to better regulate and prevent volatility in the market.

Apples are perishable and have a comparatively shorter shelf life than grains and wheat. However, China now has enough cold storage facilities to cover at least 25 percent of apple production, an amount which is expected to increase rapidly in the near future.

Sorting through the harvest in Aksu, northwest China's Xinjiang Uygur Autonomous Region, October 2017. /VCG Photo

Sorting through the harvest in Aksu, northwest China's Xinjiang Uygur Autonomous Region, October 2017. /VCG Photo

Fruits are also much harder to standardize than strains of corn or grain, with apple production spread across huge areas of China with great variations in quality and soil. However, Chinese authorities believe that the country’s inspection standards are now good enough to maintain enough quality to sustain the apple futures market.

Could the market turn sour?

In theory, the introduction of apple futures is designed to cut out risk and support China’s poorest people. However, speculators can buy and sell futures contracts without even intending to buy any fruit or produce. Instead, they engage in a market of selling and buying futures before they expire, in an attempt to predict and beat the market.

When speculation gets out of control, food prices are not dictated by supply and demand, but by futures contracts. A rapid, sudden upsurge in buyers of futures will send market prices up, while a “herd mentality” among futures sellers can send it spiraling down.

Without clear regulation to protect farmers and the poor people who struggle to afford increasingly expensive produce, futures could do more harm than good, meaning China’s apple futures market will need strict rules to avoid damaging speculation.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3