Business

18:10, 17-Oct-2017

Bona film: A journey from NASDAQ to A shares

By CGTN's Song Yuanyuan

Bona Film’s IPO prospectus was publicized by China Securities Regulatory Commission last Friday. After being delisted from NASDAQ since April 2016, Bona will soon relist on China’s A shares at Shenzhen Stock Exchange, where valuations for media and entertainment companies are much higher than in North America.

In 2016, Bona Film’s net profit was more than 100 million yuan (15.13 million US dollars, 2.6 times the net profit of last year. As of March 2017, Bona runs a total of 38 cinemas with screening license nationwide. In 2016, Bona’s self-operating cinemas generated a total of 722 million yuan (109.23 million US dollars) box office, accounting for 1.6% of the national box office market share.

VCG photo

VCG photo

The prospectus releases that Bona plans to raise a total of 1.425 billion yuan (215.85 million US dollars) for film investment and construction of more cinemas. But the prospectus also warns the potential risks in cinemas construction, such as the increasing rental costs. It also points out that as their theaters are mainly in first-tier cities at present, they will step up expanding into second and third-tier cities.

Half a year after taking private, market value tripled

Bona was only valued at nearly 5 billion yuan (816 million US dollars) right before it was delisted from NASDAQ. Within half a year, its market value tripled to 15 billion yuan (2.27 billion US dollars) in December 2016.

The prospectus discloses the details of several rounds of funds raising after taking private. In May 2016, after it completed delisting, Bona decided to increase registered capital, Ali, Tencent and other investors became shareholders with 4.86 billion yuan (735.29 million U.S. dollars) investment in total. Ali has 8.29% while Tencent has 5.80% of the shares respectively. Bona founder and CEO Yu Dong owns 34.92%.

Within only half a year, by December 2016, Bona completed A round financing of 2.5 billion yuan (360 million US dollars). After this round, Yu Dong, Ali and Tencent’s shares was decreased to 29.10%, 8.24%, and 5.17% respectively. It was valued at 15 billion yuan (2.27 billion US dollars) by then.

In March 2017, Bona accomplished A plus financing of 1 more billion yuan. (151.30 million US dollars) Wanda Film Holdings acquired 1.875% of Bona Film shares for 300 million yuan (43.5 million US dollars) as part of a wide-ranging strategic partnership. Bona’s market value was increased to 16 billion yuan (2.42 billion US dollars) by then. Famous movie stars like Zhang Ziyi, Huang Xiaoming, Zhang Hanyu also joined the investments as natural persons.

After the IPO, CEO Yu Dong’s shares will be decreased to 23.04%, still as the controlling shareholder. Ali, Tencent, Wanda movie holdings will be diluted to 6.95%, 4.36%, and 1.69%.

VCG photo

VCG photo

American Dream, not easy

Bona was the first NASDAQ listed Chinese firm, a feat accomplished in Dec 2010, but later lost value. In five NASDAQ years, Bona raised only 100 million US dollars. It was inadequate to Yu Dong, for a business that had invested in 60 films and constructed more than 30 movie theaters, the China Film Insider (CFI) reported.

CFI called the delisting was a long time coming and brought to a head amid a broad government-led campaign to distance China from foreign influence, but still was a difficult decision for Yu Dong.

Bona CEO Yu Dong in the middle, photo from stock.gucheng.com

Bona CEO Yu Dong in the middle, photo from stock.gucheng.com

“At that time, every entrepreneur was seeking their dream in America. I was quite reluctant to pull out of the US because it was not easy to get in and we experienced accomplishments and setbacks every step of the way.” Yu once told China Business News about the delisting from NASDAQ.

Bona may be delisting from an American bourse, but it is not retreating from the American market, which still, for now, is larger at the box office than China’s, as the CFI’s article “Bona film group delists from U.S. but won’t turn its back on Hollywood” published in May 2016 wrote.

According to CFI, the company has set up an office in Los Angeles and will begin operations there by the time this article is published. CEO Yu has been visiting L.A. every three months to meet with entertainment industry executives.

Bona’s international endeavors

Bona has never stopped its efforts in internalization. Just in May 2017, Bona Film Group announced the launch of a long-term film fund, in partnering with CAA (Creative Artists Agency), the world’s largest sports and entertainment management agency, with an initial 150 million US dollar investment. The first film from this fund is well-known Hollywood director, Roland Emmerich’s WWII battle film Midway.

According to the Deadline Breaking News, both companies say that the fund will be co-managed by Bona and CAA, with a focus on financing English-language films for the global marketplace, Chinese co-productions, and Chinese-language films for the local market. All films financed through the fund will be distributed in China by Bona Film Group while CAA will rep the North American (and select international distribution rights) to all the films they partner on.

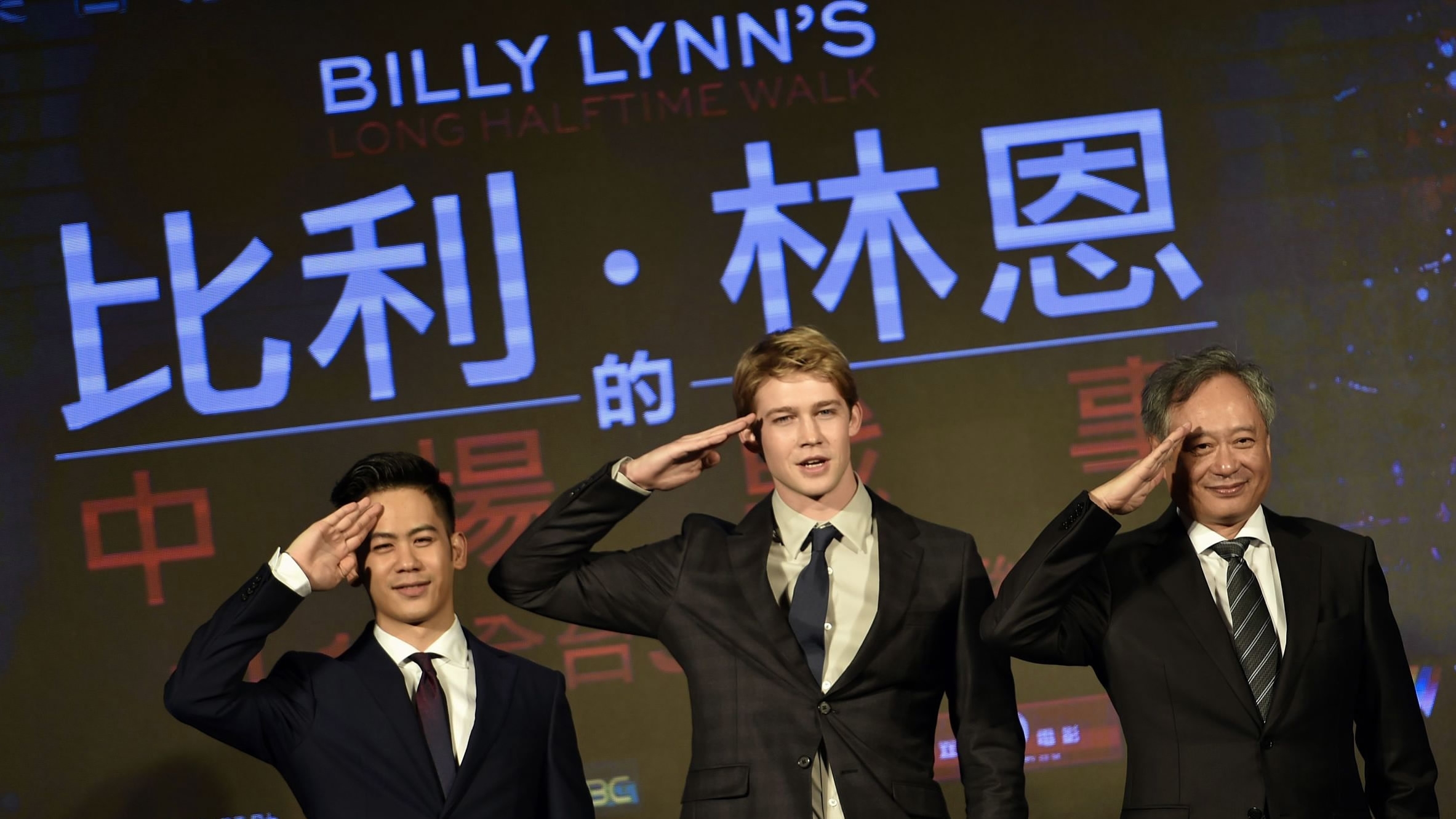

Bona was involved in the production of 2016 war drama film Billy Lynn’s Long Halftime Walk directed by Ang Lee. Earlier in November 2015, Bona announced a 235 million US dollar investment in the New York based The Seelig Group (TSG Entertainment Finance), that netted it a slice of six 20th Century Fox productions, including "The Martian", "Independence Day 2", "X-Men: Apocalypse", and "War For The Planet Of The Apes".

From L-R: Actors Mason Lee, Joe Alwyn and Oscar-winning director Ang Lee salute while promoting their latest film "Billy Lynn's Long Halftime Walk" outside the Taipei Train Station on November 2, 2016. /VCG photo

From L-R: Actors Mason Lee, Joe Alwyn and Oscar-winning director Ang Lee salute while promoting their latest film "Billy Lynn's Long Halftime Walk" outside the Taipei Train Station on November 2, 2016. /VCG photo

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3