Business

17:39, 08-Oct-2017

JP Morgan: Chicago has highest risk of bankruptcy

By CGTN's Song Yuanyuan

In recent years, a number of cities in the United States have filed for bankruptcy, crumbling under the weight of high debt burdens. The most well-known and largest of these is Detroit, which filed for Chapter 9 bankruptcy in 2013.

In fact, many large cities in the US are currently facing the same financial difficulties. Zero Hedge, a popular financial blog website recently published an article titled “Which American cities will file bankruptcy next?” It points out a number of high credit risk cities in the US, including Los Angeles, Atlanta, Houston and Chicago, which has long been rumored to be on the brink of bankruptcy.

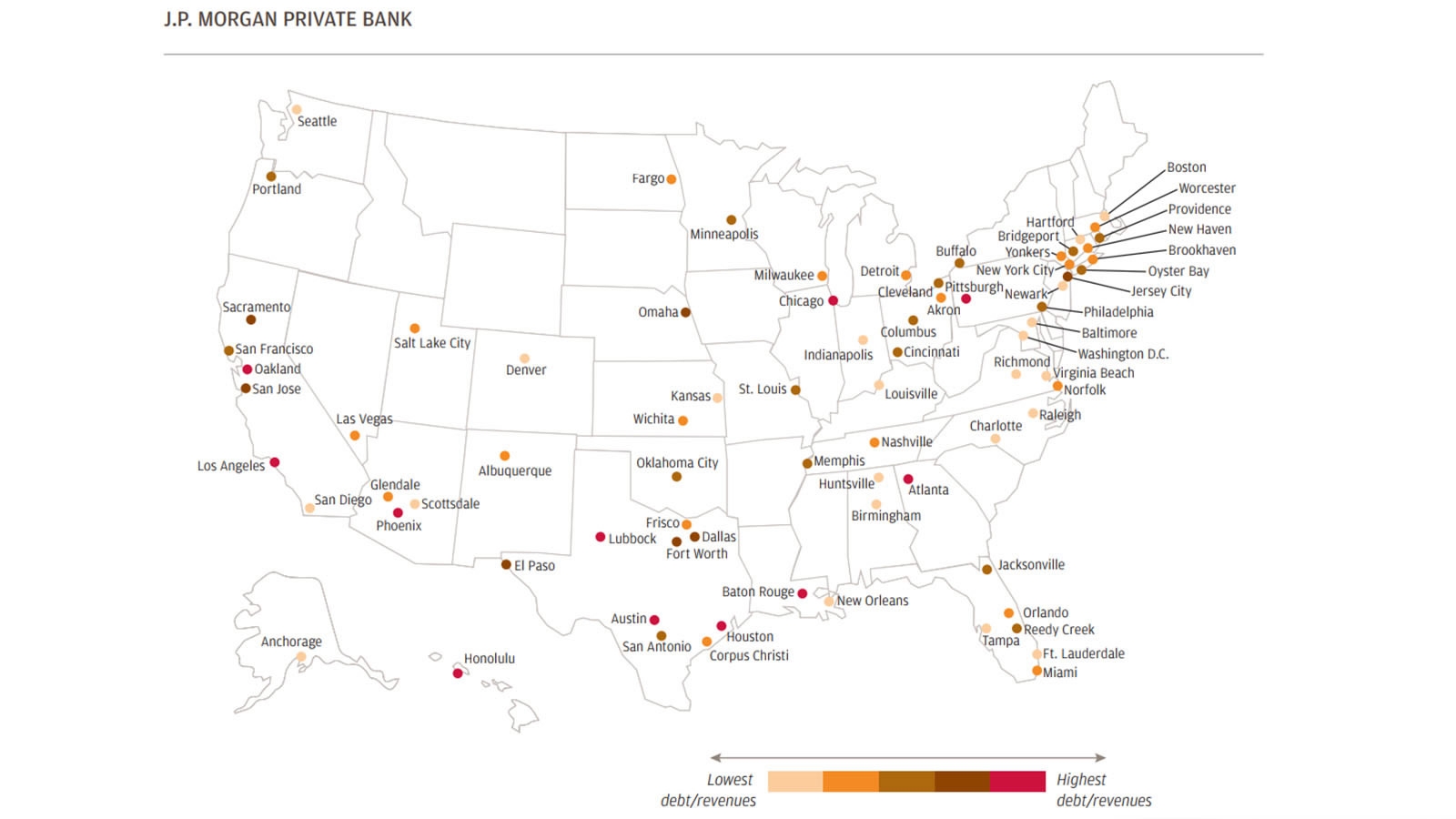

The article cited a map made by JP Morgan that ranked every major city in the US based on what percentage of their annual budgets are required just to fund interest payments on debt, pension contributions and other post-retirement benefits. “If you live in these ‘red’ cities, it may be time to start looking for another home,” the article said.

Source of J.P. Morgan

Source of J.P. Morgan

Chicago topped the list with over 60 percent of their residents' tax dollars going to fund debt and pension payments. Meanwhile, there are a dozen cities where over 50 percent of their annual budgets are used just to fund the maintenance cost of past expenditures, the article said.

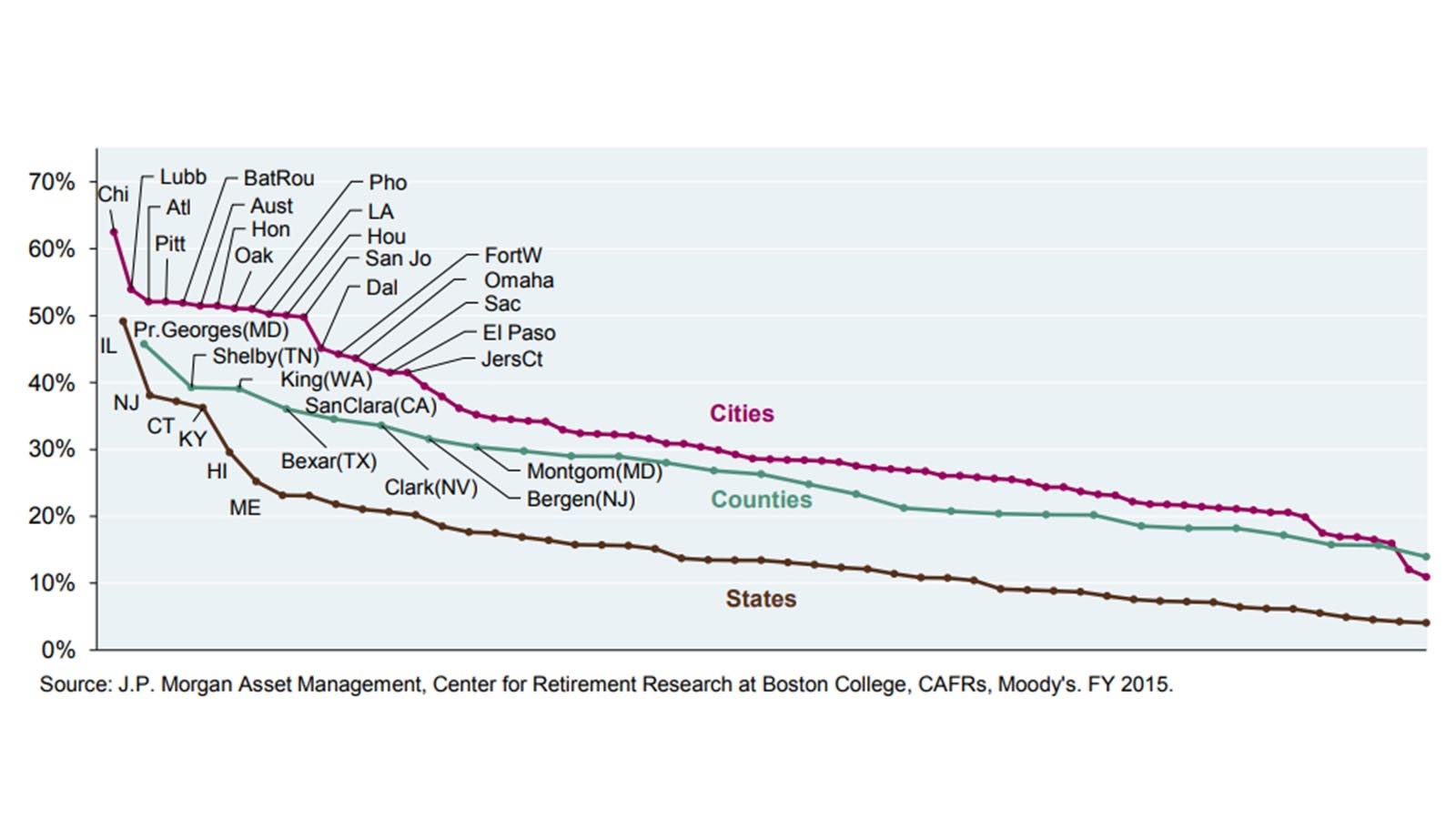

JP Morgan’s "IPOD" ratio represents the percentage of municipality’s revenues that would be needed to pay interest on direct debt, and fully amortize unfunded pension and retiree healthcare obligations over 30 years, assuming a conservative return of 6 percent on plan assets.

JP Morgan's IPOD ration chart

JP Morgan's IPOD ration chart

"While there’s no hard and fast rule, municipalities with IPOD ratios over 30 percent may eventually face very difficult choices regarding taxation, non-pension spending, infrastructure investment, contributions to unfunded plans and bond repayment," JP Morgan said.

As the chart shows, Illinois, New Jersey, Connecticut, Kentucky and Hawaii are among the states with the highest ratio.

In early June, Standard & Poor's and Moody's Investors Service downgraded Illinois to near junk, the lowest ever for a US state, Bloomberg reported.

Chicago, Illinois is the third largest city in the US, with the steel industry and manufacturing as its main sectors. However, since the 70s, the gloomy steel industry and the outward migration of manufacturers have posed big challenges. In recent years, Chicago's government has faced huge fiscal deficits and pension burdens, thus the city’s credit has been rated as non-investment grade, more commonly called junk, by Moody's.

However, Chicagoans received some good news on Thursday as a proposal by Mayor Rahm Emanuel was approved. The new initiative will seek to lower borrowing costs through a new debt structure aimed at insulating investors from the city’s financial problems.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3