Business

20:47, 12-Sep-2017

Will iPhone 8 be able to repeat iPhone 6’s ‘supercycle’?

By CGTN's Yan Qiong

Apple’s brand power and innovation will be tested as its chief executive Tim Cook is expected to unveil the company’s next flagship device iPhone 8 at a media event in California on Tuesday.

The iPhone 8 has been rumored to include wireless charging, facial recognition, an edge-to-edge display, and for the first time, no home button. Unfortunately, Apple looks poised to bump up the average selling price (ASP) for the privilege.

Is iPhone 8 taking advantage of high-tech privilege?

An earlier report from New York Times claimed the new iPhone would start from 999 US dollars.

Later, Twitter tipster Benjamin Geskin, who has shared a number of details and leaked components ahead of the launch, published the purported retail prices for the new handset.

The phone with 64GB of inbuilt storage will retail for 999 dollars, 256GB for 1,099 dollars, and a new 512GB tier for 1,199, according to Gaskin.

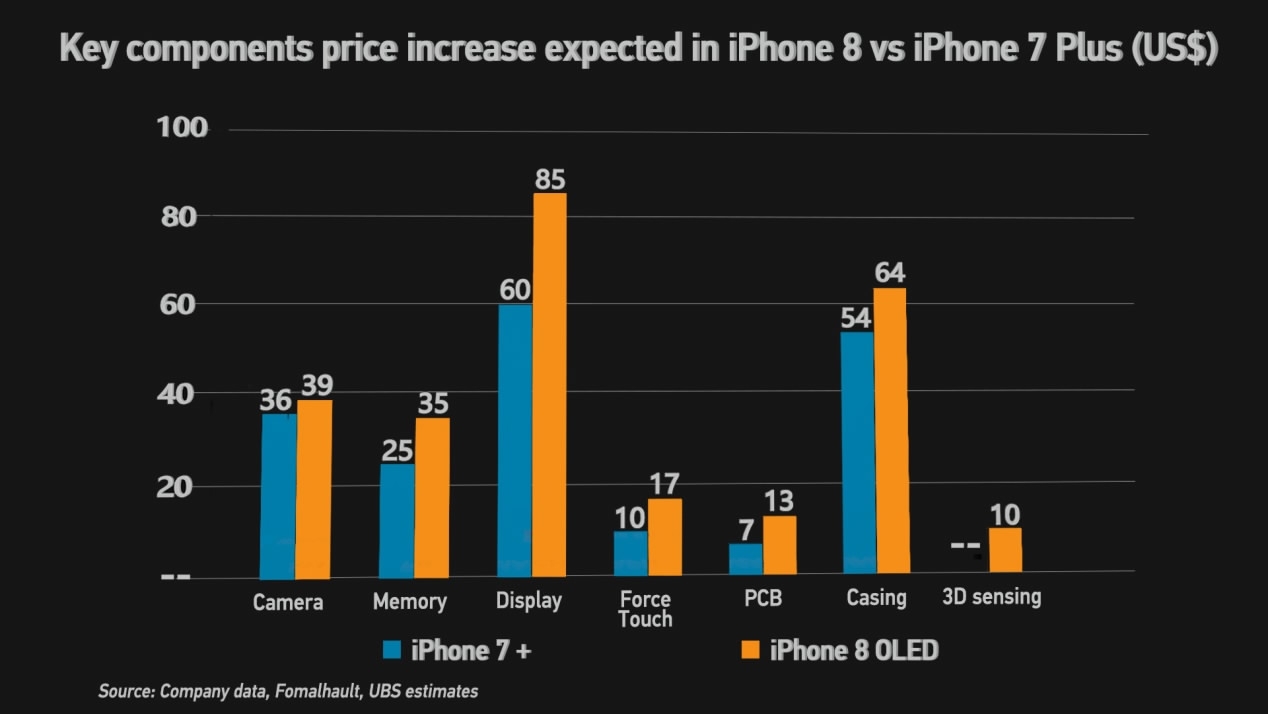

This move is not entirely surprising if Apple wants to maintain its industry leading margins, as the iPhone 8’s bill of materials (BOM) gets pushed substantially higher based on recent UBS estimates.

The BOM for iPhone 8 can easily be in the range of 300 to 325 dollars, representing a 30 percent increase from that of iPhone 7.

"We also have a more difficult memory pricing environment this year than a year ago. And we think that we're going to be able to partially offset this with the positive leverage," said Tim Cook on an earnings call.

The comment is presumably referring to the rumored higher ASP of the iPhone 8.

However, does Apple still have the leverage when trying to pass through its component costs to the end customers in a more competitive market, specifically in China?

Analysts’ view on iPhone 8’s demand, worth it or not?

While the iPhone remains Apple’s most lucrative product by far, the company’s future depends a lot on the sales of this next-generation iPhone, as the smartphone industry faces slower growth and high competition.

Sales of iPhone 7 and 7 Plus have been somewhat disappointing for several quarters, and the company will need to grab the market with the new iPhone model to sustain its cash cow and ease doubts that it has lost its innovative touch.

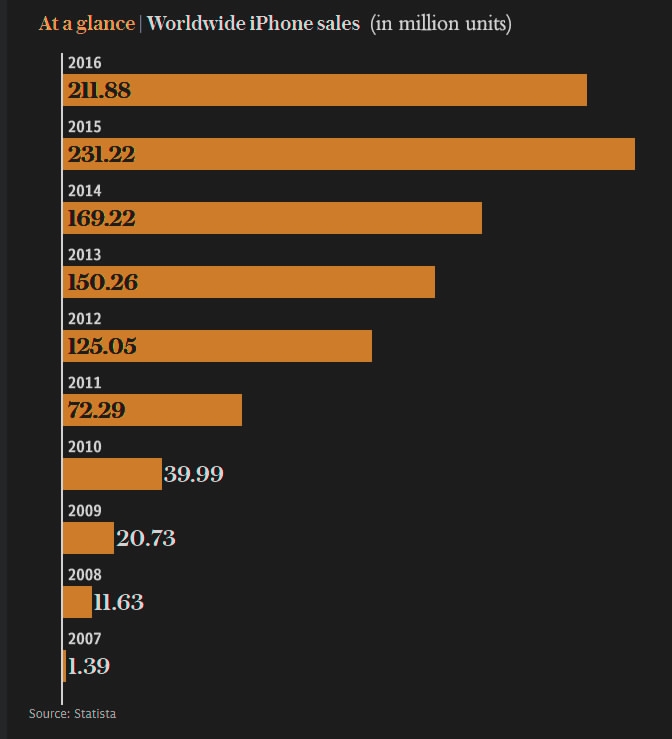

The iPhone 6 and 6 Plus represented a "supercycle" for Apple, one where they sold an enormous amount of devices. Many analysts expect the iPhone 8 to be the main driving force for a new "supercycle".

Angelo Zino, a senior equity analyst at CFRA, predicted record iPhone shipments of 241.5 million in the 12 months following the iPhone 8 launch, smashing the previous high, set by iPhone 6, following its introduction in late 2014.

"We're bullish on the iPhone 8 for three reasons: Apple's ecosystem stickiness, the expected upgradability of the device, and teenage fondness of Apple devices," Clement Thibault, a senior investing analyst with Investing.com, told The Washington Post.

Meanwhile, some are throwing some cold water on the new iPhone, arguing that a few factors may have an adverse impact on the iPhone sales, including saturation in mature markets, slow smartphone market growth today than it was back in 2015, elongating refresh cycles, declining share and increased competition in China and a growing secondary market.

Apple store in Beijing's Sanlitun area, a hotspot shopping center for Chinese and foreign youngsters. /VCG Photo

Apple store in Beijing's Sanlitun area, a hotspot shopping center for Chinese and foreign youngsters. /VCG Photo

They think Apple will be largely reliant on current users upgrading their old phones with not much room to sell iPhone to new users, which won’t be enough to match investors’ high expectations. Investors, who have bid up Apple shares 30 percent this year, are also keenly watching how the new iPhone fares.

"Given most smartphones are now refreshed on a roughly 2.7 year cycle, we think FY-18 should be measured against FY-15," Deutsche Bank’s analysts wrote in a note to investors, "This cycle and our installed base estimates suggest Apple could ship about 230 million iPhones in FY-18."

IPhone 8’s success largely depends on China

China is Apple’s second-largest market after the US, as it generates approximately 25 percent of the firm’s profits. Some analysts claim the iPhone 8’s success largely depends on sales in China.

However, the company faces slowing demand in China - the world's largest smartphone market.

Apple took in just over eight billion dollars in revenue from China for the second quarter, which is less than half of what it made here two years ago in Q2 2015. It’s also a 10 percent decline year-on-year and a 25 percent decline from last quarter. China is also the only region that saw negative growth year-over-year.

In China, locally made phones are chipping away at iPhone's market share, particularly those from Huawei, Oppo, and Vivo. And those Chinese smartphone makers have recently decided to let go of the competition on the low end and focus on the premium market, the one Apple dominates.

A customer got his iPhone 5s in Beijing's Wangfujing Apple store on September 20, 2013. /VCG Photo

A customer got his iPhone 5s in Beijing's Wangfujing Apple store on September 20, 2013. /VCG Photo

Also some investors are skeptical asking whether consumers in China will pay around 1,000 US dollars for a new iPhone, when 65 percent of smartphone shipments are for phones priced below 300 dollars.

Apple is releasing its model a day after Xiaomi, who outsold Apple in China in Q2 of 2017, released its most expensive device. The Mi Mix 2 is featured by an all-ceramic “unibody” and a full-screen display that is priced at 4,699 yuan (720 US dollars) with variations with cheaper prices.

Ben Thompson of independent research firm Stratechery also noted that only 50 percent of iPhone owners remain loyal to Apple in China, whereas that figure is closer to 80 percent in the rest of the world.

"If it’s under 1,100 dollars then I’ll buy it,” Liu Song, 29, who works for a fintech startup in Beijing, told Reuters.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3