Opinions

21:57, 18-Jan-2018

Analysis: China's steady economic growth surprises many

Guest commentary by Liu Chunsheng

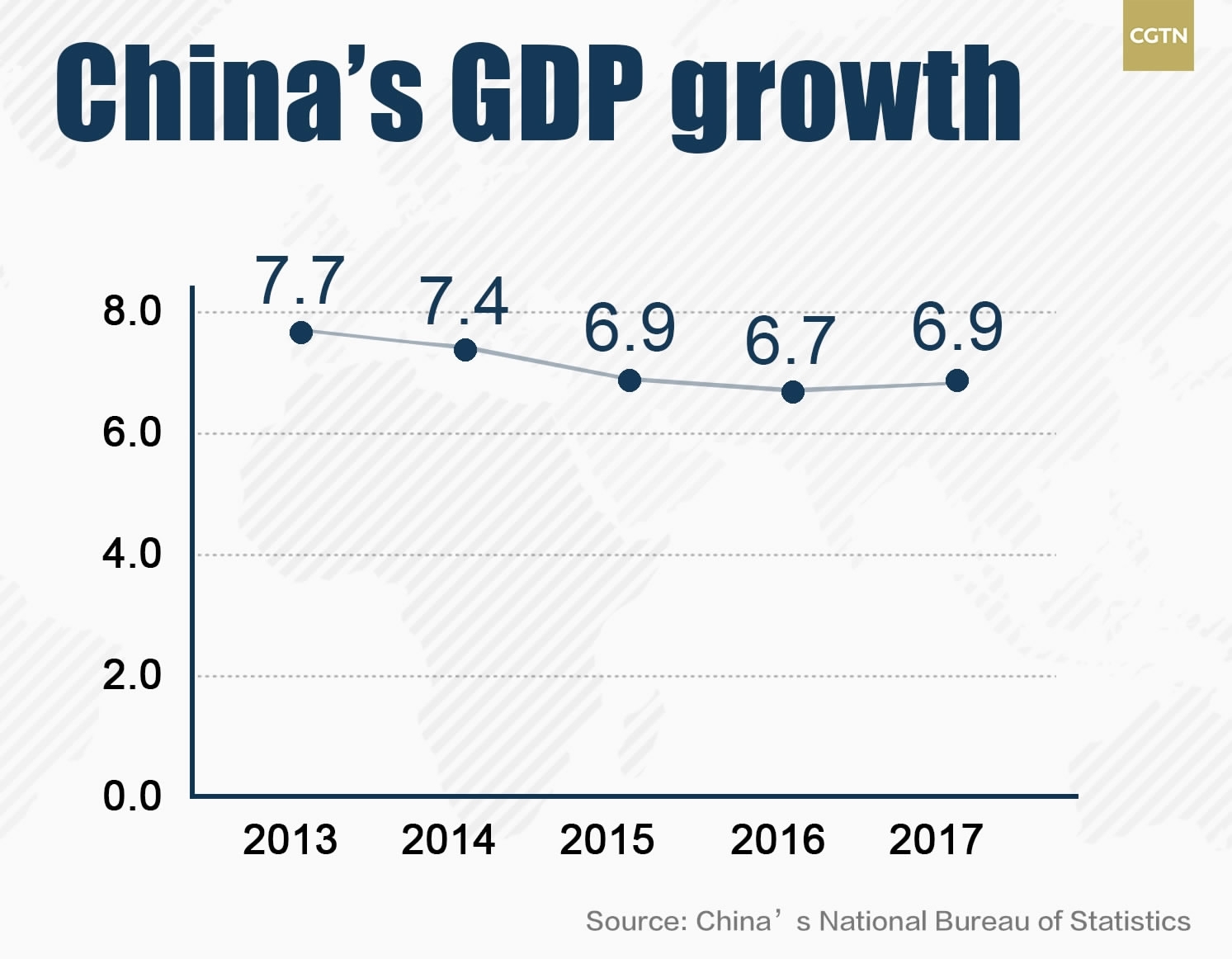

China's National Bureau of Statistics Thursday released the country’s official macroeconomic data for 2017. Thanks to an improved internal and external environment, Chinese GDP reached 82.71 trillion yuan (12.88 trillion US dollars), an increase of 6.9 percent, exceeding the 6.5-percent target set at the beginning of last year.

It is an economic performance that has surprised many. The IMF was moved to raise China’s GDP growth rate prediction four times in 2017. According to UN report "World Economic Situation and Prospects 2018", the Chinese economy alone accounted for about one-third of global growth last year.

Over the past five years, China's annual contribution to world economic growth has reached 30.2 percent, which is more than that of the United States, the euro area and Japan put together in the same period. China's GDP took up 15 percent of World Gross Product (WGP), 3.5 percent higher than five years ago.

In recent years, consumption has exceeded investment and has become the main driving force to stimulate economic growth in China. In 2017, total retail sales of consumer goods reached 36.63 trillion yuan and increased by 10.2 percent.

Investment has always played a key role in steady economic growth. National fixed asset investment (excluding farmers) was 63.17 trillion yuan, up 7.2 percent from 2016. Among that sum, state-owned holding investment was 23.29 trillion yuan, up 10.1 percent and private investment reached 38.15 trillion yuan, up 6.0 percent, which accounted for 60.4 percent of the total investment.

Buoyed by the cyclical upturn in global growth, China’s foreign trade rebounded in 2017 and the total imports and exports amounted to 27.79 trillion yuan, expanding at a pace of 14.2 percent during the year.

China’s new employment in cities and towns reached 12.8 million people from Jan to November 2017, increased by 310,000 compared with the same period of 2016. The newly investigated urban unemployment rate was kept below 4.9 percent. At the same time, China’s CPI rose by 1.6 percent in 2017, 0.4 percent down from 2016 and the inflation stayed mild. The disposable income per capita grew by 7.3 percent compared to 2016, which is 0.6 percent higher than the GDP growth rate. The growth of residents' income has exceeded the "GDP growth" again.

A business street in Beijing, January 18, 2018. /VCG Photo

A business street in Beijing, January 18, 2018. /VCG Photo

In general, China's economic resilience was strengthened, and its cuts to excessive capacity, inventories as well as cost reduction achieved obvious results. Meanwhile, new growth drivers and new industries continued to expand.

China's economy has shown a good trend in the main indicators. The profits of industrial enterprises have been rising. The growth rate of imports and exports have both been warming up and supporting manufacturing investment. The employment situation has obviously improved, prices are basically stable, and the RMB exchange rate and foreign exchange reserves were both stable.

Looking forward, although US tax cuts, monetary policy normalization of major economies and growing trade protectionism will bring uncertainty to the global economic growth, the world economy is expected to continue an overall recovery, which will provide a good external environment for China's foreign trade and investment in 2018.

The predicted global economic growth rate is 3.7 percent in 2018, up from 3.4 percent in 2017. China's economy is projected to maintain stability with a growth rate of 6.5-6.8 percent this year.

The central government will prioritize major risk prevention, targeted poverty alleviation and pollution control for high-quality growth. The supply side structural reforms are expected to gear up and tough supervision over the financial industry is going to curb widespread malfeasance in China’s financial market. Great efforts will be focused on adjusting the structure of industries and strengthening energy conservation. 2018 will see China’s development become healthier and its economic quality improve.

(Liu Chunsheng is an associate professor at Beijing’s Central University of Finance and Economics and deputy dean of Blue Source Capital Research Institute. The article reflects the author's opinion, and not necessarily the views of CGTN.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3