Business

21:29, 19-Dec-2017

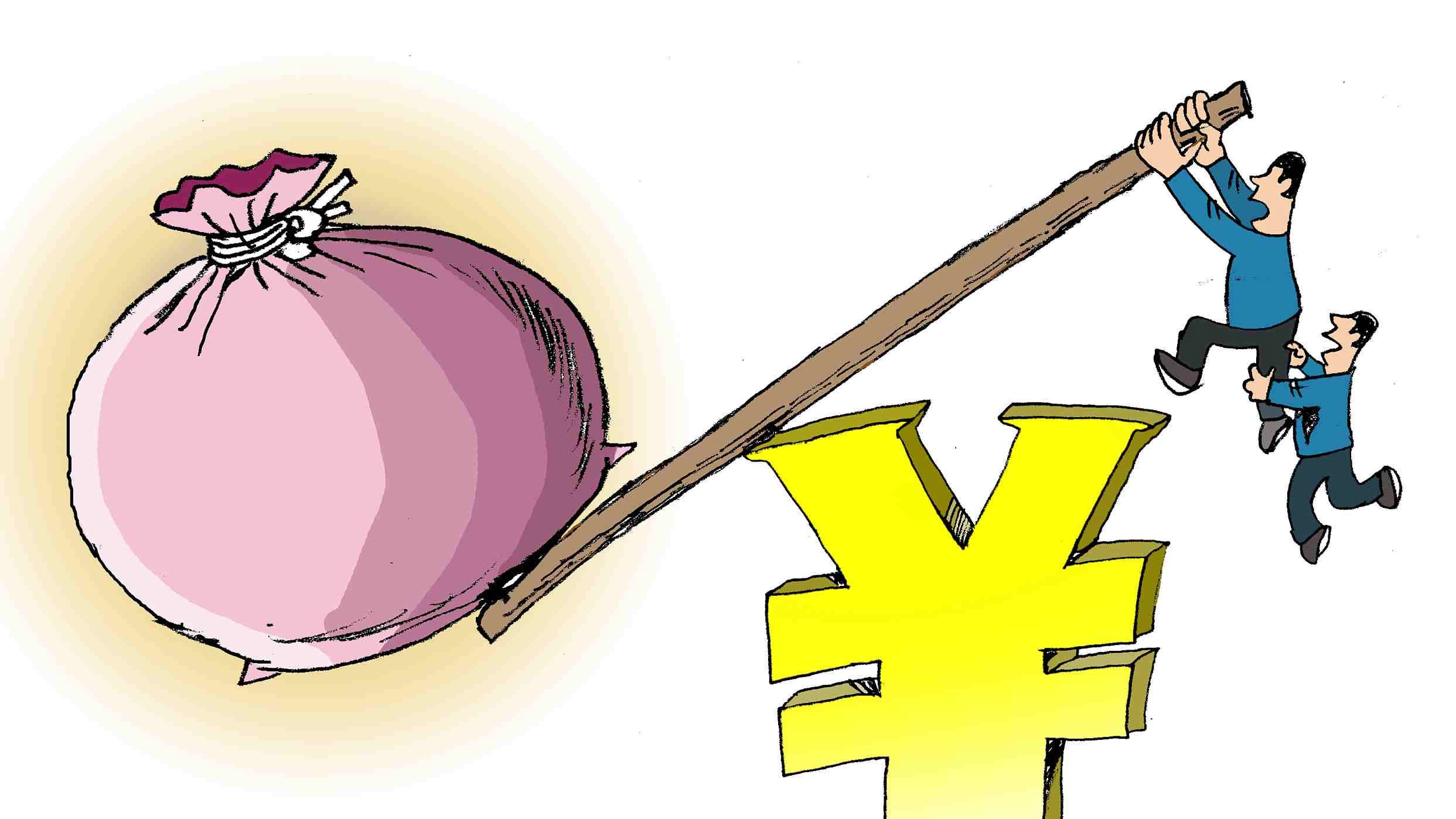

Deleveraging to tailor China’s banking, corporate sector and A-share in 2018

By CGTN’s Gao Songya

The World Bank’s new quarterly report expected China’s GDP growth in 2018 to slow down to 6.4 percent from this year’s 6.8 percent, dragged partially by country’s continuing deleveraging efforts.

So why are the deleveraging measures still necessary for China and how exactly would they affect Chinese economy in 2018?

“The deleveraging process is essentially choking off the easy money for poor quality projects, and it's indeed the purpose of deleveraging to phase out these companies and to reduce over capacity in certain industries,” said Yan Hong, deputy dean of the Shanghai Advanced Institute of Finance.

Deleveraging is also vital for China to correct its banking sector, especially the mid-small banks with mounting unregulated off-balance business.

“The off-balance item is really getting out of control,” said Hong Hao, Chief China Strategist at BOCOM International. “It’s about 250 trillion yuan in size, which is substantially larger than on-balance. So it’s time that we have to do something to rein in the off-balance items.”

Mid-small banks often rely on off-balance expansion to boost income faster and enlarge their balance sheet. So, deleveraging in off-balance business could force some mid-small banks to sell their bonds and equities to meet capital requirement.

Hong also mentioned that it might be harder for investors to gain from China’s A-share market, because the continuing deleveraging at home and coming interests rate hikes globally could shrink the “pool of liquidity.”

VCG Photo

VCG Photo

Jing Ulrich, Asia Pacific Vice Chair of J. P. Morgan, believed that deleveraging will help with risk control and investors’ education.

“There are many retail investors in China who may not be aware of the risks of investing, so I think it is absolutely right for the regulators to put a lot of emphasis on risk management and really to tighten control on asset management industry, in order to protect the wealth of retail investors in China,” said Ulrich.

Corporate restructuring has been a major way to reduce leverage among the state-owned enterprises. So Wendy Liu, Chief Equity Strategist with Nomura Greater China, said deleveraging measures may accelerate concentration of market share in upstream industrial sectors.

“If one needs to overcome potential risk (from high leverage ratio), he would argue for consolidation, so the bigger companies become bigger,” Liu said.

(Yang Chengxi also contributed to the story)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3