Business

23:10, 15-Jul-2017

China creates new financial supervisory body to curb risks

Chinese President Xi Jinping announced the decision to set up the Financial Stability and Development Board (FSDB) under the State Council, a key move to strengthen the coordination of financial oversight and rein in financial risks in the world's second largest economy.

Xi made the announcement during the fifth National Financial Work Conference held in Beijing from Friday to Saturday, where he underscored serving the real economy, curtailing financial risks and deepening financial reforms as three main tasks of China's financial sector.

The National Financial Work Conference, which has convened every five years since 1997, is widely considered to set the tone for China's financial reforms.

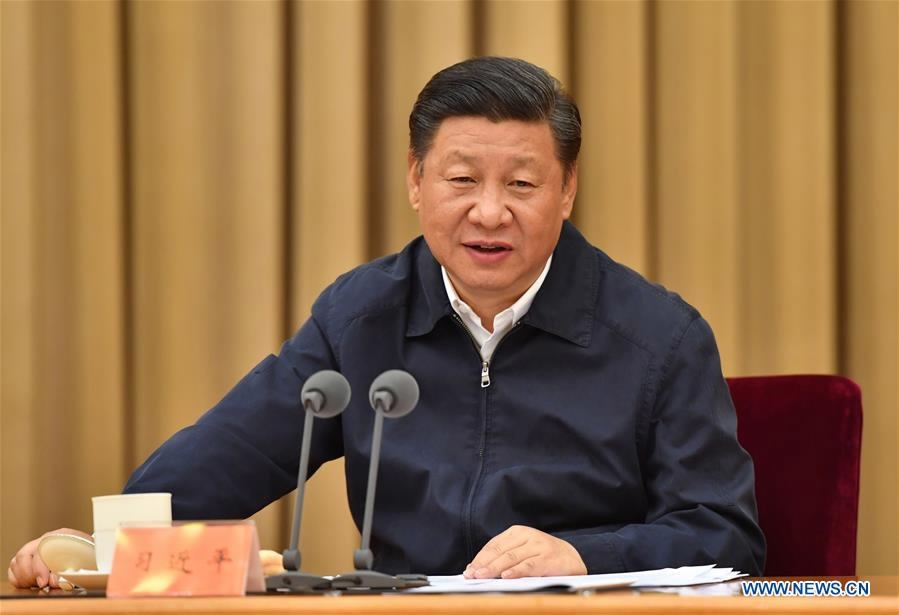

Chinese President Xi Jinping addresses the National Financial Work Conference which is held from July 14 to 15, in Beijing. /Xinhua Photo

Chinese President Xi Jinping addresses the National Financial Work Conference which is held from July 14 to 15, in Beijing. /Xinhua Photo

Closing regulatory loopholes

Currently, the country's major financial watchdogs – the central bank People's Bank of China (PBOC), the China Banking Regulatory Commission (CBRC), the China Securities Regulatory Commission (CSRC) and the China Insurance Regulatory Commission (CIRC) – largely operate independently while the boundaries of financial activities have become increasingly blurred.

In recent years, China's financial sector has been growing rapidly, creating over-leveraging problems and bubbles along the way.

Meanwhile, shadow banking and Internet financing of various forms are booming, posing new regulatory challenges.

By the end of 2016, the total assets of China's banking, securities and insurance industries amounted to 253.16 trillion yuan (about 37.37 trillion US dollars), a dramatic increase of 77.42 percent from 2012.

In 2015 and 2016, the added-value of the financial sector exceeded eight percent of the national GDP.

The imbalance between a robust financial sector and an inadequate regulatory mechanism has led to growing risks, prompting many economists to call for the establishment of a policy coordination body to reduce financial regulatory loopholes.

Their calls were answered during this week's National Financial Work Conference, as policymakers decided to create the FSDB under the State Council.

The FSDB will improve regulatory coordination by conducting comprehensive oversight and strengthening the regulators' accountability.

Meanwhile, according to Xi, the PBOC's role in prudent macro management and systemic risk prevention will be enhanced under the new mechanism.

Curtailing risks by serving real economy

Xi, who is also the general secretary of the Communist Party of China (CPC) Central Committee and chairman of the Central Military Commission, called on the financial sector to serve economic and social development and meet the diverse financial needs of the people and the real economy.

Describing finance as the lifeblood of the real economy, Xi stressed that serving the real economy is not only a duty of finance but also the fundamental way to curtail financial risks.

Premier Li Keqiang, who also attended the conference, emphasized the importance of curbing and resolving financial risks through reforms, adding that efforts must be made to promote mutually beneficial interactions between economy and finance.

Growing financial risks in China have raised wide concerns recently.

International rating agency Moody's downgraded China's rating in May, citing rising debt levels.

Zhou Xiaochuan, the central bank's governor, reiterated last month that the country should prevent systemic risks in the financial sector.

Experts say over-leveraging is a big challenge for the health of the Chinese economy, but officials are walking a fine balance between deleveraging and maintaining growth.

The premier noted that deleveraging should be pushed forward in an "active yet prudent" way.

China's economy achieved a growth rate of 6.9 percent in the first quarter of the year and is expected to register a 6.8 percent growth in the second quarter, well above the target of 6.5 percent for 2017.

"Given a reasonably healthy economy, we will see similarly contractive measures into the future," Brock Silvers, managing director of Kaiyuan Capital, told CGTN.

Four previous National Financial Work Conferences

China held its first National Financial Work Conference in 1997 amid the Asian Financial Crisis, and two financial regulators – the CSRC and the CIRC – were established during the conference.

In 2002, after China joined the World Trade Organization (WTO), a decision was made at the second conference to set up a new commission – the CBRC – to regulate the banking industry.

At the third meeting in 2007, policymakers decided to further deepen banking reforms and regulate the financial market.

Five years later, the fourth gathering took place, in which a decision was made on allowing civil capital into the financial service sector.

0km

Related stories:

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3