Business

19:16, 11-Aug-2017

RMB back on track on second anniversary of exchange rate reform

CGTN Zhu Feng

It has been two years since China's central bank announced a reform of the yuan exchange rate mechanism, and the market seems to be celebrating with good news.

The yuan's midpoint was set at 6.6642 per US dollar on Friday, the strongest level since September 2016, after an accumulated 4-percent appreciation for the past half year.

The August 11, 2015 reform took the closing rate on the inter-bank forex market of the previous day into the formation of the yuan's central parity rate.

That was intended to make China’s RMB more market-oriented and shaking off its dependence on the US dollar, so as to step further onto the global stage.

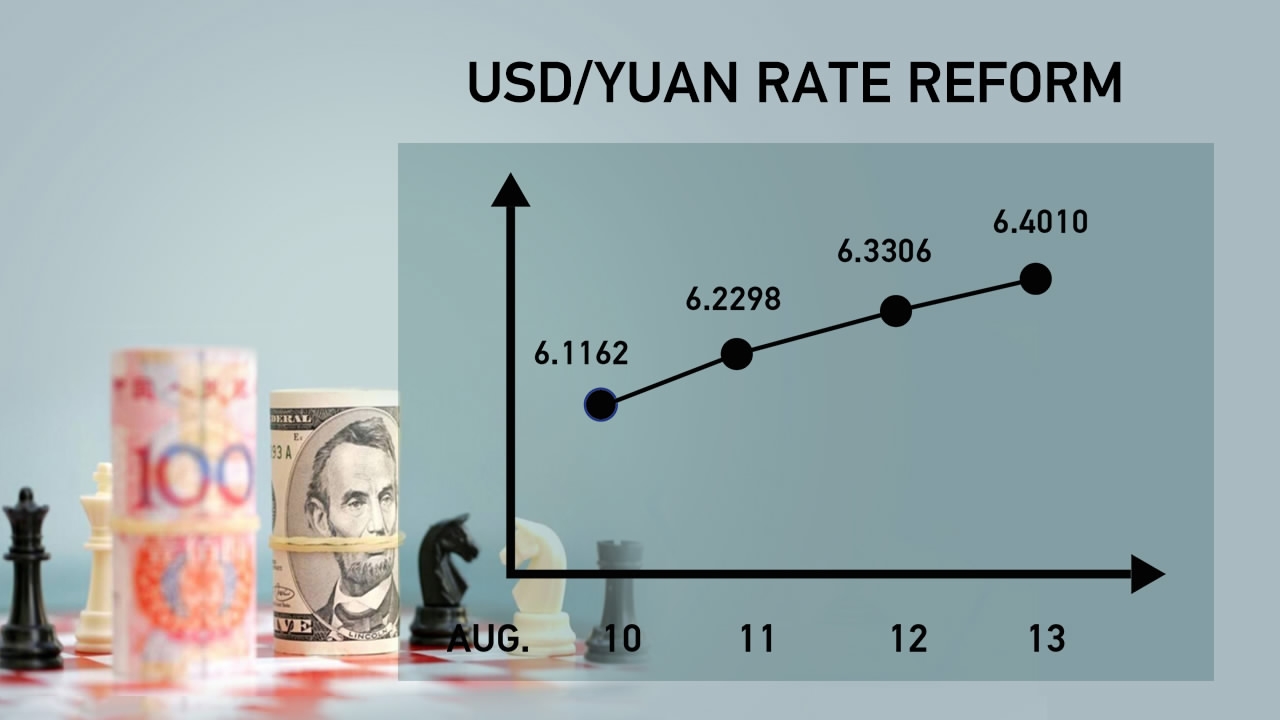

The changing yuan-dollar exchange rate in the four days after China’s central bank announced the new reform. / CGTN Photo

The changing yuan-dollar exchange rate in the four days after China’s central bank announced the new reform. / CGTN Photo

But the market disagreed back then, because the previous exchange rate mechanism had been doing so well since it was introduced in 2005 – the yuan was up 36 percent against the US dollar and was still rising.

Bad news kept coming. The yuan lost more than 1,000 basis points that day and continued to fall during the following two days to finish at about 6.4 against the greenback. That was almost 5 percent lower than the 6.1162 before the reform.

The yuan's fluctuation continued throughout 2016. Internal factors included China's falling forex reserves and sluggish foreign trade data. And the US Fed’s rate hike, Britain’s vote to leave the EU and the US presidential election were adding to the yuan’s instability from the outside.

Constant devaluation also caused huge capital outflow and China’s forex reserve shrank almost 1,000 billion US dollars from 2015 to the beginning of 2017.

The reform only started to turn around a few months ago, when the US dollar kept on weakening and the Chinese macro economy performed better than expected.

That said, the yuan’s exchange rate against the US dollar is still 9 percent down compared with before the reform. And analysts remain cautious on the outlook.

3km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3