Business

14:00, 29-Jun-2017

US Fed greenlights big banks' capital plans

The US Federal Reserve on Wednesday gave the green light to plans from the country's 34 largest banks that seek to provide large payouts to shareholders. The Fed found that the banks' financial foundations are sound enough to withstand a major economic crisis.

The central bank announced that it completed its review of the capital planning practices of the 34 banks in its annual Comprehensive Capital Analysis and Review (CCAR), and did not object to the financial institutions' capital plans.

File photo of the US Federal Reserve in Washington, DC. /VCG Photo

File photo of the US Federal Reserve in Washington, DC. /VCG Photo

Stress test

The review was the second part of the Fed's annual stress test that is designed to examine how large US banks would handle a financial crisis similar in severity to the one in 2008. The 34 banks represent more than 75 percent of the assets of all US domestic banks.

The first phase of the test, released last week, showed all 34 banks could withstand a downturn in which US unemployment soared to 10 percent and commercial real estate prices plummeted 35 percent.

It is the first time since the rigorous tests were instituted in 2009 that the Fed did not object to the banks' capital plans. The decision reflects the industry's improved resilience after years of building up capital in the aftermath of the 2008 financial crisis, Fed officials said.

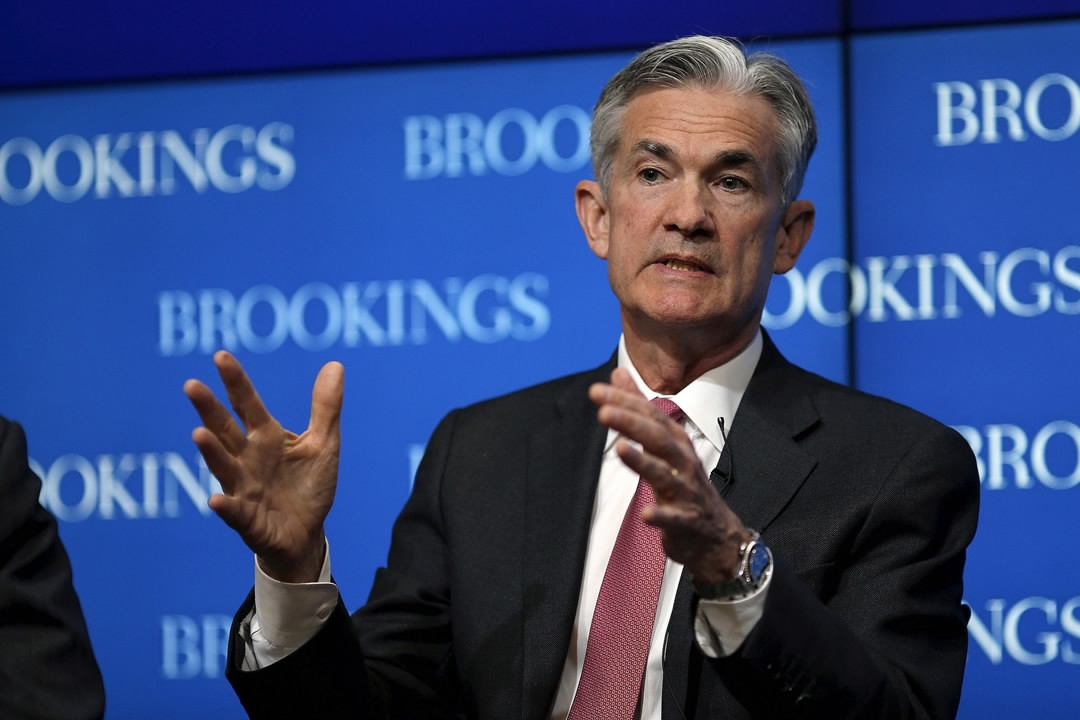

US Federal Reserve Governor Jerome Powell delivers remarks during a conference at the Brookings Institution in Washington, DC, on August 3, 2015. /VCG Photo

US Federal Reserve Governor Jerome Powell delivers remarks during a conference at the Brookings Institution in Washington, DC, on August 3, 2015. /VCG Photo

"I'm pleased that the CCAR process has motivated all of the largest banks to achieve healthy capital levels and most to substantially improve their capital planning processes," Fed Governor Jerome Powell said in a statement.

Banks‘ reaction

The US central bank required just one bank, Capital One Financial, to submit a new capital plan by the end of the year, but did not oppose shareholder payouts under the CCAR.

"We will resubmit our capital plan and are fully committed to addressing the Federal Reserve's concerns with our capital planning process in a timely manner," said Capital One chief executive Richard Fairbank.

A trader works on the floor of the New York Stock Exchange shortly after the opening bell on June 27, 2017. /VCG Photo

A trader works on the floor of the New York Stock Exchange shortly after the opening bell on June 27, 2017. /VCG Photo

After the results were revealed, several banks quickly announced dividend boosts and share buyback plans, including Citigroup, Morgan Stanley, JPMorgan and American Express.

"We are pleased by today's CCAR result, which demonstrates the strength of our diversified business model, strong capital position, and our continued focus on risk management," said Wells Fargo chief executive Tim Sloan.

(Source: Xinhua, AFP)

11159km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3