Business

21:29, 21-Aug-2017

China’s pension fund is buying A-share, should investors follow?

By CGTN's Gao Songya

Chinese government is officially investing pension funds in its stock markets – a move to stabilize the market by injecting long-term funds and generate higher returns-for the welfare of increasingly large elderly group.

The message is shown in the semi-annual reports from Joyoung and ZHmag, both are mid-small sized companies from the Chinext board, which is China’s Nasdaq-style board opened in 2009.

So, is the government recommending safe investment choices by the way? Does it mean that individual investors can simply follow up?

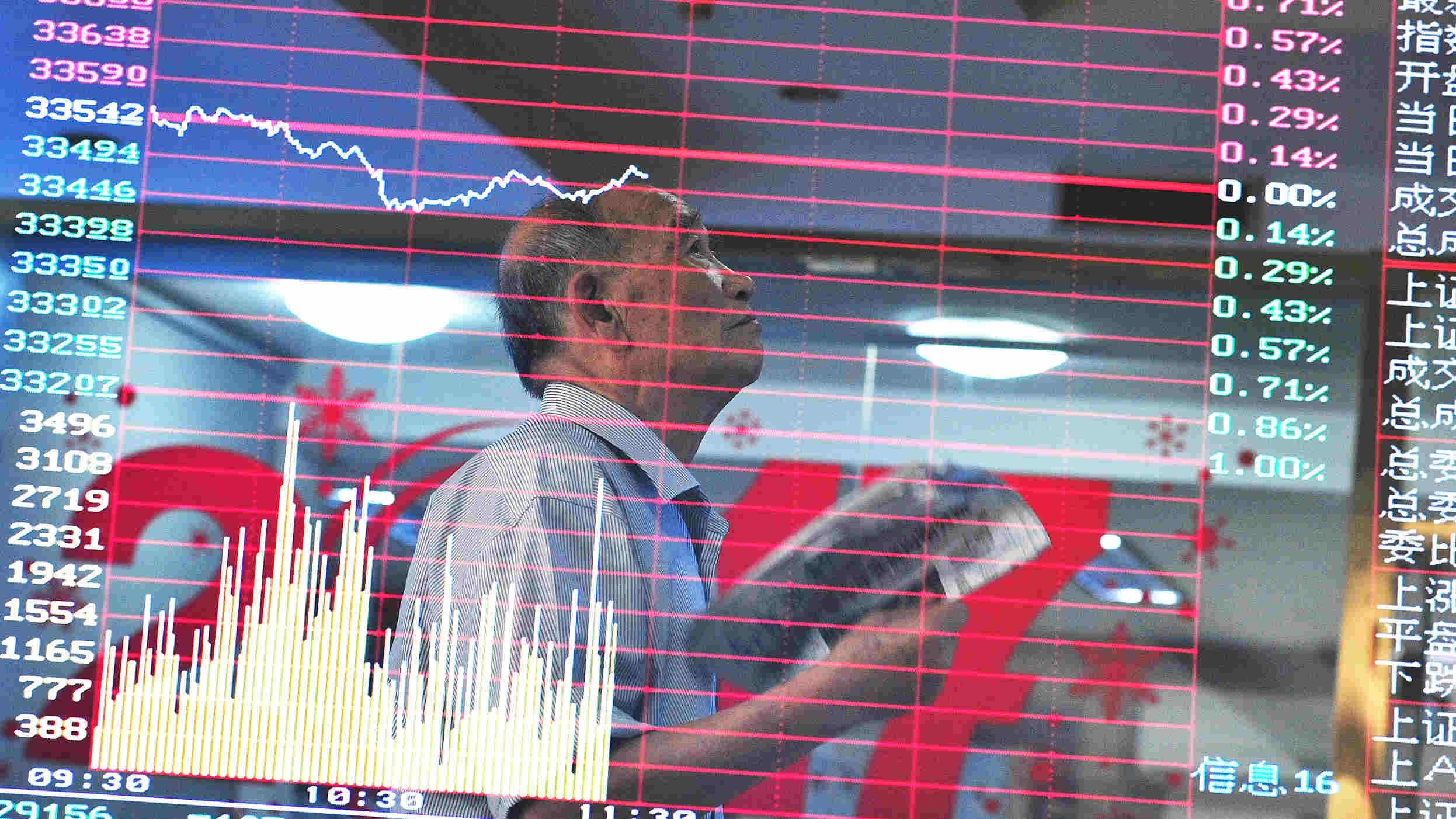

A stock exchange in Nanjing, Jiangsu province. The elderly, or those who have retired, has been a regular group of people hanging in stock exchange, checking the losses and gains all day long. /VCG Photo

A stock exchange in Nanjing, Jiangsu province. The elderly, or those who have retired, has been a regular group of people hanging in stock exchange, checking the losses and gains all day long. /VCG Photo

Hong Hao, Chief China Strategist with Bocom International Holdings, said the government is buying into reasonable-size companies with prospects and reasonable valuation, but investors should still watch out and not blindly follow the pension fund into the entire ChiNext board.

“The companies the pension funds bought in tend to be larger in market capitalization, above 10 billion yuan, and about one billion yuan in earnings, and they have really good growth in the first half of this year – some of the stocks’ growth is close to 50 percent,” Hong said.

He also mentioned that those stocks have 40 times valuation, which means their market value is as much as 40 times the book value. It’s not cheap, but is in line with the general stock index in China.

Given the ChiNext board’s underperformance in the past, Hong suggested that investors should pay attention to the stock selection criteria that the pension funds are using, and follow the funds into specific stocks, instead of the entire ChiNext board.

In the first half of this year, 1.9 trillion yuan (284.8 billion US dollars) flowed into pension funds for workers, up 25.8 percent year on year. The total expenditure in the period increased 23.2 percent to 1.6 trillion yuan, leaving a balance of around 300.5 billion yuan (45.04 billion US dollars).

According to the Ministry of Human Resources and Social Security, the country will continue to increase pension fund revenue by expanding coverage and raising fiscal investments.

(Chen Xiaoshu and Du Zhongyan contributed to the story)

6km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3