Business

22:42, 23-Oct-2017

Spain lags as markets ready for ECB decision

Han Jie

European shares were flat on Monday with banks weighing and Madrid’s bourse lagging its peers as Catalonia’s political crisis deepened.

The pan-European STOXX 600 was up 0.1 percent while Spain’s benchmark IBEX fell by 0.5 percent, with banks including BBVA down 1.4 percent and Banco Santander down 1.3 percent taking most points off the index, Reuters reported.

“At this moment you don’t have contagion from Spain to the broader European market. It’s seen as a national and localized issue,” said Pierre Bose, head of European equity strategy at Credit Suisse.

As the strong euro fueled an import boom alone with a rise in exports, euro zone’s trade surplus shrank in August. /Reuters Photo

As the strong euro fueled an import boom alone with a rise in exports, euro zone’s trade surplus shrank in August. /Reuters Photo

Shares jump in Japan

As the strong euro fueled an import boom alone with a rise in exports, euro zone’s trade surplus shrank in August. Financial shares fell across Europe, with the banking sector down 0.4 percent and heavyweights Deutsche Bank and Standard Chartered losing 1.2 percent each.

The subdued mood in Europe was in sharp contrast to Japan, where shares jumped on a weaker yen as an emphatic election win for Shinzo Abe’s ruling bloc gave a green light for more policy stimulus.

The European statistics office Eurostat said the 19-country currency bloc’s surplus in goods trade dropped to 16.1 billion euros (18.9 billion US dollars) in August from 23.2 billion in July. It was also lower than in August 2016 when it stood at 17.5 billion euros.

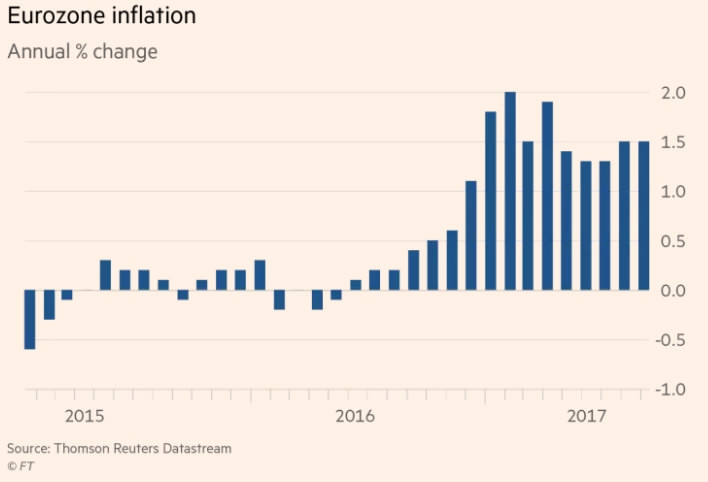

Inflation in the Eurozone remains uncertain /FT Photo

Inflation in the Eurozone remains uncertain /FT Photo

Eurozone inflation uncertain

When it comes to inflation, Mario Draghi, president of the European Central Bank, warned in September that the trend in the Eurozone was still uncertain.

Volatility in exchange rates had made the inflationary picture particularly hard to read, Draghi told the Committee on Economic and Monetary Affairs at the European Parliament in Brussels.

Although policymakers and businesses are confident with the euro’s current level, the bank’s principal currency worry is the impact of a rising euro on its ability to hit its inflation target of just under 2 percent.

“Even strong growth won’t allow the ECB to get to target any time soon,” says Ugo Lancioni, portfolio manager at Neuberger Berman.

VCG Photo

VCG Photo

ECB decision pending

A rising euro has been one of the most powerful trends in foreign exchange markets this year, its value against the dollar rising by 12.4 percent. While it has softened in recent weeks, the euro’s short-term destination will be determined by just how much decisions this week by the ECB measure up against market expectations.

Despite repeated warnings about the euro’s strength limiting the ECB’s options on tapering, “This has not stopped the euro from appreciating further," Draghi believes.

Mario Draghi, president of the European Central Bank. /Reuters Photo

Mario Draghi, president of the European Central Bank. /Reuters Photo

The ECB president is due on Thursday to announce the long-awaited start of tapering, but how the central bank will scale back a bond-buying program that began in 2015 is the subject of much conjecture, according to the Financial Times.

Eurozone borrowing costs fell on Abe’s big win as bond markets ready for the ECB to signal baby steps away from its ultra-easy policy stance.

With US President Donald Trump’s upcoming appointment of the next Fed chair and potential tax reform, the euro’s value against the dollar will be largely influenced in the future market.

7789km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3