18:18, 31-Aug-2018

Plaza Accord: History lessons recall earlier trade war

Updated

18:12, 03-Sep-2018

03:19

Meanwhile, the on-going trade dispute between China and the United States resurrects memories of the American-Japanese trade war in the 1980s. At the time, France, West Germany, Japan, the U.S. and Great Britain signed what was known as the Plaza Accord. The goal was to depreciate the US dollar against other currencies. Experts say that was the beginning of a long economic stagnation for Japan. Mayu Yoshida looks at how China could learn from Japan's past.

Takuro Kato remembers vividly when Japan's economic bubble burst in the 1990s. The Japanese yen was strengthening far more than what policymakers were expecting, hurting exporters. A strong yen led to tens of thousands of companies across Japan going bankrupt.

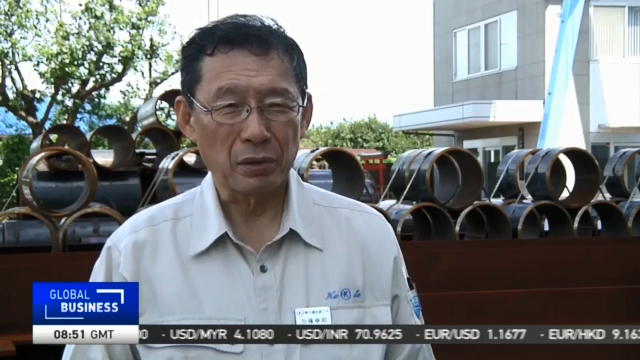

TAKURO KATO PRESIDENT OF STEEL COMPANY "I think the biggest problem back then when the bubble economy burst was the yen's surge. Manufacturers feared its industry was falling apart and were worried if they can no longer export products."

Before the bubble burst, the Japanese economy was enjoying one expensive party. Property values were soaring, stock values were high, and the weaker yen helped Japan become the world's biggest trade surplus country. This prompted a small-scale trade war with the US, which led to the signing of the Plaza Accord in 1985. Many economists say this ultimately led to Japan's Lost Decade of economic stagnation.

MAYU YOSHIDA "You worked for the Bank of Japan for more than 30-years. What was the BOJ like when the economic bubble burst? Wasn't there any way to stop it?"

HIROSHI UGAI, CHIEF ECONOMIST JP MORGAN "I recall people fiercely debating over whether the stagnation was part of the economic cycle, or whether it was something different, brought from excessive corporate debt that led to financial adjustments. Once asset bubble balloons, there's no easy way to stop it from bursting."

MAYU YOSHIDA "Does the recent US-China trade dispute resemble the smaller trade war between Washington and Tokyo in the 90s?"

HIROSHI UGAI, CHIEF ECONOMIST JP MORGAN "Two aspects are fundamentally different. In the 1990s, the United States and Japan were negotiating over a particular sector- the auto industry. This time, the focus is on intellectual property which covers a variety of topics. Japan didn't have economic hegemony that can take over the US. However, China, on the other hand, is in the position that can supplant Washington in the foreseeable future."

To cope with the impact, Japanese companies started to search for opportunities from other overseas markets.

PROF. YORIZUMI WATANABE KEIO UNIV., FORMER TRADE NEGOTIATOR "In order to mitigate the negative ramification and the negative impact of the much-appreciated Japanese yen, Japanese manufacturers started to invest massively in those countries like the Philippines, Thailand, Malaysia, Indonesia."

This was the also case for Kato's company, which now engages in big construction projects across the globe. He says diversification was the key to survive the economic crisis.

TAKURO KATO PRESIDENT OF STEEL COMPANY "It's hard to predict the future. But we need to leave the doors open for every business opportunity out there. We shouldn't be picky. That's how we minimized the negative impact, and that was the lesson I learned from the bubble collapse."

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3